Report Overview

Caps And Closures Market Highlights

Caps and Closures Market Size:

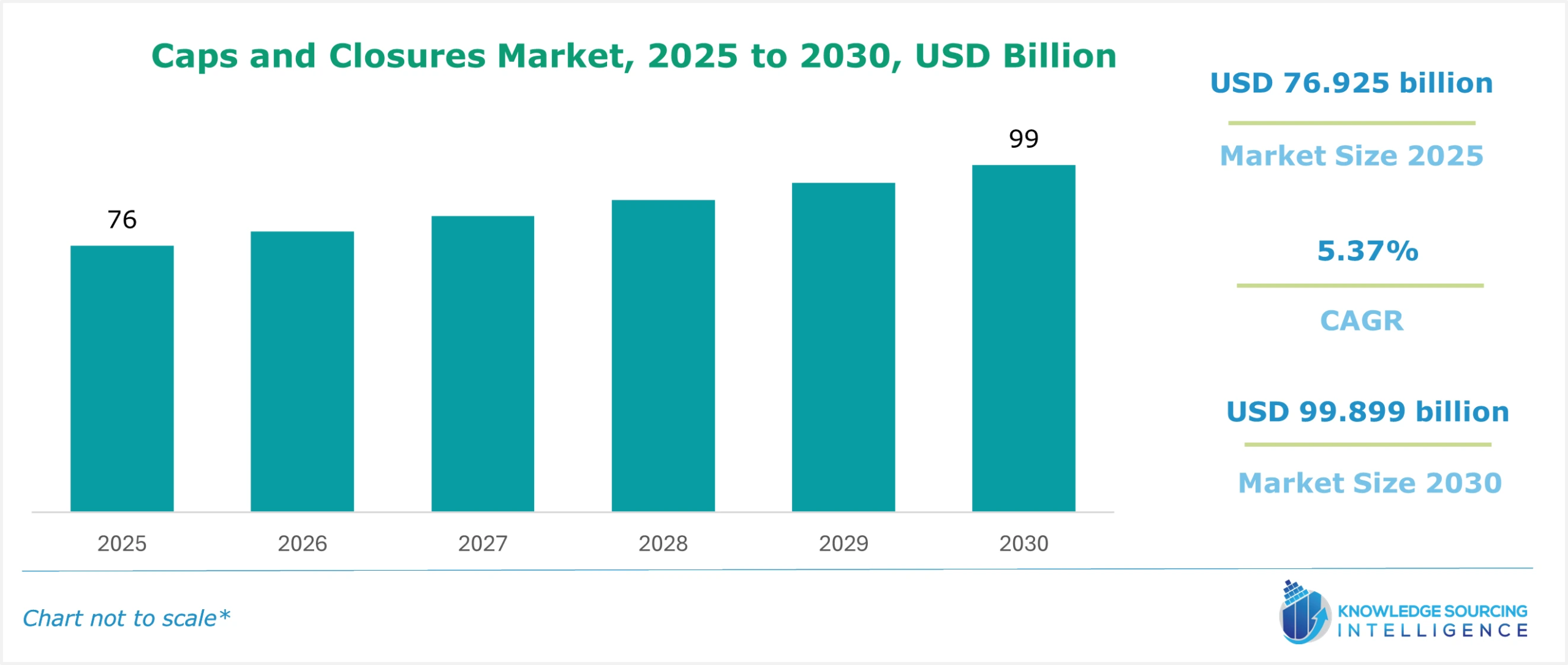

The Caps & Closures Market is expected to grow at a rate of 5.37% CAGR, reaching a market size of US$99.899 billion in 2030 from US$76.925 billion in 2025.

Caps and closures are used to seal a container, generally containing different types of liquid. They offer multiple advantages to the packaging industry. These are easy to install and open, preventing leaks and environmental exposure and keeping the products safe.

The demand for caps and closures is growing due to rising food consumption and increasing worries about the safety and quality of products, so there is a greater need for caps and closures. Due to the growing packaged food and consumer goods markets, the targeted market is also rising. As a result, there is an increasing demand for novel packaging materials that can protect from harsh environments without lowering the quality of the product. The trend in health and wellness is shifting towards preventative healthcare, which is fuelling demand for FMCG items that promote healthier lifestyles. The global market for caps and closures is expected to develop because of rising beverage consumption and inventive packaging techniques.

According to the World Integrated Trade Solution (WITS), the top importers of stoppers, lids, caps, and other closures of plastics are the United States, having imports of 367,044,000 Kg, followed by the European Union with 105,355,000 Kg, then France with 121,950,000 Kg. Germany follows it with imports of 112,421,000 Kg and Canada with 62,879,900 Kg in 2023.

The exporters of stoppers, lids, caps, and other closures made of plastics are China, with exports of US$1,887.927 million, and the European Union, with US$1,480.943 million in 2023, according to World Integrated Trade Solution (WITS).

Furthermore, the extensive applications of caps & closures market in the food & beverage sector with different companies involved in processing raw materials, packaging products & distribution require caps for packaged food, alcoholic & non-alcoholic drinks, among others. Increasing demand for bottled water is also a crucial factor determining the market growth during the forecast period.

Caps and Closures Market Growth Drivers:

- Rising demand for alcoholic beverages across the globe

Beverage packaging is one of the most important sectors for the caps and closures market. The shelf life of beverages is increased while maintaining their flavor and texture using beverage packaging. Pouches and cartons are two common packaging options used by the beverage packaging business. The need for cutting-edge differentiated closures from major beverage firms worldwide drives the market for premium caps in the beverage industry. According to the OECD, alcohol consumption has surged from 10.6 liters per capita consumption in 2021 to 10.8 liters per capita in 2022 in France.

Further, the need for tamper-evident caps and closures is driven by customer demand for bottled water during the forecast period. Bottled water's rise is driven by lifestyle changes and per capita consumption. Sales of premium bottled water have risen because of consumers' rising income levels, increasing the demand for caps and closures in the market.

- Increasing global consumption of bottled water

The International Bottled Water Association claims that a significant cause of the premiumization of bottled water is the increase in the number of high-net-worth individuals (HNWI). For instance, Silgan Closures introduced a one-piece 55 mm KS2 plastic closure for three- and five-gallon home and office delivery bottled water in July 2020. The closure differs from rival water bottle closures by including several innovative features. The closure has a pierceable shell design that almost eliminates leakage and is made of a proprietary resin mixture that resists cracking. The closure includes a tamper-evident band and a flow-in closure liner for an improved bottle seal to assure the product's safety.

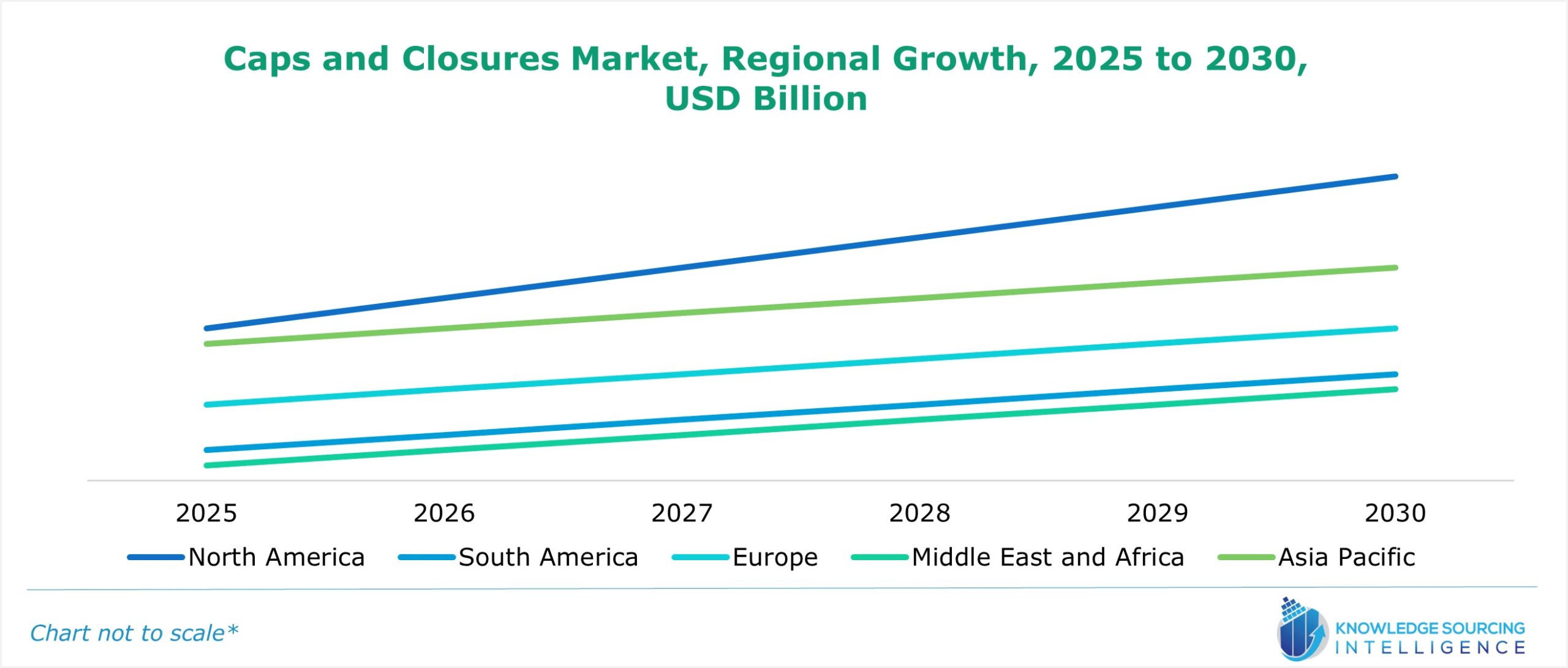

Caps and Closures Market Geographical Outlook:

By geography, the caps and closures market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The growth of North America is primarily attributed to the rapid demand for caps and closure from various Industries such as pharmaceuticals, food, alcoholic & non-alcoholic drinks, and cosmetics, among others. Increasing demand from several industries is propelling the need for caps and closures in the United States. According to the World Integrated Trade Solution (WITS), the United States is one of the largest importers of stoppers, caps, lids, seals, and other packing access and stoppers, lids, caps, and other closures made of plastics in 2023. According to the World Integrated Trade Solution (WITS), the US was the largest importer of stoppers, caps, lids, etc., for bottles and other packing accessories. The country imported 107,955,000 Kg of product worth US$891.957 million in 2023. Further, there is a growing emphasis on sustainable packaging, such as plastic bottles, metal cans, food wrappings, corrugated cardboard boxes, and others. Understanding the production and disposal of these materials is crucial for the country's economy and environment.

Caps and Closures Market Challenges:

- Increasing use of pouch and blister packaging solutions

Factors like an increase in the usage of packaging without closures, like pouches and blister packages, are constraining the market's growth. Additionally, fluctuating raw material prices limit market expansion. Volatile costs for raw materials used in the production of caps and closures are hindering the market's overall expansion.

Caps and Closures Market Key Developments:

The market leaders for the caps and closures are Saint-Gobain Life Sciences, Silgan Holdings, CSI Closure, Berry Global, Inc., BERICAP, SIG, Chemco Group, Pranil Polymers, Alpla India Pvt. Ltd., Syscom Packaging Company, and Secure Closures. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage over their competitors. For Instance,

- In October 2024, Paboco, a company specializing in paper bottle packaging based in Denmark, and Blue Ocean Closures, a company specializing in the development and production of sustainable, bio-based packaging solutions based in Sweden, collaborated to create the industry’s first market-ready paper bottle and fiber-based cap combination. The package, including cap weights of less than 16 grams, has an HDPE barrier of less than 2 grams. It is recyclable.

- In May 2024, Origin Materials, a leading carbon-negative materials company, partnered with Bachmann Group, a packaging production and logistics company based in Switzerland, for the mass production of sustainable PET caps & closures, including tethered caps. The manufacturing will take place at Bachmann’s European facilities. The caps & closures will be sustainable.

Caps and Closures Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Caps And Closures Market Size in 2025 | US$76.925 billion |

| Caps And Closures Market Size in 2030 | US$99.899 billion |

| Growth Rate | CAGR of 5.37% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Caps And Closures Market |

|

| Customization Scope | Free report customization with purchase |

The caps and closures market is analyzed into the following segments:

- By Type

- Caps

- Closures

- By Raw Material

- Plastic

- Metal

- Others

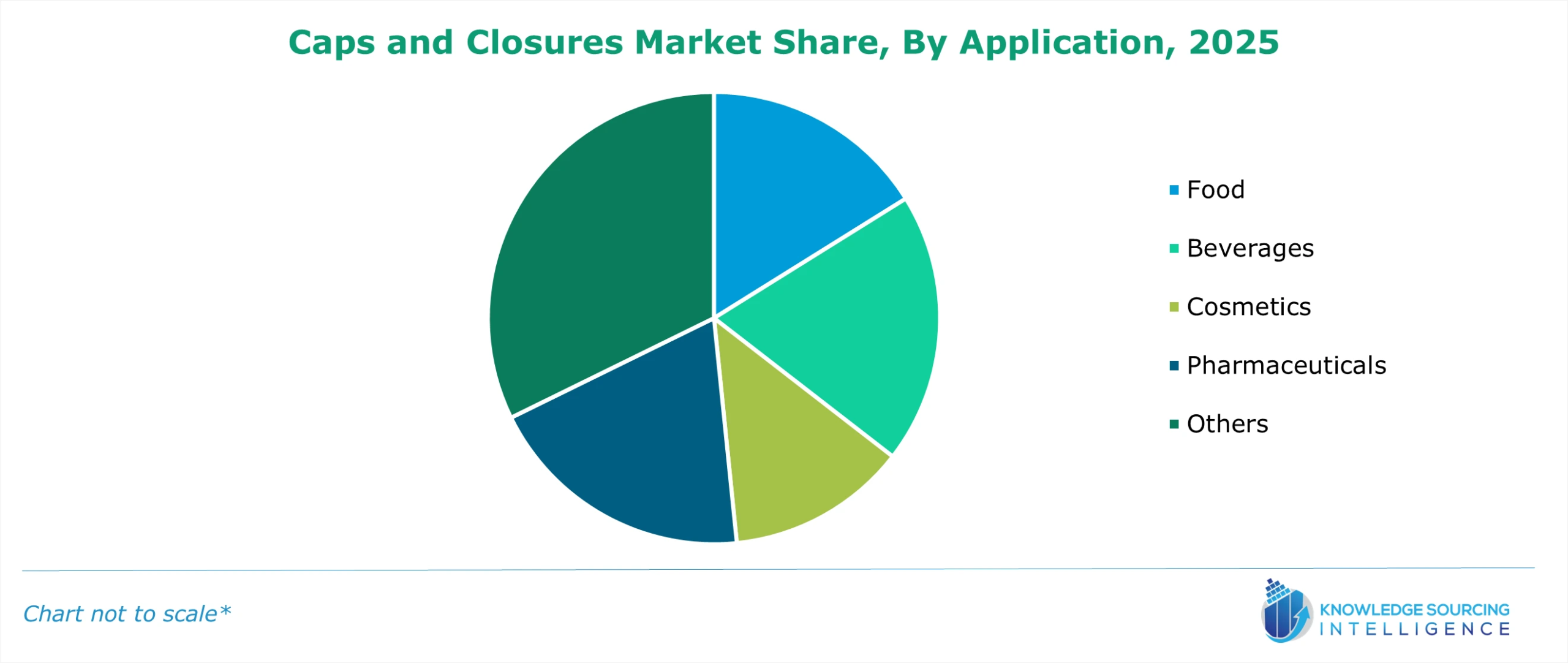

- By Application

- Food

- Beverages

- Cosmetics

- Pharmaceuticals

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports: