Report Overview

Atherectomy Devices Market Size, Highlights

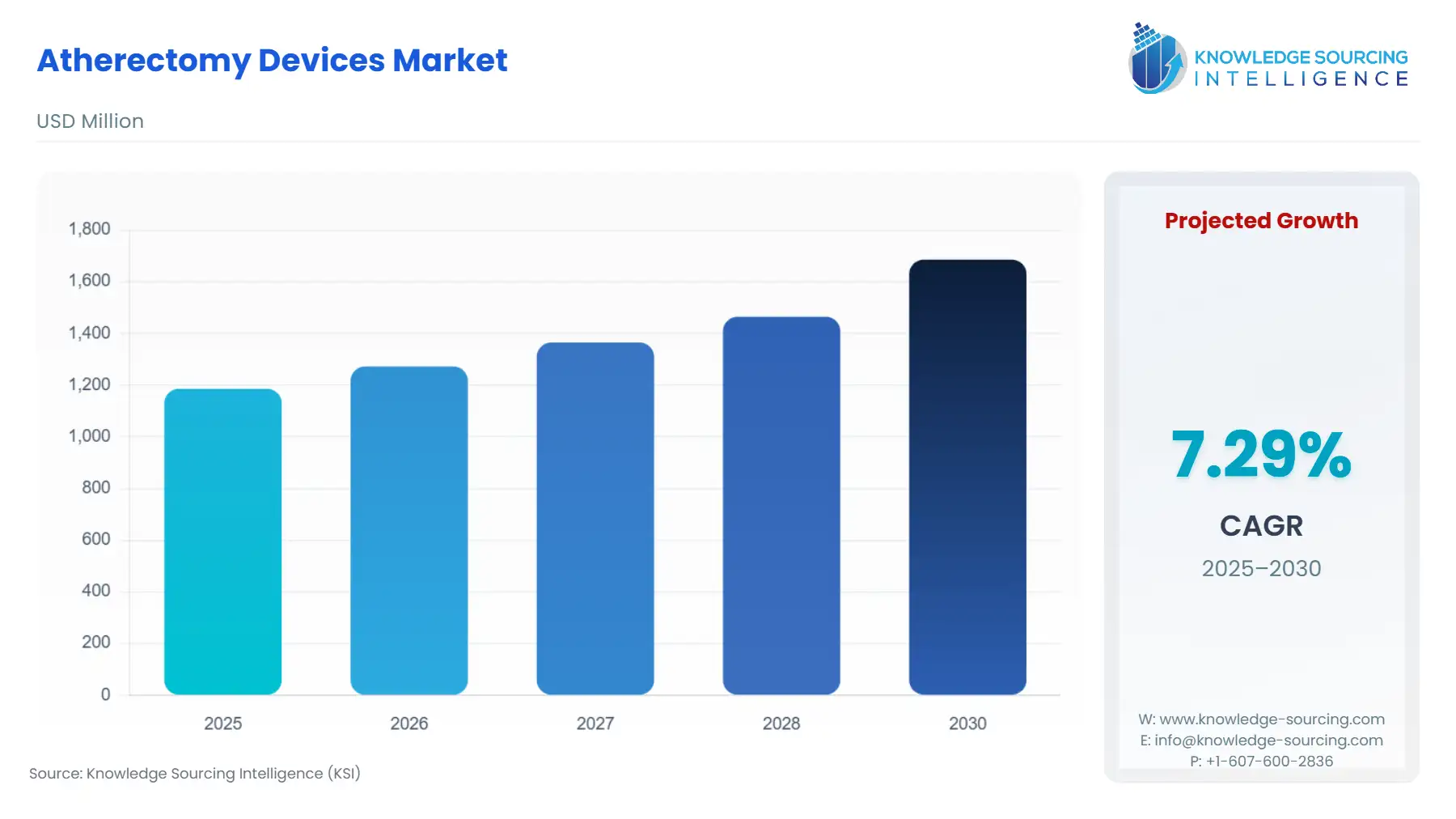

Atherectomy Devices Market Size

The atherectomy devices market is estimated to grow from US$1,186.030 million in 2025 to US$1,686.032 million by 2030, at a CAGR of 7.29%.

An atherectomy device is a type of device that is designed to remove plaque or other types of materials from atherosclerotic vessels. There are various types of atherectomy procedures, which include excisional atherectomy, laser ablation atherectomy, and rotational atherectomy among others.

The rapid advancements in medical technology are among the key factors driving the growth of the global atherectomy device market during the forecast period.

In recent years, this market has experienced significant expansion, largely due to the introduction and development of safer and more efficient devices.

Increasing demand for minimally invasive procedures is also among the major factors pushing the growth of the global atherectomy device market during the forecasted timeline. The global market witnessed a major shift towards minimal and low-invasive surgeries, as they help reduce the recovery time and lowers complication rates. The high cost of equipment and devices is one of the primary challenges to the growth of global atherectomy devices during the forecast period. The development of these devices entails significant expenses in research and contributes to rising manufacturing costs. Furthermore, the device also dilates the arteries of patients, which may lead to increased rates of restenosis, ultimately affecting the long-term effectiveness of the device.

Atherectomy Devices Market Growth Drivers:

- Increasing prevalence of cardiovascular diseases

A major factor propelling the growth of the atherectomy device market is the increasing prevalence of cardiovascular diseases across the globe. With the increasing global cases of cardiovascular diseases, like Peripheral Artery Disease (PAD), and Coronary Artery Diseases (CAD), atherectomy devices help restore healthy blood flow and minimize the symptoms of peripheral artery diseases. The American Heart Association, Inc., in its report, stated that the total cases of peripheral artery disease (PAD) across the globe is estimated at about 200 million. The agency further stated that in the USA, the cases of PAD are estimated at about 12 million. The prevalence of peripheral artery disease in individuals above the age of 70 years is among the highest compared to other age groups, as stated by the agency. Similarly, the Center for Disease Control, of the USA stated that in the USA, the total cases of heart disease in the nation was recorded at 702,880 in 2022, which is about 1 in every 5 people.

- Growing global adult population

The growing adult population in the global market is one of the key factors driving the expansion of the atherectomy devices market during the forecast period. As the number of older individuals increases, so does the prevalence of chronic diseases, including cardiovascular conditions, leading to significant growth in this sector. The global population above the age of 65 years witnessed a major growth during the past few years. The World Bank, in its report, stated that in 2021, the total population above the age of 65 years was recorded at 754.681 million, which increased to 778.122 million in 2022. In 2023, the total population above the age of 65 years across the globe was recorded at 804.475 million.

- Shift of consumer preference towards minimal invasive surgeries.

The shift in consumer preference toward minimally invasive surgeries (MIS) is a significant factor driving the growth of atherectomy devices during the projected period. Atherectomy is a therapeutic procedure that provides a minimally invasive approach to treating vascular conditions. The primary reason for this shift is the lower complication rates associated with minimally invasive surgeries, which play a critical role for patients suffering from various chronic diseases, such as cardiovascular disease and diabetes. Additionally, the atherectomy procedure helps minimize the risk of infections and trauma related to surgical interventions

Atherectomy Devices Market Geographical Outlook:

The North American region is expected to witness significant growth in the global atherectomy devices market, during the forecasted timeline. The major factor propelling the growth of atherectomy devices in the North American region, is the increasing cases of cardiovascular diseases, majorly in the USA and Canada. The cases of cardiovascular diseases, in the USA, witnessed a major growth, during the forecasted timeline. Furthermore, the improvement in the healthcare sector in the region is also among the key factors propelling the growth of the market during the estimated timeline. Countries in the region, especially in the USA and Canada, witnessed a significant growth.

Atherectomy Devices Market Products Offered by Key Companies:

Atherectomy Devices Market Key Developments:

- In January 2024, AngioDynamics, a global leader in biotechnology and biomedical engineering, announced that the company received US Food and Drug Administration (FDA) approval for its Auryon XL Radical Access Catheter. The solution helps in reducing the access site complication and accelerates patient recovery. The system also helps in expanding treatment access points in atherectomy procedures for Peripheral Arterial Disease (PAD).

Atherectomy Devices Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Atherectomy Devices Market Size in 2025 | US$1,186.030 million |

| Atherectomy Devices Market Size in 2030 | US$1,686.032 million |

| Growth Rate | CAGR of 7.29% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Atherectomy Devices Market |

|

| Customization Scope | Free report customization with purchase |

The Atherectomy Devices Market is analyzed into the following segments:

- By Product Type

- Directional Atherectomy Devices

- Rotational Atherectomy Devices

- Orbital Atherectomy Devices

- Laser Atherectomy Devices

- Photo-Ablative Atherectomy Devices

- Others

- By Application

- Peripheral Vascular

- Cardiovascular

- Neurovascular

- By End-User

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Isreal

- Others

- Asia Pacific Region

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America