Report Overview

Botulinum Toxin Market - Highlights

Botulinum Toxin Market Size:

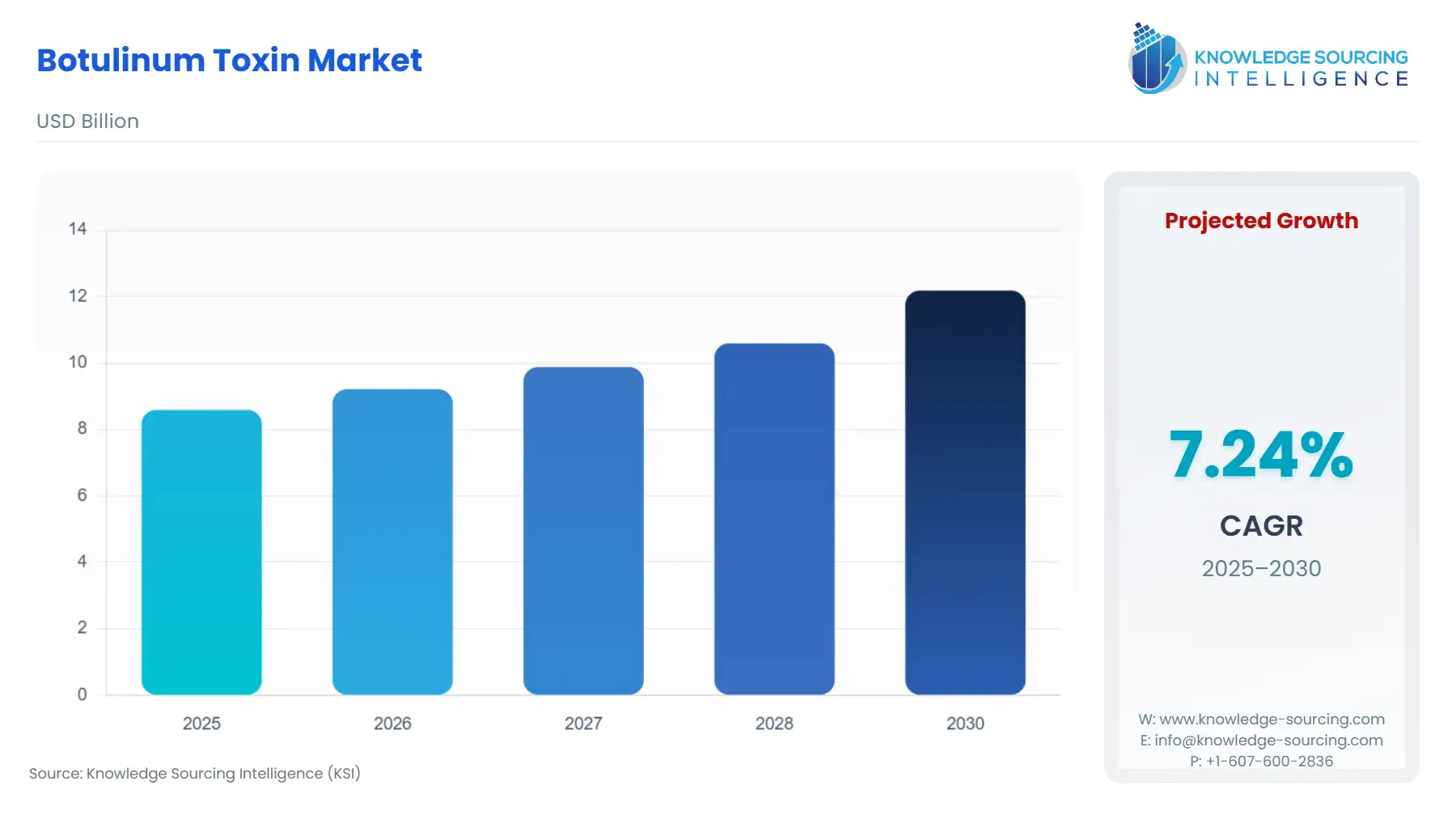

The Botulinum Toxins Market, valued at USD 12.181 billion in 2030 from USD 8.590 billion in 2025, is projected to grow at a CAGR of 7.23% through 2030.

