Report Overview

Battery Charger IC Market Highlights

Battery Charger IC Market Size:

The Global Battery Charger IC Market is forecast to grow at a CAGR of 8.0%, reaching USD 26.1 billion in 2031 from USD 17.8 billion in 2026.

A battery charger IC, also referred to as an integrated circuit, is a semiconductor device designed to regulate the charging of rechargeable batteries. These chips are mainly used in electronic devices that require portable power, including smartphones, tablets, and laptops, among other devices. Battery chargers perform various vital functions by providing maximized battery capacity that monitors the charging process and extends the battery life.

Technological developments by major players are anticipated to drive the growth of battery charger ICs as major market players focus on improving charging efficiency, enhancing safety features, and reducing energy consumption. Products such as modern charger ICs are designed to handle adequate high-charging currents and promote fast charging requirements, in addition to their integrated protection mechanism that prevents overcharging.

Battery Charger Ic Market Growth Drivers:

The battery charger IC market is driven by the rising number of electric aircraft globally

With innovative advancements in the aviation sector worldwide, the interest in electric aircraft is expected to rise multifold in the coming years. The upcoming innovations by emerging players will boost the market growth of high-capacity batteries in the forecast period. This is because these electric aircraft use batteries to power their engine as it requires more efficient and reliable battery charging solutions in the long term. For instance, in October 2023, Wright Electric, a start-up company from the United States, launched its battery management arm, known as Wright Batteries. The company is also developing its high-temperature battery technology to expand the applications of battery charger IC products. The commercial application for such batteries will be available from 2027, as per the company. Moreover, with an increasing focus on low carbon emission and environmental protection measures in the future, the number of hybrid electric aircraft will witness an upward trend, thereby creating lucrative opportunities for the battery charger IC market.

These charger ICs must also be designed to ensure the safety and reliability of the system, as any issues with battery charging can pose significant safety risks. Therefore, manufacturers worldwide are focusing on developing specialized battery charger ICs that can meet the unique requirements of electric aircraft by customizing them to suit their requirements. These charger ICs must be able to charge high-capacity batteries efficiently while also providing features such as thermal management, voltage monitoring, and overcurrent protection to ensure the safety of the battery for many years.

Further, energy storage systems, including smart grids, require battery storage solutions that can adequately balance both demand and supply needs. Therefore, battery charger IC products will witness more applications with the growth of smart grids on a global scale.

Battery Charger IC Market Segment Analysis:

The lithium-ion battery monitoring segment is expected to witness robust growth.

The lithium-ion battery monitoring applications involving battery charger IC products have grown significantly, supporting the market growth. This is due to several factors, such as the increasing adoption of these batteries in various applications, such as portable electronic devices, electric vehicles, and other renewable energy storage systems, among others. Furthermore, the growing adoption of electric vehicles will expand the market opportunity for Lithium-ion battery solutions for efficient battery management. Some other factors promoting the deployment of these batteries are the fact that they are rechargeable and have a long life cycle with higher energy density. Therefore, they deliver improved performance and advanced consistency in the long term. Furthermore, the increasing demand for portable electronic devices will propel this segment’s growth as it relies heavily on lithium-ion batteries. For instance, MP2759, provided by monolithic power systems, is an integrated battery charger used in multiple battery packs such as LiFePO, Li-polymer, and Lithium-ion battery packs, among others. The battery pack system offered by the company is used across applications, including lightning, smart cell systems, and outdoor cameras.

Battery Charger IC Market Geographical Outlook:

North America accounted for a significant global battery charger IC market share.

Based on geography, North America is a significant market for battery charger ICs, with the established presence of key companies and the increasing demand for portable devices. The increasing adoption of electric vehicles and renewable energy storage systems in developed economies like the United States and Canada also drives the demand for battery charger ICs in North America. Moreover, the growing trend of wearable devices, coupled with the rising demand for smartphones and tablets, is expected to fuel market growth. Furthermore, the market is characterized by high consumer awareness and the presence of several tech-savvy individuals, driving the demand for portable electronic devices. These factors are expected to accelerate the North American battery charger IC market.

Battery Charger IC Market Key Developments:

In 2021, Analog Devices, Inc. announced its innovative product offering, MAX17330 battery management integrated circuit (IC), which is equipped with advanced battery protection and fuel gauge for one-cell lithium ion or polymer batteries. This product's benefits include extended run time and the ability to monitor internal hazards, which shrinks the solution size of single-cell battery-powered products.

Battery Charger IC Market Key Players:

Analog Devices Inc., a leading player in the Battery Charger IC market, provides a wide range of Battery Charger IC devices for various rechargeable battery chemistry, such as lead-acid or nickel-based, LiFePO4, and Li-Ion, among others. These devices are autonomous in operation and offered in different topologies, such as linear or switching topologies.

Richtek Technology Corporation is a leading company with innovative wireless power solutions, numerous battery chargers, protection devices, and battery gauges. The company recently introduced its new generation charger, the automotive USB Type-C PD Charger IC.

Texas Instruments is a prominent company that offers a broad portfolio of chargers, including power-dense battery charger ICs that support any charging typology, such as linear, among others, and charging sources. The chargers offered by the company are coupled with multiple low-power modes that lead to maximum battery runtime and are instantly ready to use.

STMicroelectronics is a major player that provides battery chargers for various applications, such as consumer electronics, wearables, and smartphones. The company's portfolio includes highly integrated switch modes and linear chargers. It is also a pioneer of wireless battery charging solutions that operate according to wireless charging standards.

Qualcomm Technologies, Inc. is a well-known provider of Lithium-ion/polymer battery chargers and quick-charge 1.0 Battery Charger ICs. These products have numerous portable applications.

Battery Charger IC Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

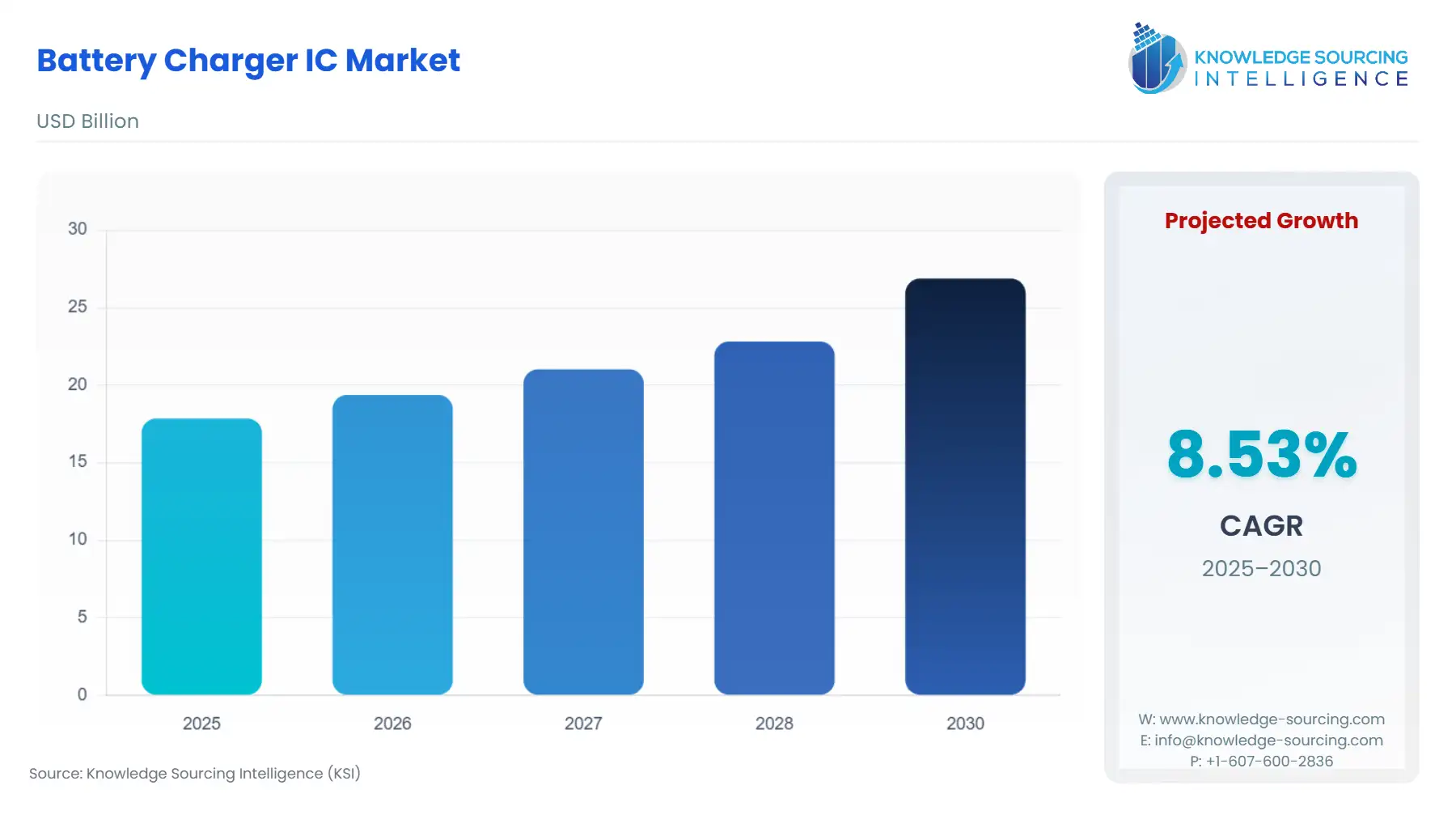

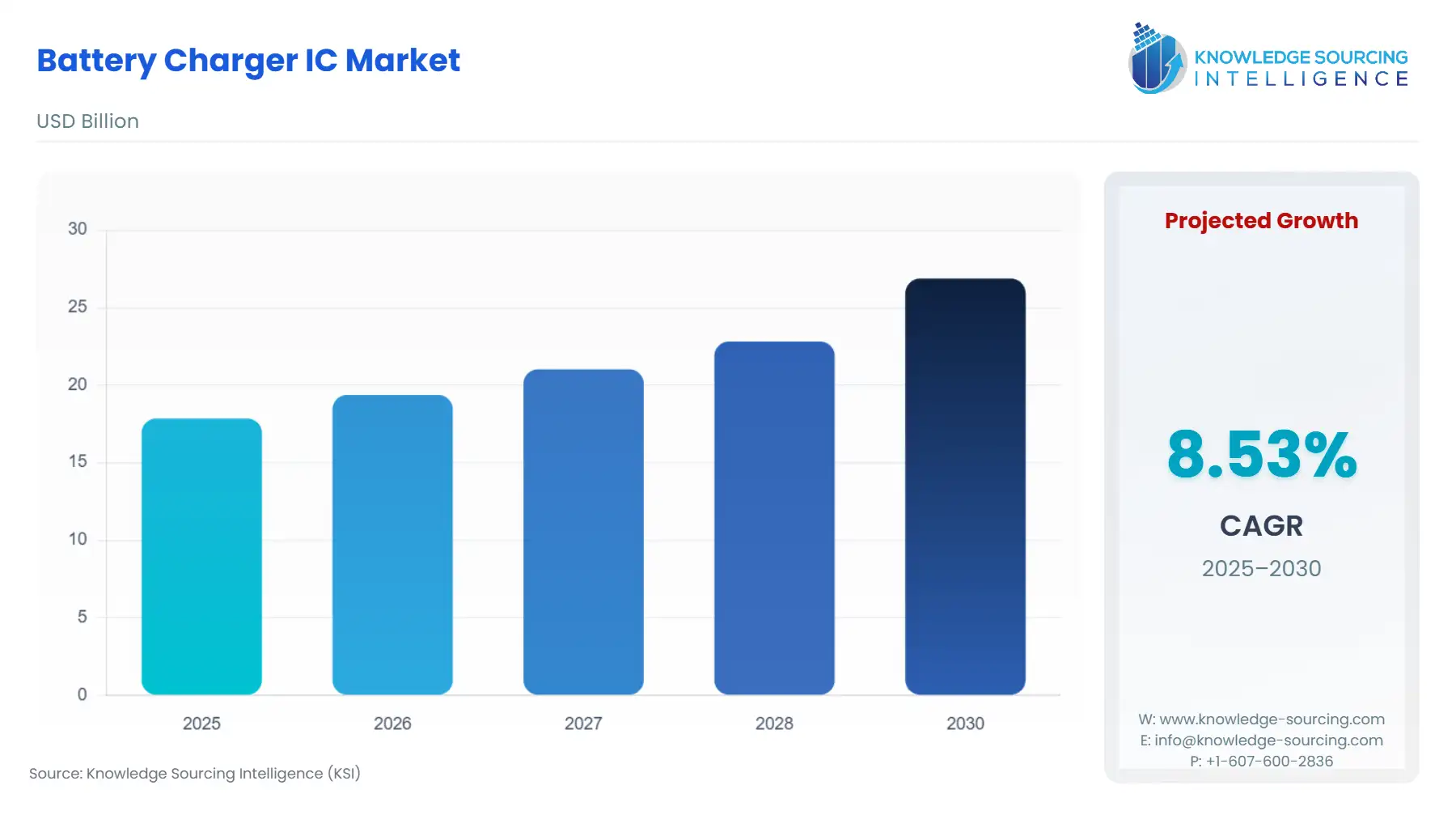

Battery Charger IC Market Size in 2025 | US$17.848 billion |

Battery Charger IC Market Size in 2030 | US$26.874 billion |

Growth Rate | CAGR of 8.52% |

Study Period | 2019 to 2030 |

Historical Data | 2019 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Battery Charger IC Market |

|

Customization Scope | Free report customization with purchase |

Battery Charger IC Market Scope:

Battery Charger IC Market Segmentation:

By Type

Lithium-ion

Nickel cadmium (NiCd)

Nickel-metal hydride (NiMH)

Lithium-ion polymer (Li-polymer)

Others

By Application

Lithium-ion battery monitoring

PV cell energy harvesting

Industrial monitoring

Wearable devices

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others