Report Overview

Breast Reconstruction Market Size, Highlights

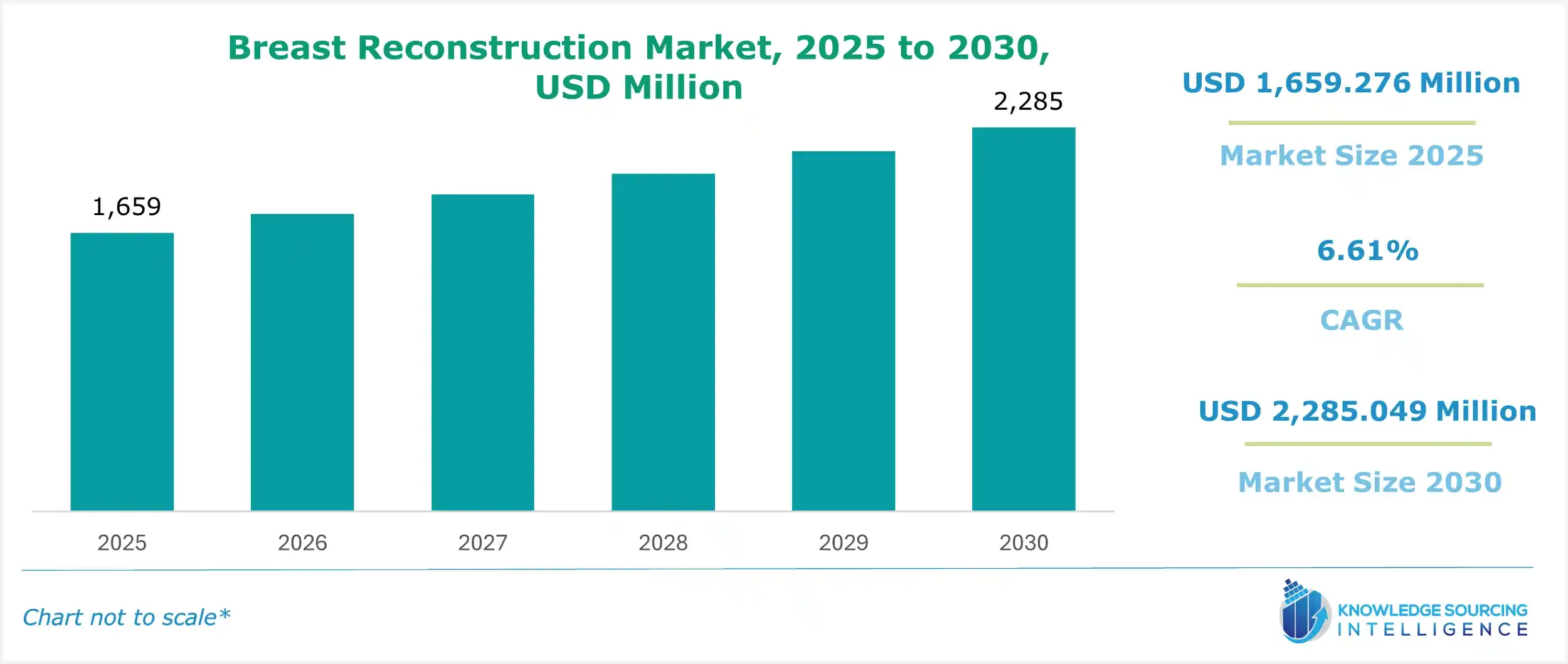

Breast Reconstruction Market Size:

The Breast Reconstruction Market, valued at US$1,659.276 million in 2025, is projected to grow at a CAGR of 6.61% reaching a market size of US$2,285.049 million by 2030.

With the growing incidences of breast cancer globally, the market is projected to show strong growth prospects. The rising demand for immediate breast reconstruction procedures following mastectomy further allows the market to thrive in the forecast period. Furthermore, with technological advancements and companies offering varied products in the form of implants or mesh, the market for breast reconstruction holds favourable growth prospects.

Breast Reconstruction Market Overview & Scope:

The Breast Reconstruction market is segmented by:

- Type: The breast reconstruction market is segmented into implants and tissue expanders. The implant segment is further sub-segmented into silicone implants and saline implants.

- Mastectomy: The market is segmented into unilateral and bilateral.

