Report Overview

Chromatography Instruments Market Size, Highlights

Chromatography Instruments Market Size:

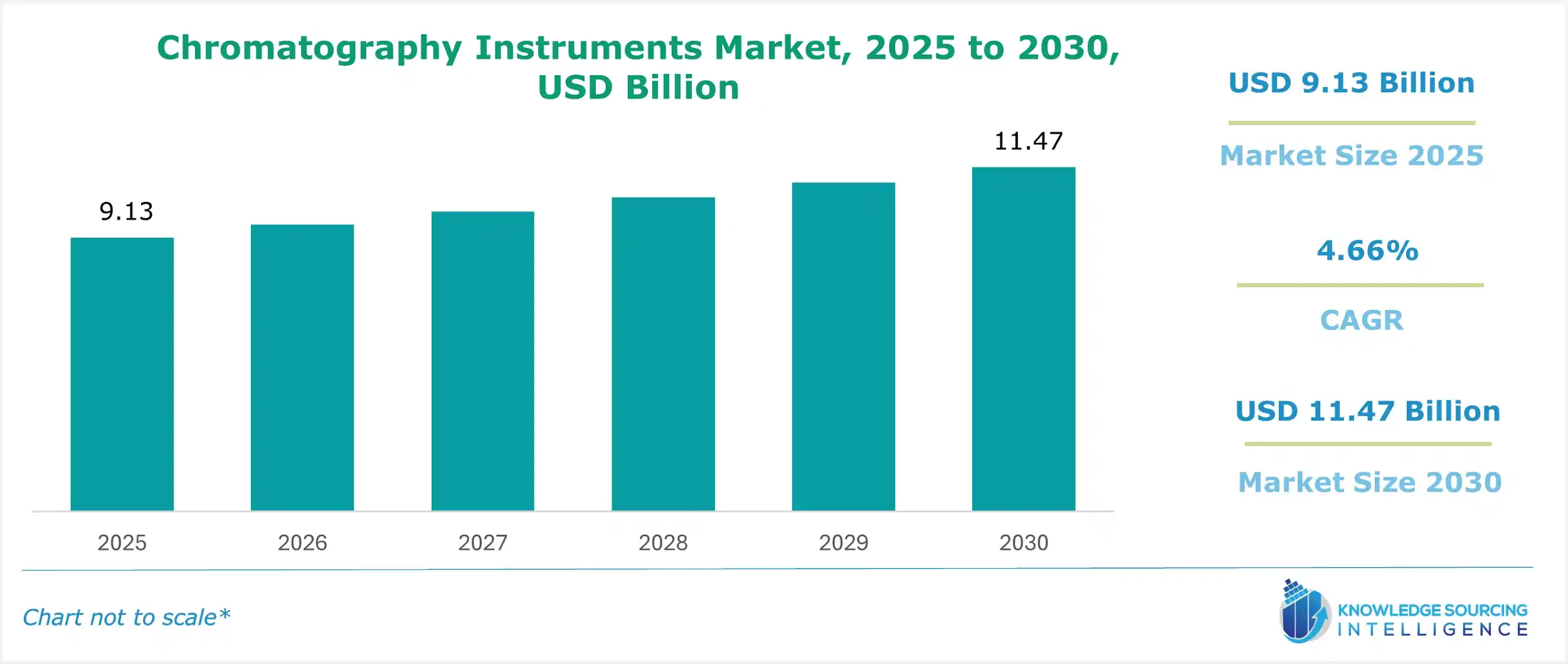

The chromatography instruments market is projected to grow at a CAGR of 4.66%, reaching total value of US$11.47 billion by 2030 from US$9.13 billion in 2025.

This growth is driven by increasing demand in drug development, clinical research, and applications in environmental and food and beverage testing, fuelled by technological advancements and innovations in chromatography techniques.

Chromatography Instruments Market Growth Drivers:

The rising prevalence of chronic diseases is a key growth factor. As of September 2022, per CDC data over 100 million US adults were estimated to have diabetes or prediabetes, with continued growth to over 105 million by early 2025. Vector-borne diseases, including those from tick, flea, and mosquito bites, have also tripled since July 2021, maintaining elevated levels into 2025. These trends accelerate the demand for chromatography columns in drug filtration and downstream processing, driving market expansion through the forecast period.

North America dominates the global chromatography instruments market, supported by robust government R&D funding, advanced healthcare systems. This growth is also being complemented by the presence of major players such as Thermo Fisher, Phenomenex, and Bio-Rad Laboratories. The U.S. is the dominant market in this region and allocates significant over 2.8% of GDP towards R&D, fostering innovation and attracting international market participants. Stringent regulatory standards for drug safety and environmental testing is further bolstering the adoption of these devices, positioning the region as a hub for chromatography instrument manufacturing and research.

The appeal for prior consent of Sartorius Stedim Biotech S.A.'s takeover of the Chromatography Equipment Business of Novasep Process SAS was granted by the Federal Trade Commission in February 2022. Additionally, in May 2022, Agilent Technologies and APC Ltd. agreed to collaborate on integrating technologies for automated process monitoring via liquid chromatography. These strategic moves are expected to accelerate market growth in the region.

Rising cancer incidences is also driving the demand for these instruments, with the American Cancer Society projecting 2.0 million new cases and 611,720 deaths in the US in 2025, up from 1.9 million cases and 609,360 deaths in 2022. This growth, driven by shifting lifestyles, is leading to increasing adoption of chromatography for new cancer vaccine development, further supporting market expansion.

Chromatography Instruments Market Key Developments:

- Agilent Technologies launched quadrupole mass spectrometers for liquid chromatography-mass spectrometry and gas chromatography-mass spectrometry in June 2022, enhancing device intelligence and diagnostics to maximize system uptime for users.

- PerkinElmer, Inc. introduced the GC 2400 Platform in June 2022, an autonomous gas chromatograph, headspace sampler, and GC/mass spectrometry solution designed to streamline lab operations, ensure reliable results, and dynamic monitoring.

The global Chromatography Instruments Market report delivers a thorough examination of the industry, offering strategic and executive-level insights grounded in data-driven forecasts and analysis. This frequently updated resource provides decision-makers with practical intelligence on current trends, emerging possibilities, and competitive forces shaping the market. It investigates demand across various chromatography techniques and systems while exploring key applications and major end-user groups such as pharmaceutical industries, biotechnology firms, and chemical sectors. The report also assesses technological progress, influential government policies, regulatory environments, and macroeconomic conditions, presenting a well-rounded view of the market.

Chromatography Instruments Market Segmentations:

Chromatography Instruments Market Segmentation by technique:

The market is analyzed by technique into the following:

Chromatography Instruments Market Segmentation by application:

The report analyzes the market by application as below:

- Environmental Testing

- Food and Beverage Analysis

- Clinical Diagnostics

- Life Sciences

- Others

Chromatography Instruments Market Segmentation by component:

The market is analyzed by component into the following:

- Detectors

- Columns and Consumables

Chromatography Instruments Market Segmentation by end-user industry:

The report analyzes the market by end-user segment as below:

- Pharmaceutical Industries

- Biotechnology

- Chemical and Petrochemical Industries

- Others

Chromatography Instruments Market Segmentation by regions:

The study also analyzed the Chromatography Instruments Market into the following regions, with country-level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain and Others

- Middle East and Africa (Saudi Arabia, UAE and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Chromatography Instruments Market Competitive Landscape:

The global Chromatography Instruments Market features key players such as Agilent Technologies, Phenomenex, Inc., Pall Corporation, JASCO, Inc., Shimadzu Corporation, Thermo Fisher Scientific, Inc., PerkinElmer, Inc., Waters Corporation, Merck KGaA, Bio-Rad Laboratories, Gilson, Inc, SCION Instruments among others.

Chromatography Instruments Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different techniques, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by end-users, with historical revenue data and analysis.

- Market size, forecasts, and trends by application, with historical revenue data and analysis of sales based on applications.

- Market size, forecasts, and trends by component, with historical revenue data and analysis across various segments.

- The Chromatography Instruments Market is also analyzed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario, and other complementary factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents a complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation of the competitive structure of the market presented through a proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players, and recent major developments undertaken by the companies to gain a competitive edge.

- Research methodology: The assumptions and sources that were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure the most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for the purchase?

- The report provides a strategic outlook of the Chromatography Instruments Market to the decision-makers, analysts, and other stakeholders in an easy-to-read format for making informed decisions.

- The charts, tables, and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and emails for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports to help cater to additional requirements with significant cost savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Chromatography Instruments Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Chromatography Instruments Market Size in 2025 | US$9.13 billion |

| Chromatography Instruments Market Size in 2030 | US$11.47 billion |

| Growth Rate | CAGR of 4.66% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Chromatography Instruments Market |

|

| Customization Scope | Free report customization with purchase |