Report Overview

Backhoe Loader Market Size, Highlights

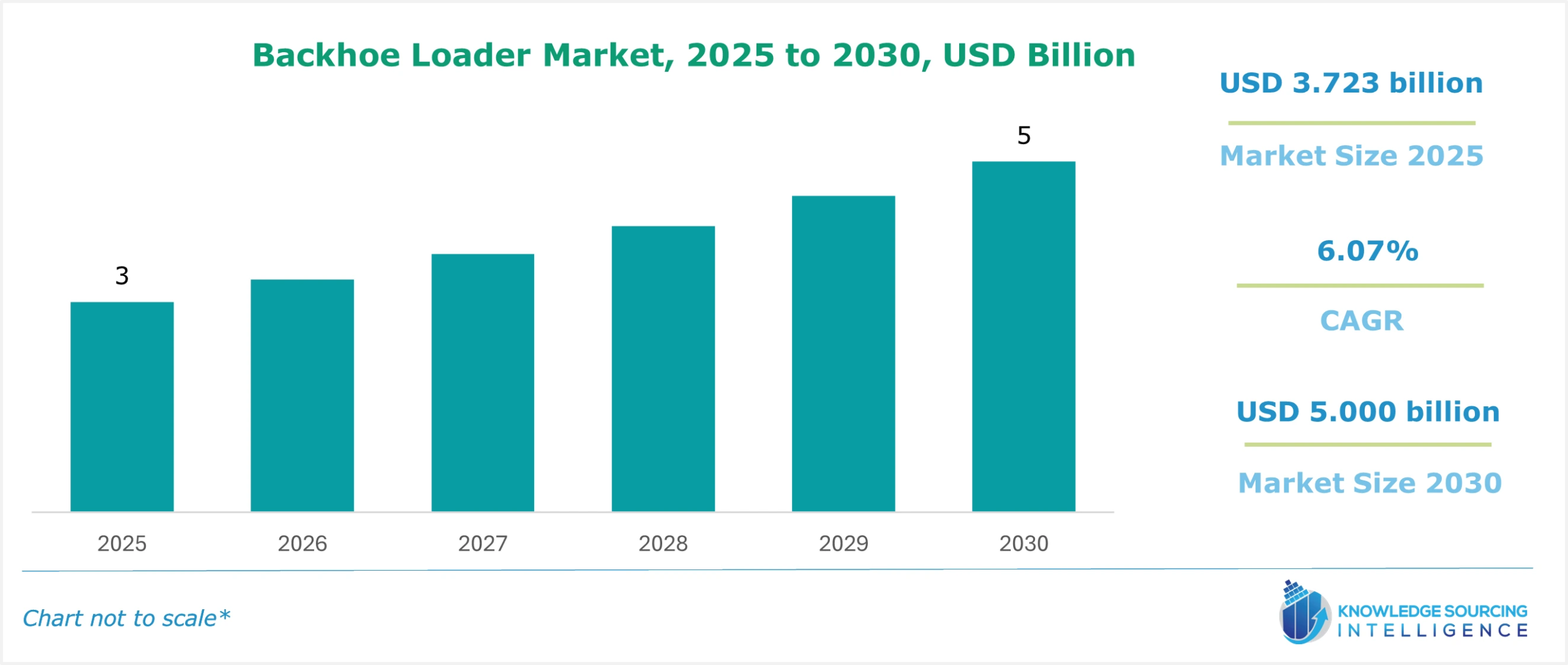

Backhoe Loader Market Size:

The backhoe loader market is estimated to grow at a CAGR of 6.07%, from USD 3.723 billion in 2025 to USD 5.000 billion in 2030.

Backhoe Loader Market Highlights:

- Increasing construction activities are driving demand for backhoe loaders globally.

- Growing urbanization is boosting backhoe loader adoption in smart city projects.

- Asia Pacific is leading the market with significant infrastructure investments.

- Advancing electric loader technology is enhancing efficiency in backhoe loader applications.

A backhoe loader or a loader excavator is a type of heavy equipment vehicle that consists of a heavy vehicle fitted with a shovel or bucket-like equipment in its front or back. It is generally used for excavation applications and to move heavy materials. The backhoe loader offers multiple benefits at the construction, agricultural, or industrial site, as it has the capacity for a high rate of digging and can also move heavy materials and equipment. This type of loader can also be used during demolition projects and planting & uprooting trees.

Backhoe Loader Market Trends:

The growing demand from the construction industry is driving the global market for backhoe loaders since the product is useful for various tasks and is compact due to its adaptability. As a result of significant population growth and an increase in gross household disposable incomes in both established and developing nations, this market has seen favorable growth in the residential building industry in recent years. Furthermore, the increased migration of people from rural to urban regions has increased investments in the development of sustainable and smart cities. As a result, construction activities have been accelerated by the use of technologically advanced machinery such as backhoe loaders.

Owing to their versatility and modest size, backhoe loaders are the most commonly employed in big, medium, and small construction projects. Backhoe loaders can be used for a range of jobs, including digging holes or excavations, construction, small demolitions, powering construction equipment, breaking asphalt, paving roads, and light material delivery. Boring, digging, excavating, and loading are just a few of the jobs that these loaders can handle. Quick-attach mounting systems and auxiliary hydraulic circuits are standard on most backhoe loaders, allowing for easier attachment and increased machine usage on the job site.

Backhoe Loader Market Growth Drivers:

- Rapidly growing global construction industry.

A major factor that is expected to propel the global backhoe market is forecasted to be the construction industry’s expansion. In this industry, the backhoe loader offers multiple key applications, from demolition of older projects, digging up grounds, excavating, and moving heavy materials. The global construction industry witnessed massive growth in its total output. In its report, the Office for National Statistics of the UK stated that the annual construction output in the nation witnessed an increase of 2% over 2022. The agency noted that the value of all work in December 2023 was recorded at GBP 15,249 million, the value of all new work was recorded at GBP 8,550 million, and the value of total repair and maintenance work was recorded at GBP 6,699 million.

Similarly, developing nations worldwide also increased their capital investments, boosting the global construction industry. For instance, the Indian Government, in its Invest India portal, stated that the construction or infrastructure sector is among the leading industries in terms of investment inflow. The Foreign Direct Investment (FDI) in the construction or infrastructure sector in the nation witnessed an inflow of about US$33.91 billion between April 2000 and March 2024. The portal further stated that the construction sector contributes about 9% of the nation's GDP. The government of India has also announced various policies and investment schemes to boost the industry further.

Backhoe Loader Market Geographical Outlook:

- Asia Pacific is forecasted to hold a major share of the backhoe loader market.

Asia-Pacific is expected to dominate the global market in the foreseeable future. This growth is due to the development of sustainable and smart cities, the emergence of small and medium-sized firms, the rise in public-private partnerships, and increased government investment in infrastructure development. An increase in power projects, highway manufacturing facilities, logistics, and backhoe loaders in developing countries like India and China is predicted to significantly expand the global backhoe loader market. Furthermore, the market is being boosted by increased foreign direct investment in developing countries.

Backhoe Loader Market Product Launches:

- J.C. Bamford Excavators Ltd., or JBC, is among the leading global manufacturers of a wide range of equipment designed to offer efficient performance in construction, agriculture, waste handling, and demolition, among many others. The company offers various types of machines, attachments, electric machines, and hydrogen equipment. Its major products include backhoe loaders, excavators, generators, compactors, super loaders, and telehandlers. In the global backhoe loader market, the company offers various loaders, including 2DX, 3DX, 3DX Plus, 3DX Xtra, and 4DX among others.

- Caterpillar, or CAT, is an American equipment manufacturer offering multiple application products and solutions. In the global market, CAT offers products and solutions for multiple industries, including mining, industrial power, electrical power, construction, and paving equipment, among others. Its products include articulated trucks, asphalt pavers, electric rope shovels, drills, dozers, and excavators. The company offers side shift backhoe leader 424 in the global backhoe loader market. This loader has a loading reach of 1,521 mm and a 180-degree swing arc. It also features a 4,015 mm loading height and 56,282 N bucket digging force.

Backhoe Loader Market Key Developments:

- In September 2024, Bobcat Company, a part of the Doosan Group, expanded its product lineup in the North American region with the launch of the B760 backhoe loader. The B760 backhoe loader offers versatile performance and has a capacity of more than 2,000 pounds, and the digging depth is 18 feet and 5 inches. It also features a 180-degree swing and has a 3.4-liter Bobcat engine, which offers high torque and efficient performance.

- In August 2024, CNH Industrial N.V. announced that its subsidiary had launched the industry's first electric backhoe loader. With this launch, the company aims to revolutionize the machinery and equipment sector globally. The new electric backhoe, 580EV, delivers the same capabilities as the traditional backhoe loader, and it features a four-wheel drive engine that can generate 97 horsepower. It includes a 400-volt, 71 kWh lithium-ion battery and can charge with the same Level 2 adapter used in most electric automobiles.

List of Top Backhoe Loader Companies:

Backhoe Loader Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Backhoe Loader Market Size in 2025 | US$3.723 billion |

| Backhoe Loader Market Size in 2030 | US$5.000 billion |

| Growth Rate | CAGR of 6.07% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Backhoe Loader Market |

|

| Customization Scope | Free report customization with purchase |

Backhoe Loader Market is segmented and analyzed as follows:

- By Type

- Centre Mount

- Side Shift

- By Application

- Highway Construction

- Public Facilities

- Lease

- Other

- By Distribution Channel

- Direct Sale

- Indirect Sale

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America