- End-User: The Breast Reconstruction market is segmented into hospitals, leading the market, cosmetology clinics, and ambulatory surgery centers.

Region: The Breast Reconstruction market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Top Trends Shaping the Breast Reconstruction Market:

1. Development of natural-looking implants

- There is a growing technological advancement in breast reconstruction technology driving development in natural-looking breast implants.

2. Rise in Medical tourism for breast reconstruction

- Medical tourism has gained traction in recent years and will gain more momentum during the forecast period. There is an increasing demand for medical tourism for breast reconstruction among consumers due to affordability and better reconstruction services.

3. Regenerative medicine expansion in breast reconstruction

- There is growing potential for the integration of regenerative medicine using biological materials such as stem cells due to its improved efficiency in functional recovery and reduction in complications.

- There is increasing advancement in the use of Adipose-derived stem cells in breast reconstruction.

Breast Reconstruction Market Growth Drivers vs. Challenges:

Opportunities:

- Growing breast cancer cases offering opportunities in the breast reconstruction market: There is a growing number of breast cancer cases globally, increasing the demand for breast reconstruction post-mastectomy. As per the data by the WHO, in 2022, there were 2.3 million women diagnosed with breast cancer. Many of them are potential candidates for delayed breast reconstruction. Some candidates require revisions of their previous breast reconstruction, further fueling the market expansion.

Challenges:

- High cost leading to less affordability: The high cost of breast reconstruction service is the major market restraint. The high cost leads to lesser affordability for the service, restricting its adoption by a large section of consumers who need breast reconstruction.

Breast Reconstruction Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is projected to grow due to rising cases of breast cancer, and demanding breast reconstruction after the treatment is increasing the market perspective. As per the data by the Global Cancer Observatory, India ranked highest in the number of breast cancer cases, 98337, in 2022, highlighting the growing number of breast cancer cases and deaths.

- North America: North America is projected to hold a significant share of the global breast reconstruction market due to advanced healthcare facilities. Additionally, prominent market players offering advanced breast reconstruction products are propelling the market growth. For example, Sientra, a public medical device company headquartered in Santa Barbara, CA, United States, offers breast implants with high-strength cohesive silicone gel. The FDA-approved breast implants are available to board-certified and board-eligible plastic surgeons only.

Breast Reconstruction Market Competitive Landscape:

The market is moderately consolidated, with the presence of some of the key notable players, such as Allergan Aesthetics, Johnson & Johnson, and Integra Lifesciences, among others. There is the emergence of some new entrants in the market with their innovative solutions, like RTI Surgical Inc. and Bimini Health Tech. There are increasing mergers, acquisitions, and partnerships in the market, such as Ideal Implant Incorporated's acquisition by Bimini Health in 2023. There is a presence of niche players like GC aesthetics.

- Market Entry: In November 2023, RTI Surgical Inc. received Investigational Device Exemption (IDE) approval for confirming the safety and effectiveness of Cortiva Allograft Dermis in implant-based breast reconstruction. RETI Surgical Holdings Inc. This milestone for RTI Surgical Inc. will enhance its market presence, particularly in the acellular dermal matrices, if the trial is successful.

- Production Expansion: In July 2024, Integra Lifesciences Holdings Corporation started manufacturing PriMatrix® and SurgiMend®, a soft tissue reconstruction widely used in breast reconstruction, at its new manufacturing facility in Braintree, Massachusetts, in the first half of 2026. This will expand its production capacity in small-scale breast reconstruction and the Accelular Dermal Matrix in implant-based breast reconstruction.

- Niche Player. There is also the presence of some niche players like GC Aesthetics offering silicone breast implants. For instance, Perle has revolutionary BioQ-surface technology and innovative Hydrocone to minimize post-operative complications with a limited market presence in Europe and Latin America.

Breast Reconstruction Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Breast Reconstruction Market Size in 2025 | US$1,659.276 million |

| Breast Reconstruction Market Size in 2030 | US$2,285.049 million |

| Growth Rate | CAGR of 6.61% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Breast Reconstruction Market | |

| Customization Scope | Free report customization with purchase |

Breast Reconstruction Market is analyzed into the following segments:

By Type

- Implants

- Silicone Implants

- Saline Implants

- Tissue Expander

By Mastectomy

- Unilateral

- Bilateral

By End-User

- Hospitals

- Cosmetology Clinics

- Ambulatory Surgery Centers

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa