Report Overview

Automated Material Handling Market Highlights

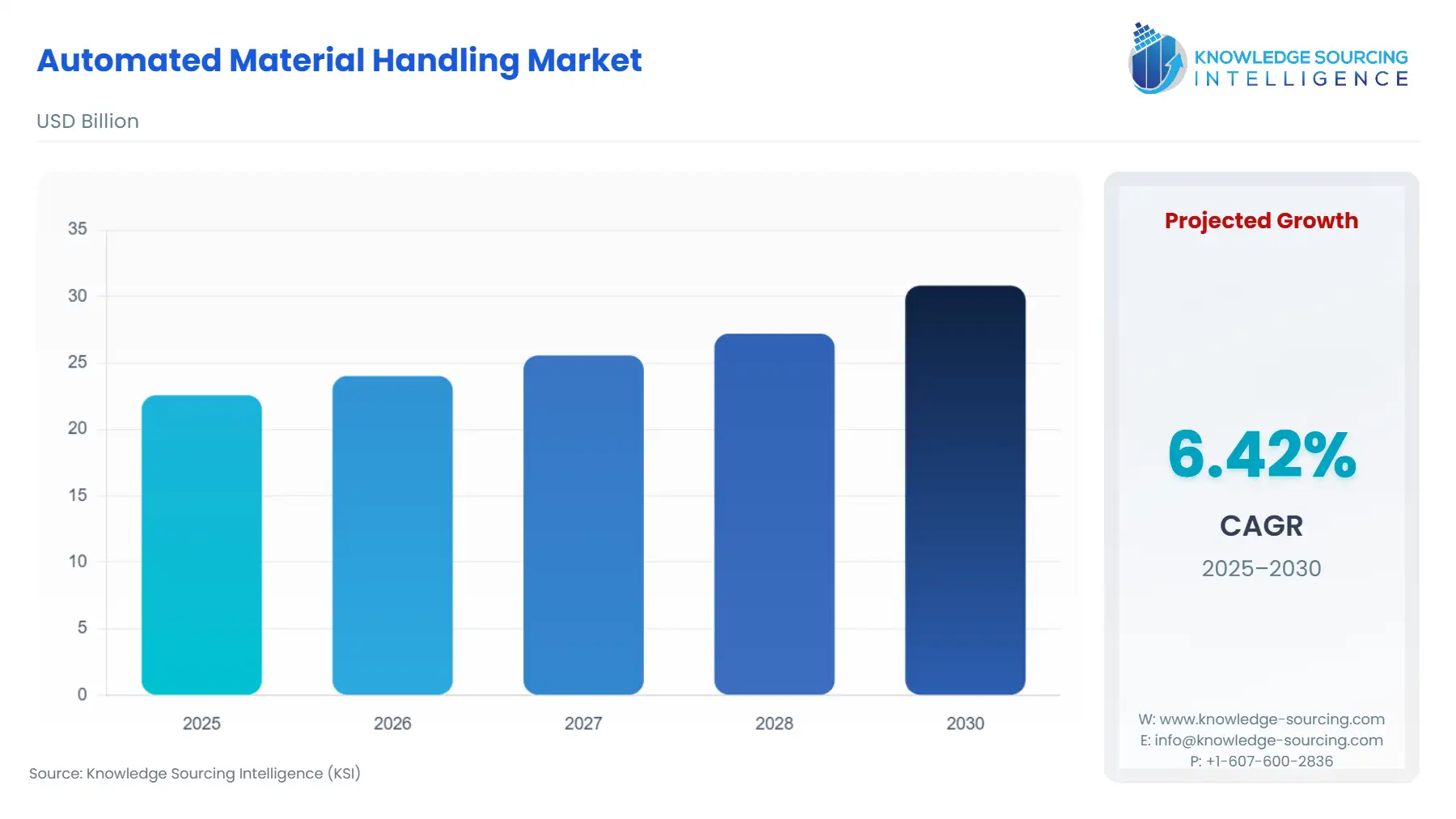

The automated material handling market is expected to grow at a CAGR of 6.42%, reaching a market size of USD 30.8 billion in 2030 from USD 22.5 billion in 2025.

The Automated material handling market involves the utilization of automated solutions, equipment, and computer programs to transfer, store, and manage heavy materials or goods in a different facility like warehousing, manufacturing, or distribution sites effectively. The objective of automated material handling is to increase productivity, decrease labor costs, and increment safety in the storage and moving of materials. These systems incorporate different innovations such as conveyors, robots, automated storage facilities, retrieval systems, automated guided vehicles, and others.

In addition, they can be tailored to fulfill the particular requirement of a specific facility, such as high-speed or heavy load handling, or the capacity to handle sensitive or hazardous materials. Automated material handling solutions are broadly utilized in the manufacturing sector to advance efficiency, and improve work environment safety by avoiding occupational injuries to workers.

Automated Material Handling Market Growth Drivers:

Growing demand for e-commerce is expected to accelerate the automated material handling market.

There is consistent expansion witnessed in the e-commerce sector that has significantly increased the growth of efficient automated material handling. Further, with the rapid adoption of e-commerce retailing and the rise in automation, the utilization of automated systems like automated vehicles and conveyors is growing as they offer efficiency and productivity. The e-commerce automated material handling incorporated storing, receiving, and distributing various goods and products. The rise of the e-commerce industry in the world is anticipated to boost the market share of automated material handling.

According to the ITA report, there is a consistent rise in the global B2B e-commerce industry which was worth U$21,019 billion in 2022 and will grow to account for US$36,163 billion by 2026. This rise in the e-commerce expenditure of the world is potentially increasing the flow of packages and parcels, propelling the demand for automated material handling for timely and fast processes.

