Report Overview

Beef Tallow Market - Highlights

Beef Tallow Market Size:

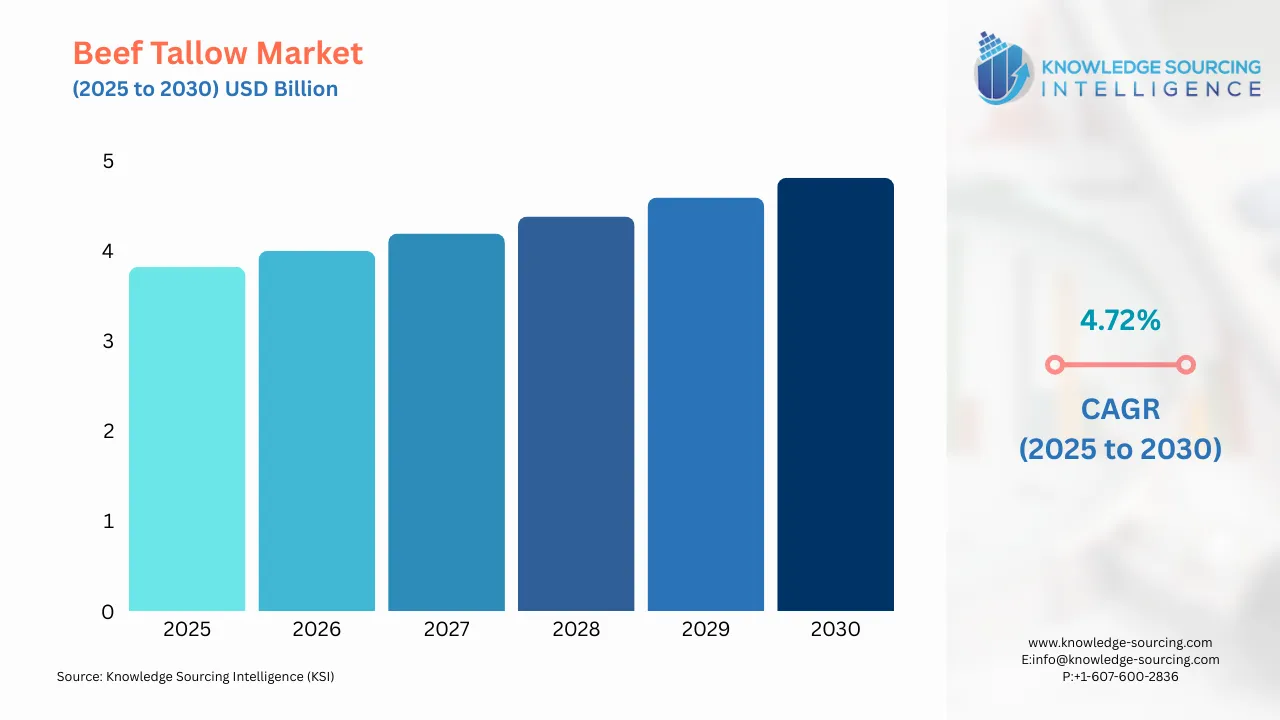

The beef tallow market is estimated at US$3.818 billion in 2025 and is anticipated to grow at a CAGR of 4.72% during the forecast period and reach US$4.809 billion in 2030.

The beef tallow market refers to the global industry and trade involving beef tallow, a type of rendered fat obtained from cattle. Traditionally used in cooking and food production, beef tallow has been prized for its high smoke point, stability, and unique flavor profile, making it a popular choice for frying, baking, and sautéing. Apart from its use in the kitchen, tallow is also highly valued within other industrial sectors, such as the production of biofuels, soaps, candles, lubricants, greases, cosmetics, and even biodiesel.

Several factors, such as the global demand for beef products, changes in trends in meat processing, a shift in consumer preferences, and a growing consciousness of health and sustainability issues, are influencing the demand for beef tallow. As consumers search for healthier and more organic alternatives to artificial trans fats as well as hydrogenated vegetable oils, beef tallow captures their attention as a far healthier cooking fat. As coming from grass-fed cattle, it can be more stable for them and comes with such health-friendly omega-3 and omega-6 fatty acids. Therefore, health-conscious consumers are choosing this over any other alternatives.

Beef Tallow Market Growth Drivers:

The food and biofuel sectors are expected to boost the market for beef tallow in the projected period

The demand for beef tallow has been growing not just in the food industry but also in the biofuel market. Beef tallow has emerged as an environmentally friendly byproduct of beef processing; it is used to create biodiesel, a much cleaner energy source than conventional fossil fuels. This shift towards biofuels and growing interest in renewable energy sources drives the beef tallow market even more in countries focused on reducing greenhouse gas emissions.

Beef tallow is also used in the food and energy sectors. In addition, it is used in the production of high-quality soaps and personal care products. Beef tallow is a natural emollient in skincare, which provides moisturizing properties and has a longer shelf life than synthetic ingredients. It is also used in the production of industrial lubricants and greases because of its high stability and performance at high temperatures.

This makes beef tallow a more relevant environmental concern as the world shifts to more sustainable products. As part of the beef processing industry by product, tallow reduces waste and creates a more circular economy by utilizing byproducts rather than wasting them. This feature appeals to consumers and industries looking at ways to reduce environmental footprints.

Regulatory policies and increasing consumer preference for beef are anticipated to fuel the market growth in the projected period

Regulatory policies and consumer trends also influence the market dynamics. In strictly regulated regions such as the European Union and North America, tallow from beef is produced and traded with varying degrees of scrutiny. Policies on food safety, waste management, and sustainability affect both supply and demand for beef tallow.

Emerging markets are characterized by increased urbanization and higher demand for beef and processed food products, which is likely to fuel demand for beef tallow. Growing opportunities have been identified in Asian and African countries, where beef consumption is increasing. International trade flows of beef and beef products also significantly influence the market because tallow is frequently traded as a secondary product in the beef supply chain.

As the market continues to develop, innovations in beef tallow applications, improvements in rendering technology, and a stronger emphasis on sustainability and ethical sourcing should propel the market further ahead. The versatility and ever-growing demand for beef tallow, combined with its status as a natural and renewable product, bode well for its future in different sectors-including food, energy, and industrial applications.

Beef Tallow Market Segment Analysis:

The edible segment is expected to hold a significant market share in the projected period

Edible beef tallow is considered dominant in the market, owing to its exclusive taste and increased use for preparing a wide array of traditional dishes, gourmet recipes, and deep-fried products. The high smoke point of tallow allows this form of fat to be used for higher-heat cooking methods in any restaurant or home-based kitchen. Edible beef tallow is healthier compared to processed vegetable oils and artificial trans fats, which have been known to cause a myriad of health problems.

Interest in traditional cooking fats has also gained traction with the popularity of ketogenic and other high-fat diets, thus raising the demand for edible tallow. These dietary trends have promoted increased consumer awareness about animal-based fats, like beef tallow, to store energy for a long period, promote metabolism, and enhance satiety. Edible tallow has gained prominence in some health-conscious groups and sustainable, whole-food cooking circles as consumers have been looking for natural, unprocessed ingredients in their diets.

Beef Tallow Market Geographical Outlook:

North America is expected to hold a significant market share

North America is estimated to be the most lucrative market for beef tallow, driven by a combination of consumer trends, growing awareness of sustainability, and the region's cultural ties to the ingredient.

The market in North America has high growth potential, especially as consumers become more discerning about the natural and sustainable ingredients in food and personal care products. This increased demand for traditional, nutrient-dense fats like beef tallow supports healthier, less processed foods and a reemergence in cooking with more familiar, natural ingredients.

Not only does beef tallow have immense cultural importance to North America, but it also presents many benefits regarding its nutritional density, stability, and high smoke point, a truly fat-rich component of traditional, homemade, hand-processed, artisanal products. In the United States and Canada, beef tallow is part of traditional cooking, particularly in deep-fried foods, pies, and pastries. Beef tallow in heritage recipes has sparked renewed interest in the ingredient, especially among consumers looking to embrace nostalgic, time-honored food preparation methods.

Besides its culinary applications, beef tallow has become a personal care and industrial darling in North America. It is increasingly becoming part of natural skincare products, soaps, and cosmetics, as consumers seek chemical-free, sustainable alternatives in beauty routines. It is also used in biofuel production, supporting the region's drive towards renewable energy sources.

Beef Tallow Market Key Developments:

Nov 2025: Investigative reporting links Diamond Green Diesel’s SAF tallow supply chain to cattle from illegally deforested Amazon land, raising sustainability concerns.

Aug 2025: The U.S. imposed a 50% tariff on Brazilian tallow (animal fats), significantly affecting exports.

Feb 2025: Coast Packing began construction of a new edible fats and oils refinery in Amarillo, Texas, to expand beef tallow and other animal fat production.

List of Top Beef Tallow Companies:

The Australian Agricultural Company

Cargill Incorporated

The Archer-Daniels-Midland Company

SARIA Ltd

Darling Ingredients

Beef Tallow Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 3.818 billion |

| Total Market Size in 2030 | USD 4.809 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.72% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Beef Tallow Market Segmentation:

By Product Type

Inedible

Edible

By Application:

Cosmetic and Personal Care

Animal Feed

Food and Bakery

Biodiesel

Others

By Geography:

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Italy

Others

Middle East and Africa

Saudi Arabia

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Thailand

Others