Report Overview

Breast Pump Market - Highlights

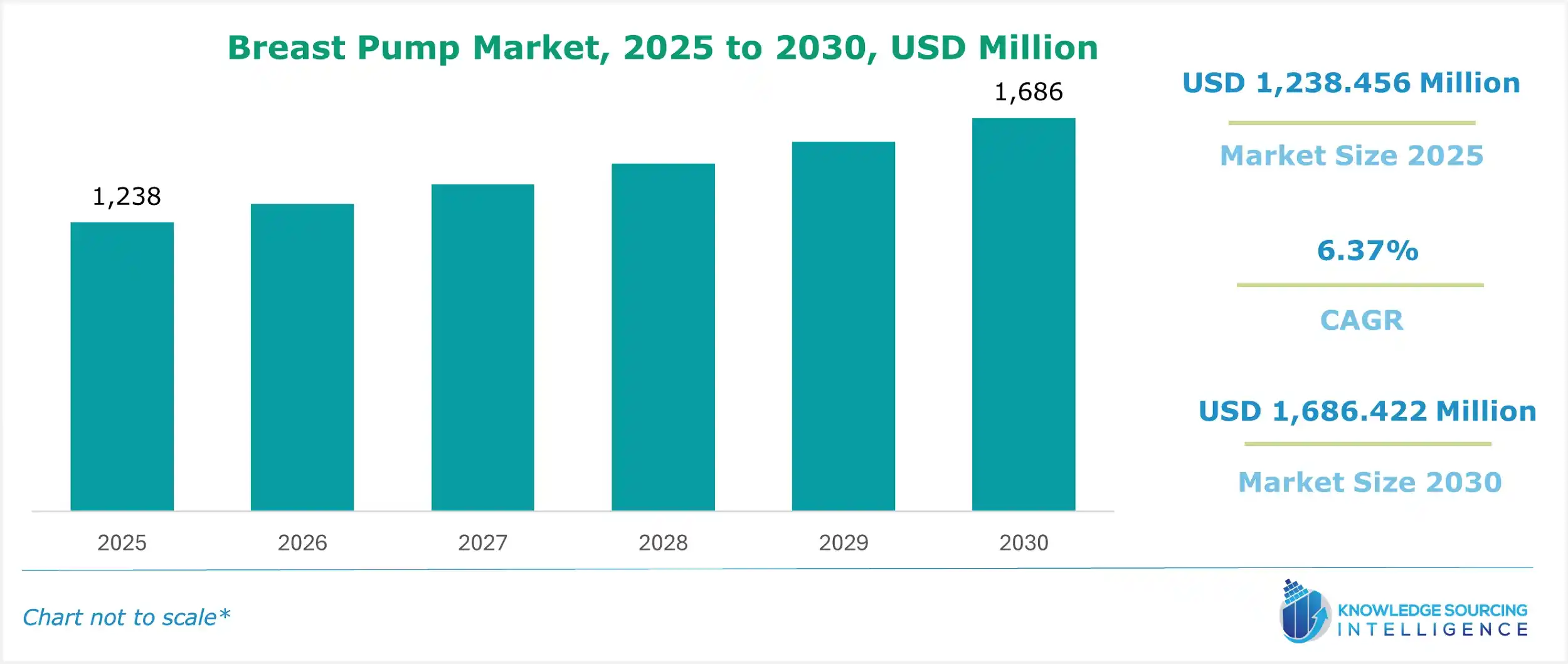

Breast Pump Market Size:

The breast pump market, valued at US$1,686.422 million in 2030 from US$1,238.456 million in 2025, is projected to grow at a CAGR of 6.37% through 2030.

The key benefits of breast pumps are storage and filtration of breast milk, thereby ensuring the efficient management of breastfeeding, especially for working women. Due to the user-friendly reimbursement policies in developed economies, the breast pump is poised to witness healthy growth during the forecast period. Further, under the purview of the Affordable Care Act, the environment for switching over to this form of breastfeeding has been made even more possible in the USA. Additionally, the growing rate of women's employment is expected to further throttle the demand for this market during the forecast period.

Breast Pump Market Overview & Scope:

The breast pump market is segmented by:

- Type: The breast pump market by type is segmented into open system and closed system. The increased utilization rates are mostly because these systems are more hygienic and contamination-free. Closed breast pumps are quickly displacing open systems, and their market share will likely grow. Breast pumps with a closed system have a lid or layer that functions as a barrier between the collecting kit and the pumping unit or motor, preventing contamination of the milk collected. This protective coating also keeps the milk particles out of the pump tube and motor. These gadgets are safer for a child's health, assure optimum impurity removal, and are simple to clean.

- Technology: The technology is segmented into manually operated, battery operated, and electricity operated. Electric pumps are preferred by working mothers because they can rapidly extract more milk. The double pumping model takes less time compared with single pumps. Even though electric pumps may be cumbersome and noisy, manufacturers have continued making lighter ones that are quieter using contemporary technologies. Mothers who need electric pumps for brief periods and cannot afford to purchase a new pump can also rent them.