Additionally, online retailers need quick and accurate order packaging and delivery, which could be achieved through efficient material handling operations, and automation in the sector helps to reach accuracy in fulfillment without errors. Automated material handling systems, such as automated storage and retrieval systems (AS/RS), automated conveyor belts, and automated guided vehicles (AGVs), have become essential tools for achieving this objective by the market.

Moreover, according to the data from the ISB Institute of Data Science and Ecom Express approximately 125 million consumers shop online in India, and about 84 million additional shoppers will be included in this by 2025. Further, fashion and accessories are the biggest category with a 60% share among other materials. This rise will fuel the larger number of online orders and the need for efficient supply chain infrastructure, hence providing potential opportunities to utilize automated material handling equipment for different facilities such as assembly, and packaging functions across multiple industries.

The growing necessity for automation in warehousing sites is expected to bolster the market of automated material handling.

Automated material handling is becoming largely used by warehousing facilities, as automated equipment can handle the heavy, repetitive lifting that laborers often do manually and therefore result in physical strain on these workers. Moreover, the increasing work-related injuries in the world results in a significant effect on warehousing companies which also justifies an uptrend of automated material handling solutions that have favoured as well as driving force to demand growth from the market.

For instance, as per the U.S. Bureau of Labor Statistics report, there is an increase in counts of total nonfatal occupational injuries and illness from 2,607.9 thousand in 2021 to 2,804.2 thousand in 2022 in the United States. This incorporated 2,343.6 thousand work-related injuries in 2022. Additionally, automated material handling companies are increasingly working in the development of new and innovative products for warehousing storage facilities requiring logistic and handling solutions and an efficient supply chain to move their products closer to the end consumers.

For example, in December 2022, Daifuku Co., Ltd. Announced plans to build a new manufacturing plant in Hyderabad, India, at its subsidiary Vega Conveyors and Automation Private Limited (Vega). The plant facility is expected to start operation in 2024 and will manufacture automated warehouse solutions, conveyors, sorters, rail-guided vehicle systems, and more, and is predicted to quadruple Vega's production capacity because of India's fast economic expansion.

Additionally, the healthcare industry vertical incorporates hospitals, clinics, and medical device manufacturers that also utilize this system in the warehousing of pharmaceutical-related products and medical machinery. Automated material handling systems are employed in these facilities to manage medical supplies and equipment, such as surgical instruments. These systems can help improve patient care and safety by reducing the risk of errors in the handling and storage of medical materials and supplies, thus increasing the market expansion in the coming years.

Increasing utilization from construction industries is anticipated to accelerate the demand for automated material handling globally.

The rising adoption of automated material handling equipment in the construction business is predicted to contribute to the market expansion globally. Automated guided vehicles will see a rise in the construction sector in the world because of diverse variables, primarily due to rapid urbanization and industrialization, as well as increasing infrastructure development such as the construction of bridges, buildings, and houses, which will require the integration of reliable automated material handling systems which will propel the market growth in the coming years.

For example, as per European Commission data, the France government planned to invest EUR 57.0 billion from 2018 to 2023 under the Grand Plan d’Investissement (Great Investment Plan) which is an investment plan for the civil engineering sector. As per this about euro 4.1 billion will be invested in infrastructure, renovation, and sustainable transportation, Euro 9.0 billion will be invested in the thermal renovation of buildings, and EUR 7.0 billion invested in developing renewable energy. Moreover, the government also planned to invest EUR 13.7 billion by 2023 for the improvement of transport, and mobility infrastructure. Thus, the growing construction and infrastructure development-related projects will fuel the market for automated material handling as there is a constant necessity for handling heavy and bulky materials.

Similarly, according to the European Construction Industry Federation (FIEC) report on construction activity in Germany, there is increasing investment in housebuilding construction and is projected to witness a rise to €117.6 billion in 2022 from €114.5 billion in 2020 while the overall investment in the construction sector was €476 billion in 2022. These data reflect positive prospects for the expansion of automated material handling systems like automated guided vehicles and automated storage systems which will employed in construction-related activities propelling the market growth in the years ahead.

Automated Material Handling Market Geographical Outlook:

The Europe region is anticipated to hold a considerable automated material handling market share.

The European region is expected to show considerable growth due to the growing deployment of material handling solutions along with the growing footprint of warehouses and logistics, which are expected to drive a high demand in the market. Moreover, the European government through their policies and initiatives is supporting automation in industries and advancement in technology which will further contribute to regional market expansion.

Additionally, there are new innovative launches and collaborations witnessed by regional players to expand their automated material handling portfolio which is expected to drive the growth in the regional market. For instance, in May 2023, Speedcargo collaborated with Germany-based company, Güdel to launch an automation system for ULD palletizing, focusing on revolutionizing ground handling operations. The system was the first robotic end-to-end material handling product in the world. They can handle cargo of different weights and sizes and standard to odd-shaped, tending to the challenges confronted by automated solutions in the airfreight sector.

Automated Material Handling Market Key Developments:

May 2024- KION North America and Fox Robotics reported a non-exclusive strategic collaboration, which incorporates KION in manufacturing and assembling work of FoxBot autonomous trailer loaders/unloaders (ATLs) at their Summerville facilities in South Carolina.

May 2023- Toyota Material Handling launched three new electric forklift models, namely, a Side-Entry End Rider, a Center Rider Stacker, and an Industrial Tow Tractor, to improve its automated guided vehicle lineup. These electric models provide productivity, flexibility, and operator convenience, with improved features and design to increase material handling solutions in the industry.

Automated Material Handling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|