Report Overview

Cardiovascular Devices Market - Highlights

Cardiovascular Devices Market Size:

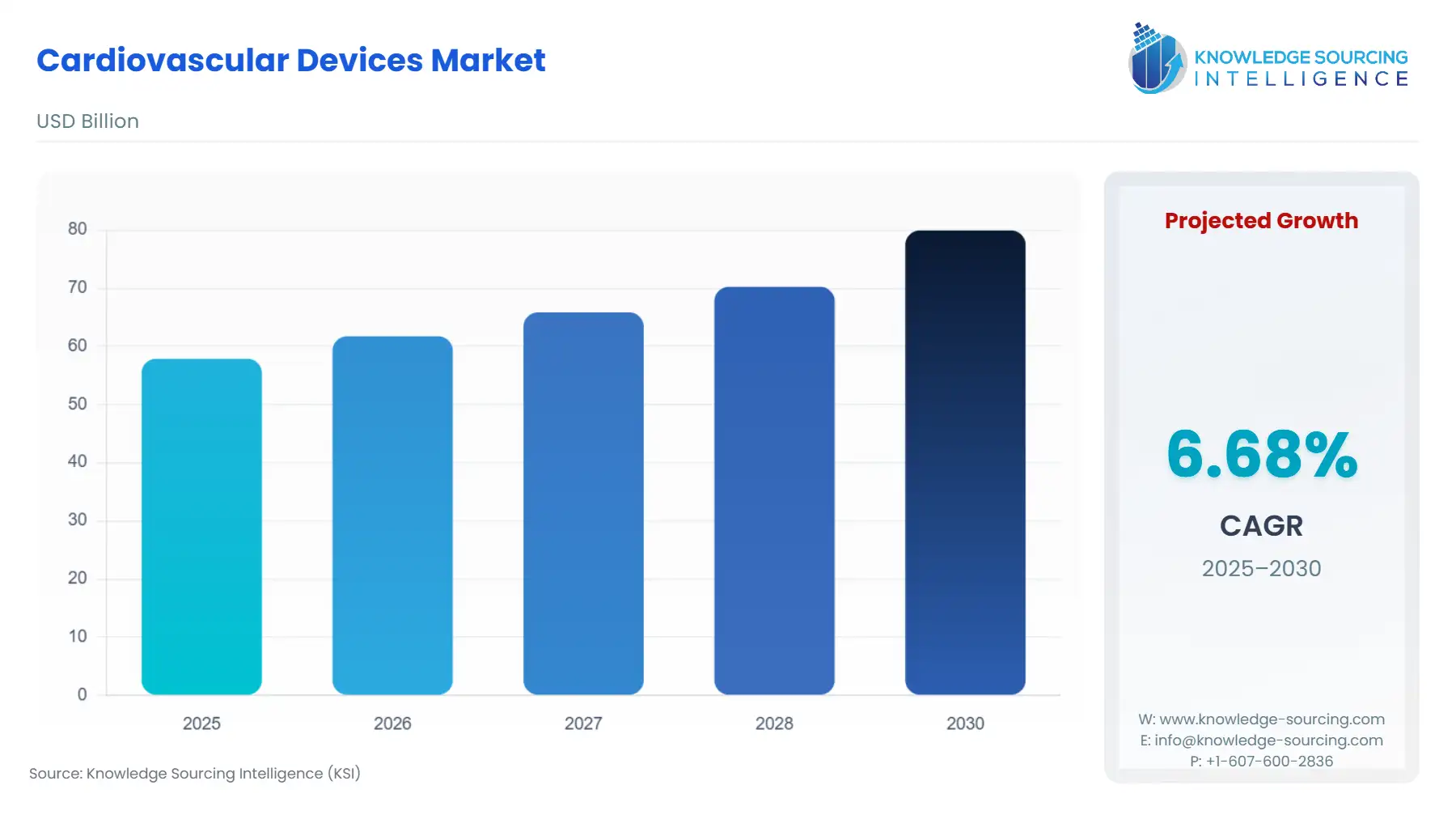

The Cardiovascular Devices Market is projected to grow at a CAGR of 6.68% to reach US$79.951 billion in 2030 from US$57.877 billion in 2025.

Cardiovascular Devices Market Introduction:

The global cardiovascular devices market is a critical segment of the medical device industry, encompassing a wide range of technologies designed to diagnose, monitor, and treat cardiovascular diseases (CVDs), which remain the leading cause of mortality worldwide. These devices include diagnostic tools like electrocardiograms (ECGs) and cardiac biomarkers, interventional devices such as coronary stents and catheters, and therapeutic solutions like pacemakers, defibrillators, and heart valves. The market serves a diverse range of applications, from minimally invasive procedures to complex surgical interventions, addressing conditions such as coronary artery disease, heart failure, arrhythmias, and structural heart defects. As healthcare systems globally grapple with the rising burden of CVDs, driven by aging populations and lifestyle-related risk factors, the demand for advanced cardiovascular devices continues to grow.

Cardiovascular devices are specialized medical tools used to manage heart and vascular conditions, enabling early diagnosis, effective treatment, and continuous monitoring. The market includes diagnostic and monitoring devices (e.g., ECGs, echocardiograms, wearable monitors), interventional cardiology devices (e.g., stents, balloons, catheters), cardiac rhythm management devices (e.g., pacemakers, implantable cardioverter defibrillators), and surgical devices (e.g., heart valves, grafts). These technologies are integral to procedures like percutaneous coronary intervention (PCI), transcatheter aortic valve replacement (TAVR), and coronary artery bypass grafting (CABG). The global burden of CVDs drives market growth, with the World Health Organization (WHO) estimating that CVDs account for approximately 17.9 million deaths annually, representing 32% of global mortality. The increasing prevalence of risk factors such as hypertension, diabetes, and obesity further amplifies the need for innovative devices.

The market is characterized by rapid technological advancements, with a focus on minimally invasive procedures, personalized medicine, and digital health integration. For instance, the adoption of wearable ECG monitors and AI-enhanced diagnostic tools has transformed patient care by enabling real-time monitoring and early intervention.

Cardiovascular Devices Market Overview:

Rising cases of cardiovascular diseases (CVDs) and their severity, resulting in a surging death rate among patients, are driving global cardiovascular device market growth. Increasing expenditure on the healthcare sector and infrastructure development by the government is also contributing to this market growth. Technological innovation in the industry is leading to increased automation and inventions for early and better diagnosis, prevention, and treatment to reduce life threats, significantly expanding the market size. Furthermore, the growing aged population and increasing complexities of lifestyle are elevating the risk of CVDs, broadening the market scope for cardiovascular devices.

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 57.877 billion |

| Total Market Size in 2030 | USD 79.951 billion |

| Forecast Unit | Billion |

| Growth Rate | 6.68% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Device Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

The global cardiovascular device market is expanding during the forecast period, driven by a rise in cardiovascular disease (CVD) cases. According to a World Health Organization (WHO) report, CVDs claim around 17.7 million lives each year, representing 31% of all deaths worldwide, predominantly from heart attacks and strokes.

A growing elderly population is a key factor bolstering this market’s growth. The WHO predicts that by 2050, this group will surpass 1.5 billion, influenced by declining fertility rates and shifting lifestyles. The increasing prevalence of CVDs is raising government awareness and spending, boosting the need for cardiovascular devices for both diagnosis and treatment.

Additionally, the market is supported by robust healthcare infrastructure in regions like North America and Europe, while Asia Pacific is emerging as a high-growth region due to increasing healthcare investments and rising CVD prevalence. The Asia Pacific region’s cardiovascular device market is poised for strong growth throughout the forecast period, fueled by a boom in medical tourism. Industry projections indicate rapid expansion in this area, significantly elevating its market share. This surge is largely attributed to the region’s affordable, high-quality medical services, attracting patients from North America, Europe, and the Middle East. Countries like India, Singapore, South Korea, Thailand, and Malaysia are at the forefront, offering cost-effective healthcare solutions.

Some of the major players covered in this report include Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Edwards Lifesciences Corporation, and Cardinal Health, among others.

Cardiovascular Devices Market Growth Drivers:

Rising Prevalence of Cardiovascular Diseases: The increasing global burden of cardiovascular diseases, fueled by aging populations, lifestyle-related risk factors, and chronic conditions, is a primary driver of the cardiovascular devices market. CVDs, including coronary artery disease, heart failure, and arrhythmias, account for a significant portion of global mortality.

Technological Advancements and Minimally Invasive Procedures: Innovations in cardiovascular device technology, particularly in minimally invasive procedures, are significantly driving market growth by improving patient outcomes and reducing recovery times.

Growing Healthcare Infrastructure in Emerging Markets: The expansion of healthcare infrastructure in emerging markets, particularly in Asia Pacific, is a key driver of the cardiovascular devices market. Countries like China, India, and Brazil are investing heavily in healthcare facilities, driven by rising CVD prevalence and increasing disposable incomes.

Cardiovascular Devices Market Segmentation Analysis:

Cardiovascular Devices Market Segmentation Analysis by Device Type:

Stents: Stents dominate the cardiovascular devices market due to their widespread use in treating coronary artery disease (CAD) and other vascular conditions through minimally invasive procedures like percutaneous coronary intervention (PCI).

Pacemakers: Pacemakers are critical for managing cardiac arrhythmias by regulating heart rhythm, with innovations like leadless pacemakers enhancing patient outcomes.

Implantable Cardioverter-Defibrillators (ICDs): ICDs are used to prevent sudden cardiac death in patients with severe arrhythmias, offering life-saving interventions.

Cardiac Resynchronization Therapy (CRT) Devices: CRT devices improve heart function in patients with heart failure by coordinating ventricular contractions.

Other: Other devices, such as heart valves and grafts, support surgical interventions for structural heart conditions.

Cardiovascular Devices Market Segmentation Analysis by Application:

Coronary Artery Diseases: Coronary Artery Disease (CAD) is the leading application segment in the cardiovascular devices market, reflecting its status as the most common form of cardiovascular disease globally.

Cardiac Arrhythmia: Devices for cardiac arrhythmias, such as pacemakers and ICDs, address irregular heart rhythms, a growing concern due to aging populations.

Heart Failure: Heart failure devices, including CRT devices and ventricular assist devices, support patients with reduced cardiac function.

Other: Other applications include structural heart defects and peripheral vascular diseases, addressed by devices like heart valves and vascular grafts.

Cardiovascular Devices Market Segmentation Analysis by End-User:

Hospitals: Hospitals represent the primary end-user segment, serving as the main setting for diagnosing, treating, and managing cardiovascular conditions with advanced infrastructure.

Specialty Clinics: Specialty clinics focus on outpatient cardiac care, using devices like ECG monitors and stents for non-invasive procedures.

Ambulatory Surgical Centers: Ambulatory surgical centers perform minimally invasive procedures, such as PCI, using stents and catheters.

Others: Other end-users include diagnostic centers and research institutes using cardiovascular devices for testing and development.

Cardiovascular Devices Market Geographical Outlook:

The Cardiovascular Devices market report analyzes growth factors across the following regions:

North America: North America is a significant market, driven by robust healthcare infrastructure and high CVD prevalence, particularly in the USA.

Europe, Middle East & Africa: Europe’s market is propelled by advanced healthcare systems and stringent regulations, while the Middle East and Africa show slower growth due to limited infrastructure.

Asia Pacific: The Asia Pacific region is poised for strong growth, fueled by increasing healthcare investments, rising CVD prevalence, and a boom in medical tourism.

Cardiovascular Devices Market Competitive Landscape:

Medtronic plc: Medtronic is a leading player, offering advanced devices like leadless pacemakers and TAVR systems for cardiovascular care.

Abbott Laboratories: Abbott provides innovative stents and diagnostic tools, focusing on coronary artery disease and heart failure solutions.

Boston Scientific Corporation: Boston Scientific specializes in electrophysiology devices, such as ablation catheters for treating arrhythmias.

These companies are among the global leaders in cardiovascular device manufacturing, driving innovation through advanced technologies and strategic partnerships.

Cardiovascular Devices Market Latest Developments:

July 2025: The Abu Dhabi Investment Authority (ADIA) signed an investment agreement to acquire a 3% stake in Meril Life Sciences for $200 million, aimed at advancing the development and global commercialization of cardiovascular devices.

November 2024: Johnson & Johnson MedTech received FDA approval for its VARIPULSE Pulsed Field Ablation (PFA) Platform, designed for treating drug-refractory paroxysmal atrial fibrillation (AFib).

October 2024: Boston Scientific launched the FARAWAVE NAV Ablation Catheter and FARAVIEW Software, receiving FDA approval to enhance its FARAPULSE PFA System for treating atrial fibrillation.

August 2024: Johnson & Johnson introduced the MatrixSternum fixation system in the U.S., designed to stabilize the sternum following open-heart surgeries.

Cardiovascular Devices Market Scope:

Cardiovascular Devices Market Segmentation:

By Device Type

Stents

Pacemakers

Implantable Cardioverter-Defibrillators (ICDs)

Cardiac Resynchronization Therapy (CRT) Devices

Other

By Application

Coronary Artery Diseases

Cardiac Arrhythmia

Heart Failure

Other

By End-User

Hospitals

Specialty Clinics

Ambulatory Surgical Centers

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others