Report Overview

Biomimetic Materials Market Size, Highlights

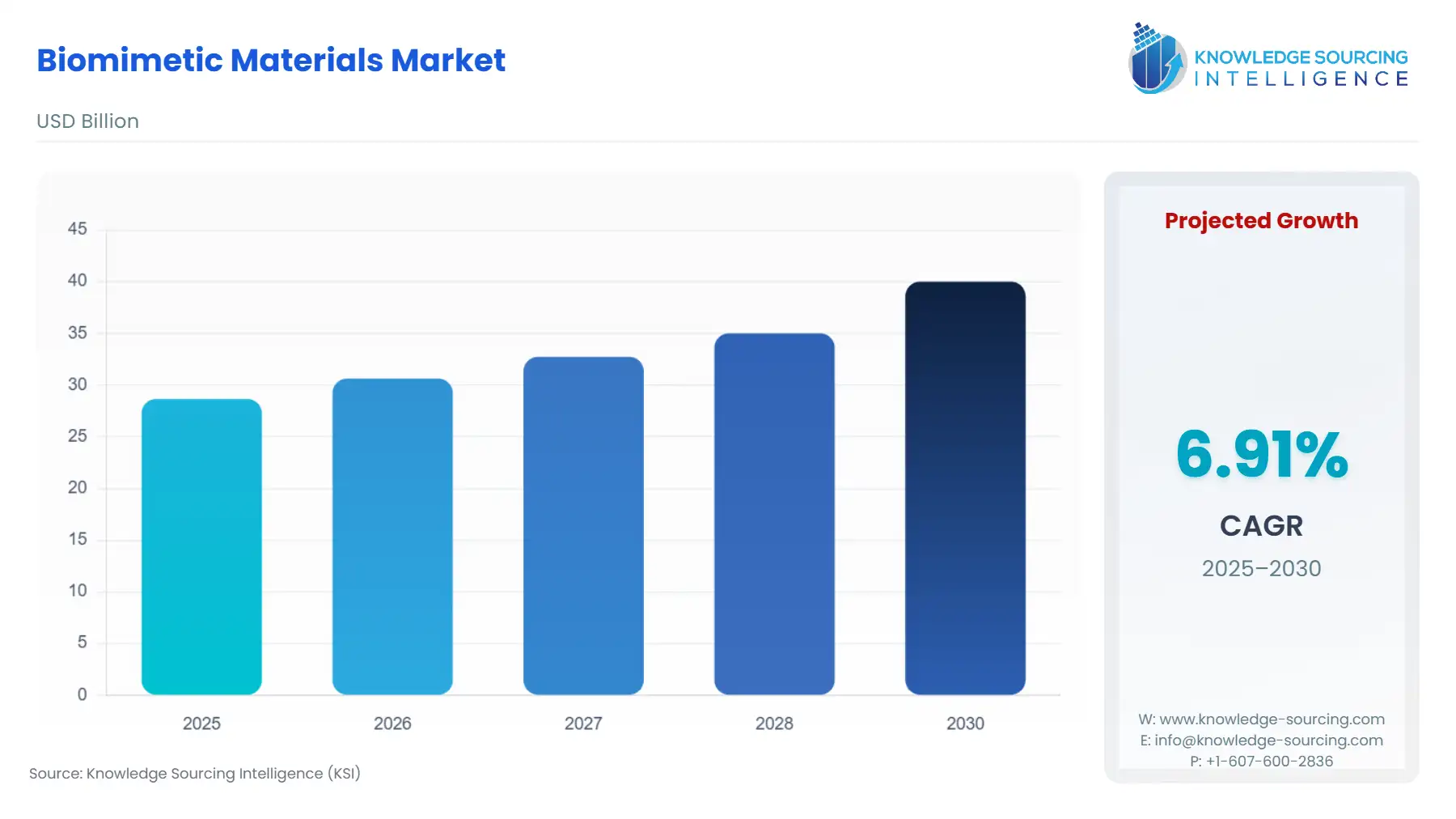

Biomimetic Materials Market Size and Forecast:

The biomimetic materials market is set to witness robust growth at a CAGR of 6.91% during the forecast period to be worth US$40.021 billion in 2030 from US$28.659 billion in 2025.

Biomimetic Materials Market Trends:

The biomimetic materials market continues to grow as organizations pursue sustainable options with trends such as advancements in nanotechnology and investments in research.

The market experienced ongoing growth during the projected period, driven by global sustainability priorities and advancements in nanotechnology that enhance the properties of smart materials, such as improved weight strength. Additionally, there is an increasing demand for medical products, including implants and medical devices, due to their high compatibility with human tissues.

Biomimetic Materials Market Growth Drivers:

- Increasing Demand in Healthcare: The medical sector drives biomimetic material growth due to rising demand for non-invasive treatments and new medical equipment innovations such as artificial organs and diverse medical devices. A research report by Allergan Future of Aesthetics Global Trends showed that in 2022, 81% of people favor safer, non-invasive aesthetic procedures than they did five years ago. Research from Hamilton Fraser stated the non-invasive cosmetic treatment market reached $61.2 billion in 2022 and is projected to grow 15.40% by 2030 from 2023.

- Technological Advancements: Robotics and artificial muscles benefit from nanotechnology and synthetic biology by making biomimetic materials that behave like living things and work well in different environmental settings. These innovations significantly benefit the military & defense, medicine, food, textile, and vehicle manufacturing industries. Nanotechnology helps engineers create advanced self-repairing materials and improves both medical implants and power conversion technologies through precise material arrangement.

Biomimetic Materials Market Segmentation Analysis by Type:

- Biomimetic Polymers: These polymers lead the biomimetic materials market because of their flexibility and support for diverse uses across healthcare, medical engineering, electronics, and automobile manufacturing. Technological progress and environmental awareness fuel the demand for materials that combine sustainability with benefits such as antibacterial protection and good tissue compatibility.

- Biomimetic Ceramics: The biomimetic ceramics segment exhibits strong market growth due to its ability to mimic the shape and features of natural bone and teeth, which benefits both medical treatments and manufacturing fields.

Biomimetic Materials Market Segmentation Analysis by Product:

- Biomimetic Coatings: The biomimetic coating segment is expected to expand due to sustainability and healthcare developments, specifically in cardiovascular stents and implants, as diseases rise and regulators support this growth.

- Biomimetic Films: Biomimetic films are increasingly utilized in multiple industries because they replicate human tissues and maintain the shelf life while making drug delivery systems smarter for improved patient outcomes.

Biomimetic Materials Market Geographical Outlook:

Biomimetic Materials Market– Competitive Landscape:

- BASF

- DuPont

- Evonik Industries

- Covestro

Market players are collaborating with advanced technology providers to develop products that serve healthcare services and automotive and electronic industry customers effectively. Companies in biomimetic materials strive to develop sustainable solutions while making materials that work automatically to suit changing weather conditions in real time.

Biomimetic Materials Market Latest Developments:

- In December 2024, Two Ray of Hope alumni entities named Amphico and Fusion Bionic teamed up to manufacture functional textiles without PFAS and using natural design patterns. This collaboration, named LaserTex, aims to transform technical material design by applying laser-generated shapes inspired by natural biomimetic material elements.

- In December 2024, Scientists at Swansea University designed a bone graft made from coral parts to help bones heal faster and dissolve safely inside the body when needed. Whitney Laboratory scientists created a biomimetic material duplicating coral-converted bone graft substitute properties for human bone replacement.

Biomimetic Materials Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Biomimetic Materials Market Size in 2025 | US$28.659 billion |

| Biomimetic Materials Market Size in 2030 | US$40.021 billion |

| Growth Rate | CAGR of 6.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Biomimetic Materials Market |

|

| Customization Scope | Free report customization with purchase |

Biomimetic Materials Market is analyzed into the following segments:

- By Type

- Biomimetic Polymers

- Biomimetic Ceramics

- Biomimetic Metals

- Others

- By Product

- Biomimetic Coatings

- Biomimetic Films

- Biomimetic Foams

- Biomimetic Adhesives

- By End-User

- Healthcare

- Aerospace and Defense

- Automotive

- Electronics

- Construction

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

- North America