- End-User: The breast pump market by end-user is segmented into personnel and hospitals. Hospital-grade breast pumps can be rented monthly for individual use, but they are usually utilized in hospitals due to their strong motors. Because of their "closed system," these breast pumps safeguard against milk and other fluids from inside the motor. By doing this, contamination is reduced, and the safety of numerous users is guaranteed.

- Region: The North American region has a greater market share due to its quick adoption of cutting-edge machinery. Leading manufacturers' presence and the rapid uptake of cutting-edge products are anticipated to further accelerate the region's growth.

Top Trends Shaping the Breast Pump Market:

1. Rising Government Initiatives

- The demand for breast pumps is expected to rise worldwide due to supportive government policies and growing consumer awareness. For instance, WHO and UNICEF jointly developed the Baby Friendly Hospital Initiative (BFHI). BFHI was devised to promote breastfeeding and to support families in achieving their breastfeeding goals by ensuring practices with scientific evidence that guarantee breastfeeding success. Analogously, the Affordable Care Act mandates that support for lactation, including products such as breast pumps, is offered in most coverage. Hence, it is expected to drive increased consumption levels as end-users more readily buy into such products that now benefit. Demand for these items then expands, increasing the need for breast pumps.

2. Demand for Wearable Pumps

- Wearable pumps are gaining popularity in the market. Wearable pumps can be utilized by nursing moms while wearing them in a nursing bra or with hands-free pumping bras. Because these devices don't have cords, nursing women can use them while working, making them more advantageous than traditional pumps. Additionally, market participants are increasingly concentrating on introducing sophisticated wearable pumps, like silent wearable pumps. Major players are also working with national suppliers to increase the number of insurance-covered breast pumps available. For instance, Momcozy offers a wearable pump like the S9 Pro. They offer great comfort and provide hands-free freedom to any mother, plus a long-lasting power source battery.

Breast Pump Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing Population of Working Women: The demand for these devices among working women has increased due to the significantly rising employment rate among women. From October to December 2023, there were approximately 14.40 million employed women and 1.62 million self-employed women in the United Kingdom, according to a 2024 article from the House of Commons Library. These devices are also expected to have wide acceptance due to their various advantages, i.e., easy to access, portable, and a provision for carrying pumped milk in bottles ahead and for comfortable feeding. Furthermore, this could be useful for breastfeeding mothers who have undergone breast surgery.

- Technological Advancement: Rapid technological improvements and increased usage of advanced products are expanding the breast pump industry. Ongoing improvements in breast pump technology, such as the invention of electric or battery-operated pumps, two pumps for simultaneous expression, and smart pump functions, all contributed to this market’s growth. Breast pumps enabled by smart technology allow mothers to keep track of their feeding habits, milk production, and pumping sessions through smartphone applications. These apps might also offer personalized insights, reminders, and advice.

Challenges:

- Adverse Effects of Breast Pumps: The market's growth is expected to be hampered during the forecast period by the negative effects of these devices on women, including decreased milk production, delayed recovery after childbirth, damage to the breast and nipple tissue, and engorgement. Additionally, these devices can hinder the baby's development because bottle feeding can lead to tooth decay, reduce the nutrients in breast milk, and increase the risk of milk contamination.

Breast Pump Market Regional Analysis:

- North America: The breast pump market in North America is primarily growing due to the increasing prevalence of chronic diseases, such as respiratory and cardiovascular diseases, resulting from unhealthy lifestyle choices in the presence of advanced healthcare. The dominance of governmental initiatives and major manufacturers' prevailing influence are important factors driving market expansion.

Breast Pump Market Competitive Landscape:

The market is fragmented, with many notable players, including ALBERT Hohlkörper GmbH & Co. KG, Magento, Inc. (Ameda), Ardo Medical, Inc., and Babybelle Asia, among others:

- New Product: The BabyBuddha Portable Breast Pump 2.0, which was launched in May 2024, has the same distinct "pull patterns" as the original BabyBuddha pump but with the addition of a new "Soft Stimulation Mode." It provides a gentler suction range, making it more comfortable for users while maintaining its effective milk expression capabilities.

- Recognition: Ameda Inc. declared that its hospital-grade Ameda Pearl breast pump had won the 2024 Baby Innovation Awards' coveted Breast Pump Product of the Year title. Ameda Pearl's creative design and exceptional performance enthralled the market, with outstanding user satisfaction and results from hospital to home.

Breast Pump Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Breast Pump Market Size in 2025 | US$1,238.456 million |

| Breast Pump Market Size in 2030 | US$1,686.422 million |

| Growth Rate | CAGR of 6.37% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation | Type

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Breast Pump Market | |

| Customization Scope | Free report customization with purchase |

Breast Pump Market Segmentation:

By Type

- Open System

- Closed System

By Technology

- Manual Pump

- Battery Operated Pump

- Electric Pump

By End-User

- Personal

- Hospital

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa