Report Overview

Building Integrated Photovoltaics Market Highlights

Building Integrated Photovoltaics Market Size:

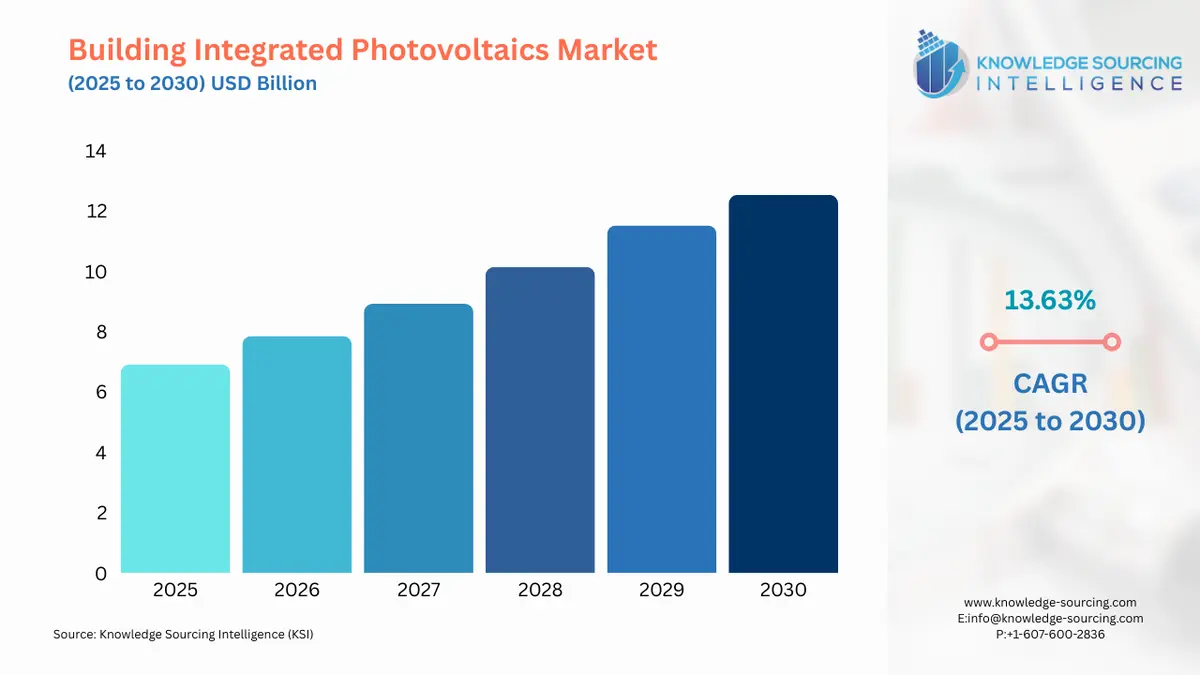

The building integrated photovoltaics market is projected to grow at a CAGR of 13.63% over the forecast period, increasing from US$6.910 billion in 2025 to US$12.526 billion by 2030.

Photovoltaics or PV is the technology, that converts light energy from the sun into electrical energy. Building integrated photovoltaics or BIPV is a type of PV material, that is commonly used in infrastructural projects and is used to replace conventional building materials, like roofs, facades, and skylights, to generate electricity. The BIPV solution helps in the generation of solar energy and also helps in reducing the carbon footprint of the infrastructure.

Building Integrated Photovoltaics Market Trends:

The increasing adoption of PV technology in the residential sector is among the major factors pushing the growth of the market. The National Renewable Energy Laboratory, or NREL, in its report, stated that the residential adoption of standalone and storage solutions of BIPV technology in the California region of the USA witnessed major growth during the past few years. The agency stated that in 2022, residential building-integrated photovoltaics installation in the region was recorded at 8.9 MWdc. Between 2020 and 2022, the residential BIPV installation witnessed a growth of about 140%. Furthermore, in California, the major installation of BIPV in the residential sector was completed by Tesla. The agency stated that in 2021, the company installed about 98% of the all-new residential BIPV in the state, and 94% in 2022.

Building Integrated Photovoltaics Market Growth Drivers:

- Increasing adoption of photovoltaic technology

The global adoption of photovoltaic technology witnessed significant growth. The major factor propelling the adoption of photovoltaic technology in the global market is the shift in consumer preference towards more sustainable and renewable energy, especially solar energy. With the changing preferences of the consumer, the demand for solar energy, and solar energy solutions, which includes BIPV technology witnessed a major growth.

The introduction of favorable policies, and subsidy schemes by governments across the globe is also among the key factors propelling the growth in photovoltaics adoption. SolarPower Europe, in its report, stated that in 2023, the annual PV installation capacity in the global market witnessed an increase of 87%, reaching 447 GW in 2023, compared to 239 GW in 2022. In 2023, China and the USA were the biggest solar markets, with total installed recorded at 253 GW and 32.4 GW respectively. In 2023, the total solar installation in Brazil and Germany was recorded at 15.4 GW and 12.5 GW respectively.

Similarly, the Department for Energy Security and Net Zero, of the UK Government, in its report stated that the installation capacity of the nation witnessed significant growth during the past few years. The agency stated that in August 2024, the total capacity of solar photovoltaics deployed in Great Britain was recorded at 19,967.3 MW, which surged to 17,019.2 MW in September, and 17,094.9 MW in October 2024. In November 2024, the total installed capacity of solar photovoltaics in the nation was recorded at 17,171.2 MW.

Similarly, the deployment of solar energy in the USA also grew significantly. The International Energy Agency, in its Technology Collaboration Program report, stated that in 2023, the USA witnessed major growth in the deployment of solar energy. The agency stated that in 2023, the total deployment of solar PV in the nation was recorded at 26.3 GWac. The agency further stated that the price of residential PV modules witnessed a decline in 2023, with an average price of residential PV modules recorded at an average of US$2.49/W. Furthermore, the Department of Energy Efficiency and Renewable Energy, in its report stated that, in the USA, the share of building-sited distributed PV was recorded at 30% of every new solar PV installed, in 2020.

- Growth demand for roof PV solution

Building-integrated photovoltaic equipment can essentially be placed at any characteristic surface of a building's exterior. Roof elements consist of photovoltaic shingles, rolled thin-film surfaces, and PV glass skylights with PV cells or transparent PV surfaces incorporated. This roofing systems installation of building-integrated photovoltaic systems fully replaces the traditional metal roofs, 3-tab asphalt shingles, and even ceramic tiles.

Utility-scale solar photovoltaic is the least expensive for generating new electricity in most parts of the world, notwithstanding the increasing commodity prices. Distributed solar PV, like rooftop solar, is on the verge of faster growth due to elevated retail electricity prices combined with increasing policy support. Most importantly, Governments across the world are providing incentives, such as feed-in tariffs, tax breaks, and net metering programs to promote renewable energy use which are increasingly contributing to the rise of building-integrated photovoltaic installations such as roofs as they are more financially appealing to owners of buildings.

The solar energy program was adopted by the EU Commission in May 2022 to free the current sector from all the existing and prospective barriers and challenges involved in it. The program focuses on being able to deliver over 320 GW of solar photovoltaics by 2025 and almost 600 GW by 2030 as part of the REPowerEU plan. Also, the European Solar Rooftops Initiative wants to harness the potential rooftops for the clean generation of energy. Its objective is to introduce a solar-ready requirement for new buildings as part of the revised Energy Performance of Buildings Directive. Existing public buildings will progressively install solar energy from 2027, if technically, economically, as well as functionally feasible.

Building Integrated Photovoltaics Market Geographical Outlook:

- The North American region is expected to witness significant growth in the building-integrated photovoltaics market

The growth of the North American building-integrated photovoltaics market is mainly attributable to the United States market owing to the growing demand for renewable energy, government incentives as well as a shift in focus toward sustainability. The market for building-integrated photovoltaics in the United States is growing rather significantly due to a demand for renewable energy, government incentives as well as a shift in focus toward sustainability. Adopting renewable energy sources is currently one of the main drivers in the United States market, which makes building-integrated photovoltaic systems appealing for both residential and commercial projects because they offer power generation through solar energy integration. For instance, as per the International Energy Agency (IEA) data, the increase in renewable electricity capacity was projected to be 337.1 GW in 202-2028 from 156.6 GW in 2017-2022.

The federal and state incentives for tax credits and rebates have made the installation of building-integrated photovoltaics systems more affordable in the nation. As an example, the US government introduced the Inflation Reduction Act (IRA) in August 2022, which is expected to ramp up funding for renewal energy within the next decade through tax credits and other methods. $11.7 billion was reserved by the IRA for the Loan Programs Office (LPO) to create new loans, increasing loan authority by $100 billion. This brought utility-scale solar PV and wind projects with LPO loan guarantees into the mainstream energy mix of the nation for a cleaner future.

Building Integrated Photovoltaics Market Key Developments:

- In May 2024, Silfab Solar received the Innovation Award from the U.S. Department of Energy for its Made-in-USA solar cell program. The $20 million project intends to make a class of back-contact N-type cells with an efficiency of about or above 26%. It involves establishing a 300-MW pilot line at the South Carolina site. Thus, the project enables swift upscaling of a cost-effective back-contact cell technology into high-volume manufacture onto Silfab's next premium PV solar module line. Silfab also won a different innovation award from the Solar Energy Technologies Office of the DOE to develop high-efficiency building-integrated PV modules as solar spandrels.

Building Integrated Photovoltaics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Building Integrated Photovoltaics Market Size in 2025 | US$6.910 billion |

| Building Integrated Photovoltaics Market Size in 2030 | US$12.526 billion |

| Growth Rate | CAGR of 13.63% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Building Integrated Photovoltaics Market | |

| Customization Scope | Free report customization with purchase |

The building-integrated photovoltaics market is analyzed into the following segments:

- By Technology

- Crystalline Silicone

- Thin Film

- Others

- By Application

- Roof

- Facades

- Others

- By End-User

- Industrial

- Commercial

- Residential

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific Region

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America