Report Overview

Cell Surface Markers Market Highlights

Cell Surface Markers Market Size:

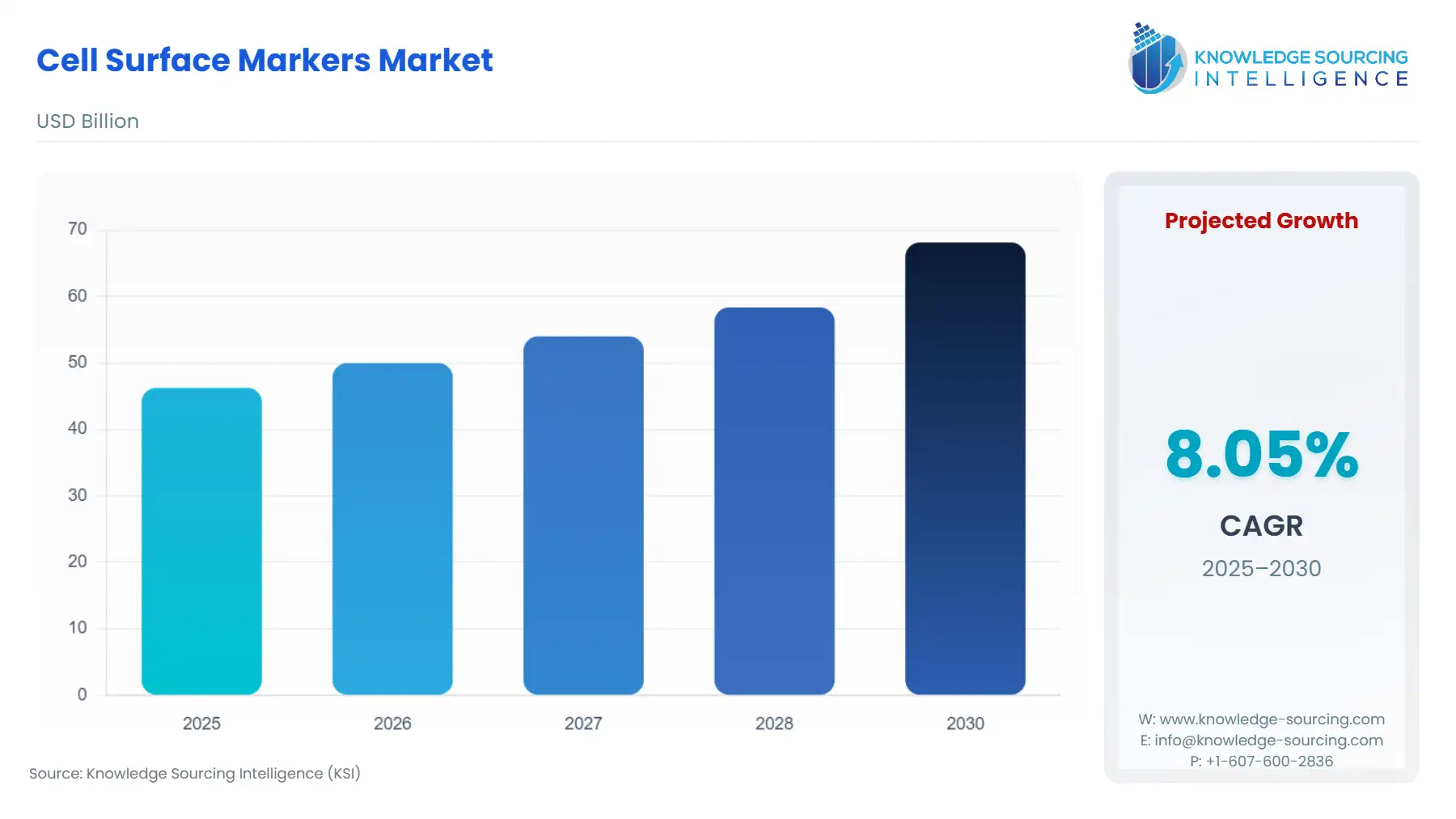

The cell surface markers market is projected to grow at a CAGR of 8.05% over the forecast period, increasing from US$46.263 billion in 2025 to US$68.147 billion by 2030.

Cell surface markers are special proteins used on the surface of cells. In the cell membrane, these serve as markers of specific cell types. These are used in the T cell and B cell to identify their lineage. These are also expressed at a specific time in a particular cell and can be used to identify a particular cell and monitor its growth and differentiation.

Beyond the identification of cells, cell surface markers are also used to aid in drug discovery for personalized medicine. The cell surface markers assist researchers in identifying individual cells, leading to the development of new drugs.

Cell Surface Markers Market Growth Drivers:

- Innovative technologies

Innovative technologies have been contributing to the demand for cell surface marker applications. In November 2024, researchers at the University of Illinois Urbana-Champaign innovated a tiny, four-fingered nanorobot from a single piece of DNA. This can identify the virus that causes COVID-19 for highly sensitive, rapid detection and can even block viral particles from entering cells to infect them. The cell surface markers are used to recognize and make distinctions by the NanoGripper, the nanorobotic hand. Using cell surface markers, nanorobots can interact with other viruses and be used for targeted drug delivery, such as cancer treatment.

- Rising number of cancer cases

A growing number of cancer cases worldwide has propelled the application of cell surface markers. The United States detected new cases of cancer at 2,001,140 in 2024 and 611,720 deaths in the same year. This increased number of cancer cases will continue to drive the need for new drugs. Cell surface markers are being used for identification purposes. These identified cell clusters provide new targets for chemotherapeutic drugs. And if the drugs can be developed to work on the cancer clusters, it may prove successful in the development of the specified drugs.

- Expanding usage in stem cell research

Stem cells and their derivatives are now used to develop novel pharmaceuticals for tissue replacement therapies. The proteomic-based identification of cell surface markers has benefited from various novel biochemical, genetic, and cell-based tools. This has been used in research and clinical applications. Cell surface markers are used to track changes in cells, purify cell populations, and identify cell types.

Cell Surface Markers Market Geographical Outlook:

By geography, the cell surface markers market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific regions. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region.

The Asia Pacific region is expected to grow notably in the cell surface markers market, driven by increasing healthcare expenditure, the presence of major players, and ongoing research and development activities. China's healthcare expenditure has increased from 8,532 billion yuan in 2022 to 9,057 billion yuan in 2023. This increased expenditure has been used in advanced research related to stem cells, targeted medicines, and the development of novel drugs. The increasing cases of cancer and other chronic diseases have also augmented the demand for cell surface markers. Further, the Indian healthcare industry continued its growth in 2023 and reached a value of US$372 billion. This growth is driven by the advancement of the pharmaceutical sector and research and development activities being undertaken by both the private and government sectors.

Cell Surface Markers Market Company Products:

- BD Lyoplate Human Cell Surface Marker Screening Panel: The BD Lyoplate Human Cell Surface Marker Screening Panel contains 242 purified monoclonal antibodies to cell surface markers. These panels have both mouse and rat isotype controls. It can be used to screen cell lines, primary cells, or tissue.

- R&D Systems Inc.: The R&D Systems interactive resource tool allows for exploring the cell surface and intracellular markers. These are characterized by immune, neural, and stem cell types or specific organelles. It is designed to simplify finding appropriate cell or organelle markers. This is helpful in selecting highly sensitive and specific antibodies and immunoassays that can be used for detecting markers of interest.

Cell Surface Markers Market Key Developments:

The major leaders of the cell surface markers market are Abbott Laboratories, Beckman Coulter Inc., Becton, Dickinson and Company, Bio-Rad Laboratories Inc., Immucor Inc., Nihon Kohden Corporation, Thermo Fisher Scientific Inc., Siemens Healthineers, Sysmex Corporation, QIAGEN NV, Agilent Technologies Inc., and Luminex Corporation. The key players in the market are implementing various growth strategies, such as product launches, mergers, acquisitions, etc., to gain a competitive edge.

For Instance:

- In January 2025, Merck acquired HUB Organoids Holding B.V. (HUB). The acquisition was a strategic step aligned with the company’s commitment to providing novel next-generation biology solutions to the life science industry, specifically by enabling wider access to HUB’s technology for faster and more effective drug development. HUB’s organoid offering complements Merck’s cell culture portfolio of media, reagents, and devices.

- In May 2024, Radar Therapeutics completed an oversubscribed $13.4 million in seed financing led by NfX Bio. Major investors Eli Lilly and Company, Biovision Ventures, and KdT Ventures also joined the round, with participation from PearVC, BEVC, and other investors. The financing would support advancing Radar’s internal programs, team expansion, and partnering. Radar Therapeutics is a biotech company developing smart programmable medicines. Radar Therapeutics focuses on full transcriptomic analysis, which sets them apart from traditional targeting methods that rely solely on cell surface markers.

- In February 2024, Iovance Biotherapeutics, Inc. announced that the U.S. Food and Drug Administration (FDA) approved AMTAGVI suspension for intravenous infusion. AMTAGVI is a tumour-derived autologous T-cell immunotherapy indicated for treating adult patients with unresectable or metastatic melanoma previously treated with a PD-1-blocking antibody. Iovance Biotherapeutics, Inc. is a biotechnology company focused on developing and delivering novel polyclonal tumour-infiltrating lymphocyte (TIL) cell therapies for patients with cancer.

Cell Surface Markers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cell Surface Markers Market Size in 2025 | US$46.263 billion |

| Cell Surface Markers Market Size in 2030 | US$68.147 billion |

| Growth Rate | CAGR of 8.05% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Cell Surface Markers Market |

|

| Customization Scope | Free report customization with purchase |

Cell Surface Markers Market Segmentation:

- By Product

- Antibody

- PCR Array

- By Cell Type

- T Cell

- B Cell

- NK Cell

- Monocyte Cell

- Others

- By Source

- Human

- Mouse

- Rat

- Others

- By Application

- Research

- Clinical

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America