Botulinum Toxins Market Introduction:

The Botulinum Toxins Market is a dynamic and rapidly expanding segment within the aesthetics market trends, driven by the growing popularity of non-invasive cosmetic procedures and the expanding therapeutic applications of botulinum toxins. Derived from the bacterium Clostridium botulinum, botulinum toxins, such as Type A (e.g., Botox, Dysport, Xeomin) and Type B (e.g., Myobloc), are neurotoxic proteins used to temporarily paralyze muscles, addressing both cosmetic concerns like facial wrinkles and medical conditions such as chronic migraines and muscle spasticity.

The market’s growth is fueled by advancements in neurotoxin clinical trials, increasing FDA approvals, and the proliferation of cosmetic clinics and medspas. The Botulinum Toxins Market is a cornerstone of the cellular therapy market for both aesthetic and therapeutic applications, driven by the global shift toward minimally invasive treatments. In aesthetics, botulinum toxins are widely used to reduce wrinkles, such as glabellar lines, crow’s feet, and forehead lines, offering quick results with minimal downtime. Therapeutically, they address conditions like cervical dystonia, hyperhidrosis, and chronic migraines, expanding their clinical utility.

The market’s significance is underscored by its ability to cater to a broad demographic, from millennials seeking preventative treatments to aging populations addressing visible signs of aging. For instance, Allergan Aesthetics’ 2024 FDA approval for BOTOX® Cosmetic to treat platysma bands marked a significant expansion of its aesthetic indications, reinforcing its dominance in non-invasive cosmetic procedures. The rise of cosmetic clinics and medspas, particularly in urban areas, has made these treatments more accessible, further driving market growth. The market is also propelled by innovations in neurotoxin clinical trials, which are exploring new formulations and indications. Galderma’s 2025 launch of RelabotulinumtoxinA (Relfydess), a ready-to-use liquid toxin, demonstrated rapid onset and long-lasting effects for glabellar lines, enhancing patient outcomes in minimally invasive treatments. The aesthetics market trends emphasize personalization and convenience, with cosmetic clinics and medspas offering tailored treatments and walk-in services.

Additionally, the therapeutic segment is expanding, with FDA approvals for indications like spasticity and migraines, as seen in Revance Therapeutics’ 2023 approval of DAXXIFY for cervical dystonia. These developments highlight the market’s dual role in aesthetics and therapeutics, positioning it as a critical player in modern healthcare.

Several major factors are propelling the market growth, including:

- Growing Demand for Non-Invasive Procedures: Non-invasive cosmetic procedures like Botox are preferred for their minimal downtime and effectiveness.

- Expanding Therapeutic Applications: Neurotoxin clinical trials broaden indications, including migraines and spasticity, driving market growth.

- Rise of Cosmetic Clinics: Cosmetic clinics and medspas increase accessibility, boosting demand for minimally invasive treatments.

- Regulatory Support: FDA approvals for new indications and products enhance market credibility and adoption.

Factors hampering the market expansion include:

- High Treatment Costs: Botox treatment costs can deter adoption in cost-sensitive markets, limiting accessibility.

- Risk of Counterfeit Products: Unregulated products pose safety risks, impacting trust in non-invasive cosmetic procedures.

How Much Does Botox Treatment Cost?

The Botox treatment cost varies based on factors such as geographic location, provider expertise, and the number of units required. In the USA, the average cost per unit of Botox ranges from USD 10 to USD 20, with typical treatments requiring 20–50 units per session, resulting in a total cost of USD 200–USD 1,000 per procedure. For example, treating glabellar lines may require 20–30 units, costing approximately USD 300–USD 600, while more extensive treatments like platysma bands may cost more. Cosmetic clinics and medspas in urban areas often charge higher rates due to demand and overhead costs, while rural clinics may offer lower prices. A recent article noted that Botox treatment cost is a key consideration for patients, with financing options like PatientFi expanding affordability.

- How Long Does a Botox Treatment Last and Is It Safe?

The duration of Botox treatment typically ranges from 3 to 6 months, depending on the indication, dosage, and patient metabolism. For aesthetic applications, such as wrinkle reduction, effects last approximately 3–4 months, while treatments like chronic migraine prevention may require re-administration every 12 weeks. Galderma’s 2025 neurotoxin clinical trial for RelabotulinumtoxinA reported a median duration of 4–5 months for glabellar lines, aligning with aesthetics market trends favoring longer-lasting formulations. Newer products like DAXXIFY, approved in 2023, extend efficacy up to 6 months, enhancing patient satisfaction. Regarding safety, Botox treatment is generally considered safe when administered by licensed professionals in cosmetic clinics and medspas, with FDA approvals ensuring rigorous testing. Common side effects include mild pain, swelling, or bruising at the injection site, but serious complications like eyelid drooping or allergic reactions are rare. The FDA has warned about counterfeit Botox products, which pose risks of botulism and adverse effects, emphasizing the importance of regulated providers. Neurotoxin clinical trials, such as AbbVie’s 2023 phase 3 studies for trenibotulinumtoxinE, confirmed safety for glabellar lines, reporting minimal adverse events. Proper administration and adherence to FDA-approved protocols ensure Botox treatment remains a reliable option in minimally invasive treatments.

Botulinum Toxins Market Overview & Scope

Botulinum toxin is made from Clostridium botulinum, a gram-positive anaerobic bacterium. The major growth drivers for the botulinum toxin market are the aging population, increasing numbers of minimally invasive surgeries, upsurge in facial aesthetics procedures, the rising alternative of non-surgical procedures, and advancements in innovation. This includes increasing the duration of action for Botulinum Toxin Type A, which has been an important innovation. Besides, increased healthcare spending in emerging markets is a major driving factor. The Botulinum Toxins Market is segmented by:

- Product Type: Botulinum Toxin Type A demand will be fueled by its growing application in minimally invasive cosmetic treatments.

- Application: Aesthetic applications will significantly demand wrinkle reduction and facial rejuvenation. Traditionally, Botox treatments were preferred by middle-aged women, but now, men are also seeking better looks.

- End User: With products such as Botox injections, which can quickly boost their looks, cosmetic centers will witness surging demand for botulinum toxin products.

Top Trends Shaping the Botulinum Toxins Market

- Growing demand from the developing countries like China

Emerging economies like China have a significant demand for various botulinum toxins. Many people have a significant disposable income and a growing consciousness about their looks, expanding the botulinum toxin market, as people now can spend a notable amount on cosmetics. - Expanding applications in non-invasive cosmetic procedures and treatments.

In aesthetics, glabellar lines, crow's feet, and forehead lines remain primary targets, with Galderma’s 2025 RelabotulinumtoxinA launch offering faster onset and prolonged efficacy for these indications. Therapeutically, botulinum toxins are gaining traction for cervical dystonia, chronic migraine treatment, upper limb spasticity, hyperhidrosis, and overactive bladder. Revance Therapeutics’ 2023 DAXXIFY approval for cervical dystonia and glabellar lines extended treatment duration, enhancing patient outcomes in the cellular therapy market. The rise of cosmetic clinics and medspas fuels accessibility, with minimally invasive treatments like Botox injections for hyperhidrosis and overactive bladder gaining popularity. AbbVie’s 2023 phase 3 trials for trenibotulinumtoxinE validated efficacy for moderate to severe glabellar (frown) lines. These aesthetic market trends, supported by FDA approvals, highlight botulinum toxins’ versatility, driving adoption across cosmetic and medical applications for enhanced patient care.

Botulinum Toxins Market: Growth Drivers vs. Challenges

Drivers:

- Advancement of technology and development of new products: The development of new products and the positive results from the research have encouraged manufacturers to develop new products for faster adoption. In September 2024, AEON Biopharma, Inc. developed a botulinum toxin complex under a 351(k) biosimilar pathway. The company announced receipt of the formal minutes from a Biosimilar Initial Advisory (BIA) Meeting with the U.S. Food and Drug Administration (FDA). This is for ABP-450 (prabotulinumtoxinA) injection as a biosimilar utilizing BOTOX (onabotulinumtoxinA).

- Growing usage in minimally invasive treatments: The botulinum toxins are used in minimally invasive treatments. The trend has continued to rise in popularity, driven by technological advancements. Neuromodulator injections like Botox and dermal fillers have become essential in aesthetic maintenance. It provides immediate results with minimal recovery time. In 2023, there were 4,715,716 procedures using botulinum toxin type A (including Botox, Dysport, and Xeomin), reflecting a 6 percent increase from the previous year in the USA, according to the American Society of Plastic Surgeons.

- Expansion of Therapeutic Applications through Neurotoxin Clinical Trials: The broadening of therapeutic applications, validated by neurotoxin clinical trials, significantly drives the Botulinum Toxins Market. Beyond aesthetics, botulinum toxins treat conditions like chronic migraine treatment, cervical dystonia, upper limb spasticity, hyperhidrosis, and overactive bladder, addressing unmet medical needs. Revance Therapeutics’ 2023 FDA approval of DAXXIFY for cervical dystonia highlighted its extended efficacy, expanding the cellular therapy market. Ongoing neurotoxin clinical trials, such as AbbVie’s 2023 phase 3 trials for trenibotulinumtoxinE targeting chronic migraine treatment, demonstrate improved patient outcomes, driving adoption in medical settings. The versatility of botulinum toxins in minimally invasive treatments for neurological and urological disorders enhances their market appeal, supported by increasing healthcare provider acceptance and patient demand for effective therapies.

- Proliferation of Cosmetic Clinics and Medspas: The rapid expansion of cosmetic clinics and medspas globally is a key driver, increasing accessibility to botulinum toxin treatments and fueling aesthetics market trends. These facilities offer tailored non-invasive cosmetic procedures, making Botox treatment and other minimally invasive treatments widely available to diverse demographics. Galderma’s 2025 launch of RelabotulinumtoxinA, a liquid botulinum toxin for glabellar lines, was designed for ease of use in cosmetic clinics and medspas, enhancing patient convenience and driving market growth. The rise of medical tourism and urban wellness centers further amplifies demand, as cosmetic clinics provide professional settings for safe administration, supported by FDA approvals. This trend, coupled with marketing through social media and influencer endorsements, positions botulinum toxins as a mainstream solution in the aesthetics market.

Challenges:

- Counterfeiting: Counterfeiting is a serious challenge to the expanding profit and demand for botulinum toxins. In June 2024, the FDA alerted healthcare professionals and consumers about unsafe counterfeit versions of Botox. These have been found in multiple states in the USA and are administered to consumers. This is a serious concern for drug authorities. This issue affects cosmetic clinics and medspas, where patients expect safe, minimally invasive treatments. The need for stringent quality control and FDA approvals increases operational costs for legitimate providers, slowing market growth. Addressing this restraint requires enhanced regulatory enforcement and consumer education to ensure safe adoption of botulinum toxins in the aesthetics market.

- High Botox Treatment Cost: The high Botox treatment cost is a significant restraint for the Botulinum Toxins Market, limiting accessibility in price-sensitive regions and among lower-income consumers. Costs, typically ranging from USD 200–USD 1,000 per session depending on units and location, can deter regular use, particularly for aesthetic applications like glabellar lines and forehead lines. A 2024 article highlighted that Botox treatment cost remains a barrier, despite financing options like PatientFi. High costs also impact therapeutic applications, such as chronic migraine treatment, where repeated sessions strain healthcare budgets. This restraint challenges market penetration, requiring cost-effective formulations or insurance coverage to broaden access to non-invasive cosmetic procedures and minimally invasive treatments in cosmetic clinics and medspas.

Botulinum Toxins Market Segmentation Analysis

- By Product Type, Botulinum Toxin Type A is growing significantly

Botulinum Toxin Type A dominates the Botulinum Toxins Market due to its widespread use in both non-invasive cosmetic procedures and therapeutic applications. Products like Botox, Dysport, and Xeomin leverage Botulinum Toxin Type A to temporarily paralyze muscles, effectively treating glabellar lines, crow's feet, forehead lines, and medical conditions such as chronic migraine treatment and cervical dystonia. Its high efficacy, minimal side effects, and established safety profile, validated by neurotoxin clinical trials, drive its preference in cosmetic clinics and medspas. Galderma’s 2025 launch of RelabotulinumtoxinA, a liquid Botulinum Toxin Type A, enhanced minimally invasive treatments with faster onset and extended duration for aesthetic applications, reinforcing its market leadership. FDA approvals for products like Letybo further solidify Botulinum Toxin Type A’s dominance in the cellular therapy market. - The Aesthetic Application segment is expected to lead the market growth

Aesthetic Applications lead the application segment, driven by the global demand for non-invasive cosmetic procedures to address aging signs like glabellar lines, crow's feet, and forehead lines. Botulinum toxins, particularly Botulinum Toxin Type A, are favored for their quick results and minimal downtime, making them a staple in cosmetic clinics and medspas. Allergan Aesthetics’ FDA approval for BOTOX Cosmetic to treat platysma bands expanded its aesthetic scope, enhancing neck aesthetics and aligning with aesthetics market trends. The rise of preventative treatments among younger demographics further boosts demand for minimally invasive treatments, positioning aesthetic applications as a key growth driver in the Botulinum Toxins Market.

Botulinum Toxins Market Regional Analysis

- North America is dominating the market

The consumption of botulinum toxins has been significant in this region. For instance, neuromodulator injections are used for softening wrinkles and fine lines on the face. Further, soft tissue fillers are in demand year over year by patients for injectables to replenish the natural hyaluronic acid in the skin by adding volume and hydration. The Neuromodulator injection (Botox, Dysport, Xeomin, Jeuveau, Daxxify) for cosmetic minimally invasive procedures has been 9,480,949 in 2023, an increase of 9% from the previous year. This increased demand for the application will expand the market. North America, particularly the USA, dominates the Botulinum Toxins Market due to its advanced healthcare infrastructure, high consumer demand for non-invasive cosmetic procedures, and robust FDA approvals. The region’s large volume of aesthetic procedures, driven by cultural emphasis on appearance and disposable income, supports market growth. Revance Therapeutics’ 2023 FDA approval of DAXXIFY for cervical dystonia and glabellar lines highlighted North America’s leadership in neurotoxin clinical trials, enhancing therapeutic applications like chronic migraine treatment and upper limb spasticity. The proliferation of cosmetic clinics and medspas in the USA and Canada, coupled with strong regulatory support, drives adoption of minimally invasive treatments, making North America the epicenter of the Botulinum Toxins Market.

Botulinum Toxins Market: Competitive Landscape

The market is fragmented, with many notable players, including Ipsen Group, Allergen, Inc., Metabiologics, Merz Pharma, Galderma, AbbVie Inc., Medytox, Lanzhou Institute of Biological Products Co., Ltd., HUGEL, Inc., Evolus, Inc., Revance Therapeutics, Inc., and Supernus Pharmaceuticals, Inc., among others:

A few strategic developments related to the market:

- Launch: In January 2025, Galderma launched RelabotulinumtoxinA, a ready-to-use liquid botulinum toxin Type A for glabellar lines and forehead lines, offering rapid onset and extended duration up to five months. This minimally invasive treatment, validated in neurotoxin clinical trials, enhances patient convenience in cosmetic clinics and medspas, aligning with aesthetics market trends for faster, longer-lasting results.

- Launch: In October 2024, Allergan Aesthetics, an AbbVie company, announced that the U.S. FDA approved its BOTOX Cosmetic for temporary improvement in the appearance of moderate to severe vertical bands connecting the jaw and neck in adults.

- New Product: In July 2024, Merz Aesthetics announced the U.S. Food and Drug Administration (FDA) approved XEOMIN (incobotulinumtoxinA) as the neurotoxin for the treatment of upper facial lines – forehead lines, frown lines, and crow’s feet. XEOMIN is the only FDA-approved neurotoxin for the simultaneous treatment of upper facial lines.

- New Product: In March 2024, Hugel America, Inc. announced it received U.S. FDA approval for its neurotoxin, Letybo, to treat moderate-to-severe glabellar (frown) lines in adults. This botulinum toxin type A has been the leading neurotoxin brand in South Korea for seven consecutive years. Hugel sold over 26 million vials in 50+ different countries.

Botulinum Toxins Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 8.590 billion |

| Total Market Size in 2031 | USD 12.181 billion |

| Growth Rate | 7.23% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Application, End User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Botulinum Toxins Market Segmentation:

- By Product Type

- Botulinum Toxin Type A

- Botulinum Toxin Type B

- By Application

- Aesthetic Applications

- Therapeutic Applications

- By End User

- Hospitals

- Clinics

- Cosmetic Centers

- By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa