Report Overview

Catalyst Regeneration Market - Highlights

Catalyst Regeneration Market Size

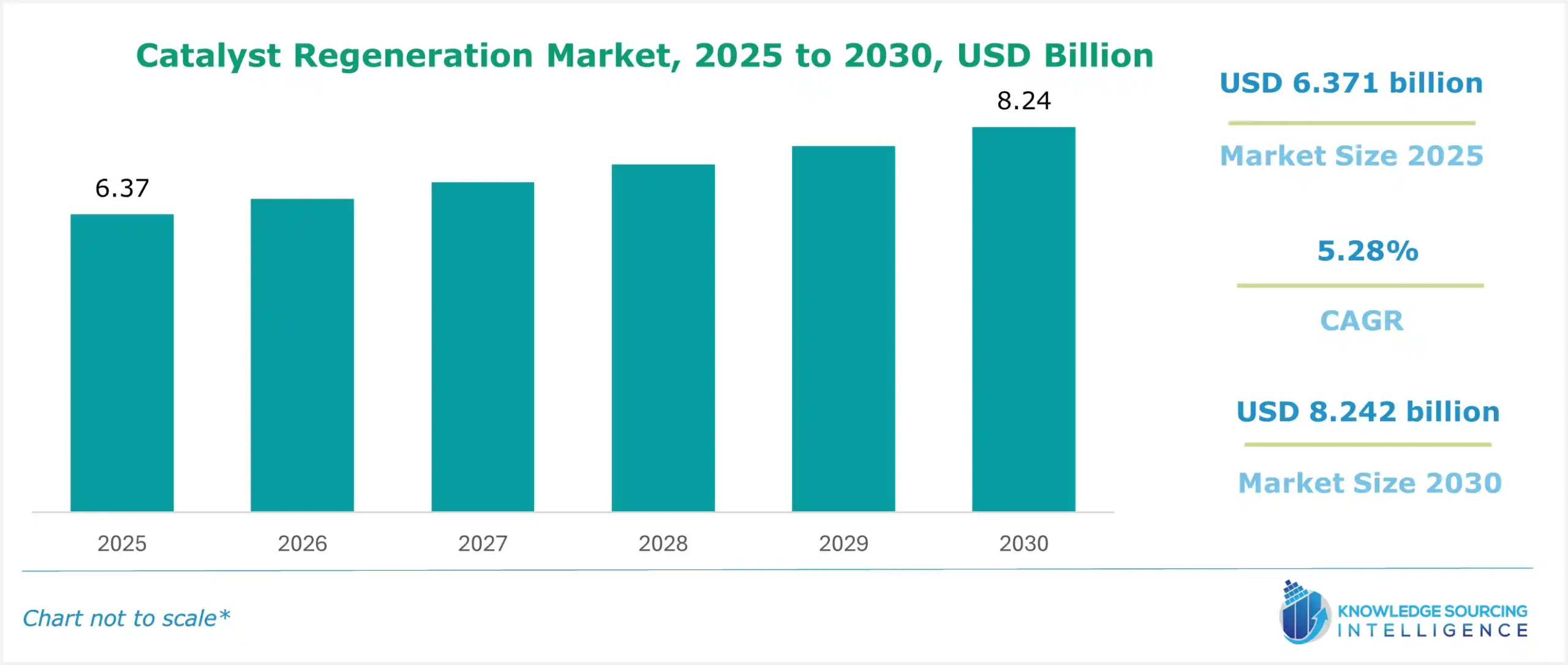

The catalyst regeneration market is expected to grow at a CAGR of 5.28%, reaching a market size of US$8.242 billion in 2030 from US$6.371 billion in 2025.

Catalyst regeneration is the process that employs methods of reviving a de-activated or deteriorated catalyst formed as a result of causes such as fouling, poisoning, and sintering associated with chemical reactions. Techniques used include washing, oxidation, or thermal treatment, eliminating impurities, and restoring the surface properties. It is widely applied in refineries, petrochemical industries, and environmental management, where catalysis is essential for an efficient process and must be cycled to avoid loss and promote cost-effectiveness and sustainability.

Growing applications for catalyst regeneration in the petroleum refining and industrial sectors are anticipated to propel market growth in the projected period. For instance, according to the Ministry of Petroleum & Natural Gas, Indian refining capacity has increased from 215.5 Million Metric Tonnes per Annum (MMTPA) to 256.8 MMTPA in the past 10 years. In 2023-24, the total refining capacity was 256.8 MMTPA, and the domestic consumption of petroleum products in 2023-24 was 233.3 MMTPA. By 2028, India’s petroleum refining capacity is expected to increase to 309.5 MMTPA. Additionally, according to the Ministry of Statistics and Programme Implementation (MoSPI), the gross value added from manufacturing coke and refining products was INR1.56 lakh crore in 2013-14, which increased to INR2.12 lakh Crore in 2022-23. This increase also contributed to All India's GDP from INR99.44 lakh crore to INR269.49 lakh crore in the corresponding year, at current prices. Hence, with the growing refining sector, the catalyst regeneration market is anticipated to grow.

Furthermore, catalyst regeneration market growth will be fuelled positively by increasing application in areas such as the chemical synthesis process and a greater focus on the development of cost-effective regeneration technologies. Hence, the growth and expansion in various end-user industries, particularly in developing economies, are anticipated to propel the catalyst regeneration market in the projected period.

What are the catalyst regeneration market drivers?

Segment analysis of the catalyst regeneration market:

- By type, the on-site regeneration segment is expected to hold a significant share of the catalyst regeneration market.

By type, the catalyst regeneration market is segmented into on-site regeneration and off-site generation. The on-site regeneration segment is expected to hold significant market share in the projected period, as it allows companies to effectively recover the catalyst activity within their plants, thus maintaining continuity in production. At the same time, efficiency is improved, especially for high-capacity industries like petrochemicals and refining. On-site methods also provide more flexibility and tailoring towards specific operations needs, thus granting quicker response times to production demands.

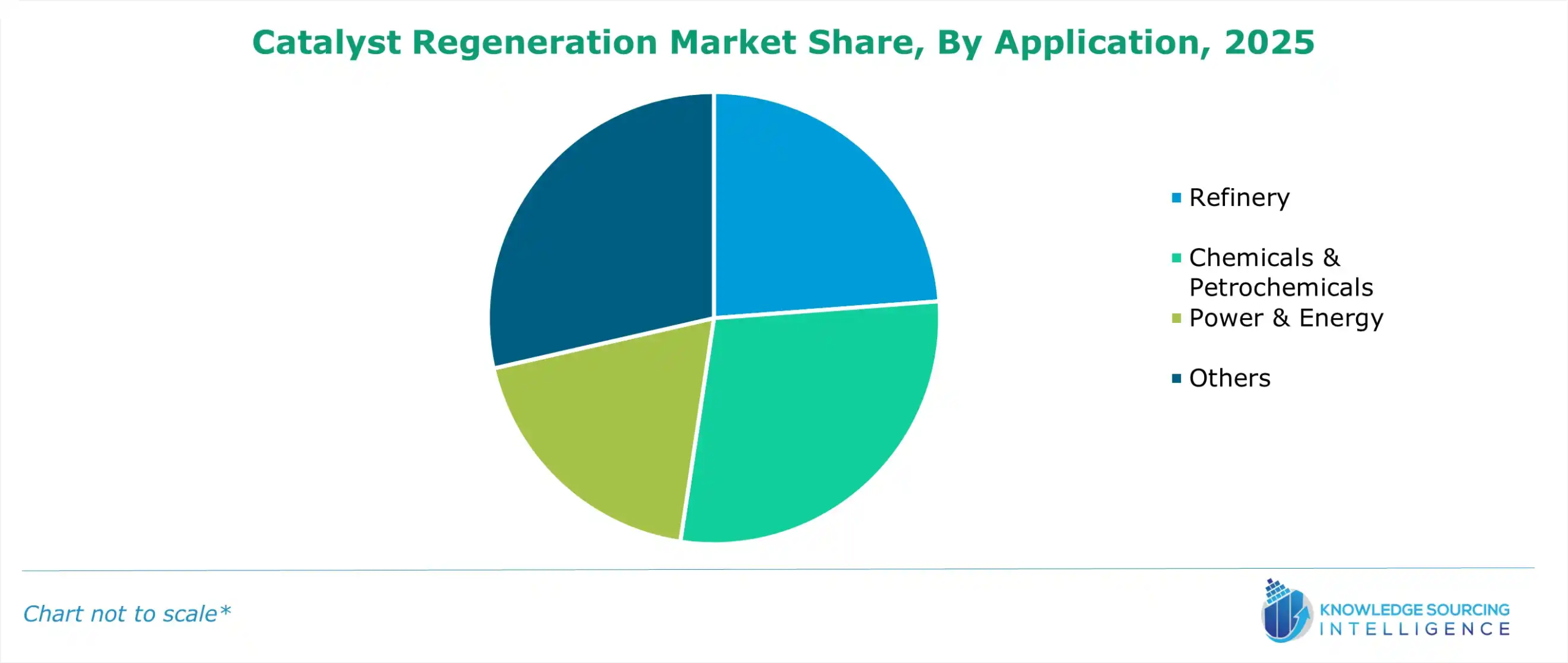

- By application, the refinery segment is expected to hold a significant share of the catalyst regeneration market.

By application, the catalyst regeneration market is segmented into chemical and petrochemical, refinery, power and energy, and others. The refinery sector is anticipated to hold a substantial share of the growing refining capability in developing countries, with the ongoing increase in the strict regulations related to the disposal of spent catalysts. Moreover, in the projected period, the rising application of catalyst regeneration in various industries is anticipated to positively influence market growth.

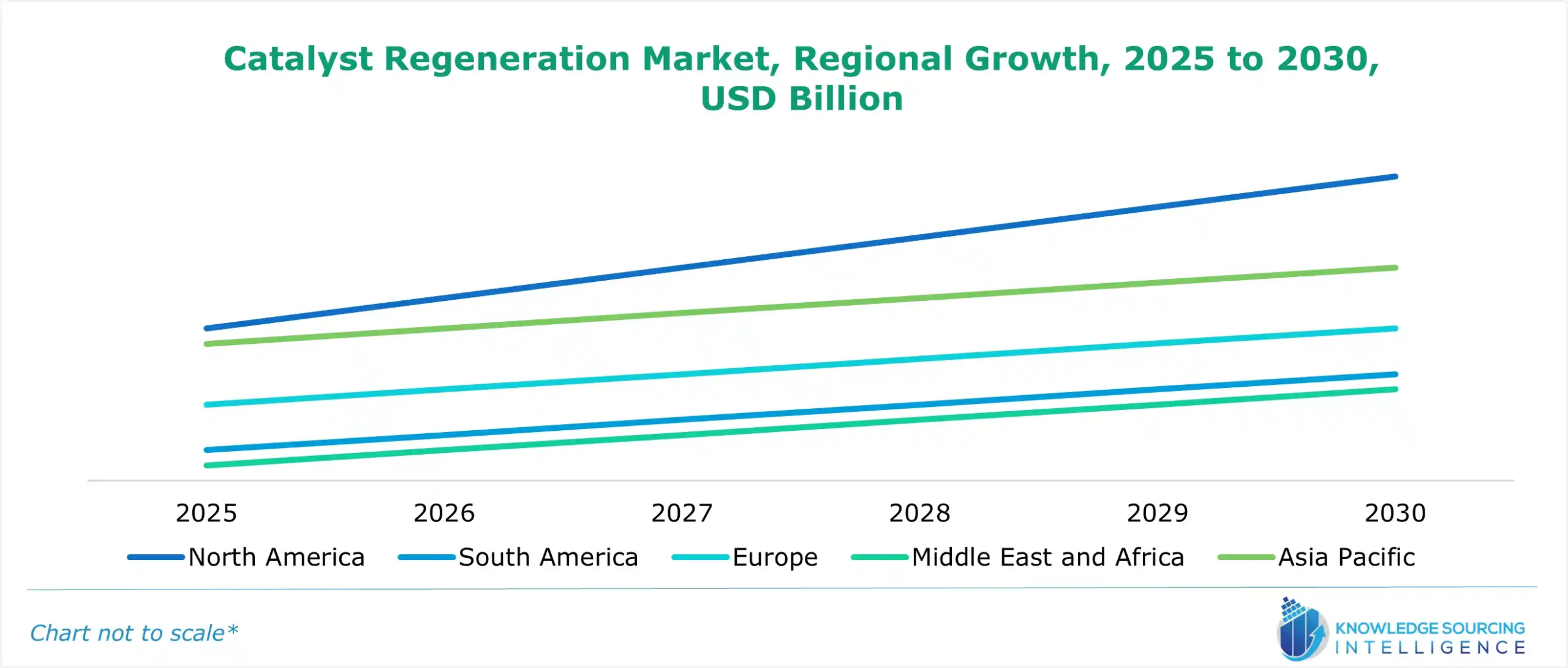

- The Asia Pacific region is anticipated to hold a significant share in the coming years.

The Asia Pacific region is expected to dominate the catalyst regeneration market in the coming years, as the region has some of the fastest-growing economies, such as India and China. Furthermore, the increasing per capita income coupled with growing segments such as refining, chemical, and petrochemical are expected to fuel the Asia Pacific market in the forecasted period. For instance, according to the International Energy Agency, China’s oil refining product sector increased from 2,87,84,257 TJ in 2020, which increased to 2,92,74,286 TJ in 2022. Hence, these factors are expected to fuel the market for catalyst regeneration in the forecasted period.

Copper Ammonium Carbonate Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Catalyst Regeneration Market Size in 2025 | US$6.371 billion |

| Catalyst Regeneration Market Size in 2030 | US$8.242 billion |

| Growth Rate | CAGR of 5.28% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Catalyst Regeneration Market |

|

| Customization Scope | Free report customization with purchase |

Catalyst Regeneration Market Segmentation:

- By Type:

- On-site regeneration

- Off-site regeneration

- By Application:

- Refinery

- Chemicals & Petrochemicals

- Power & Energy

- Others

- By Geography:

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America