Report Overview

Artificial Intelligence as a Highlights

AI As A Service Market Size:

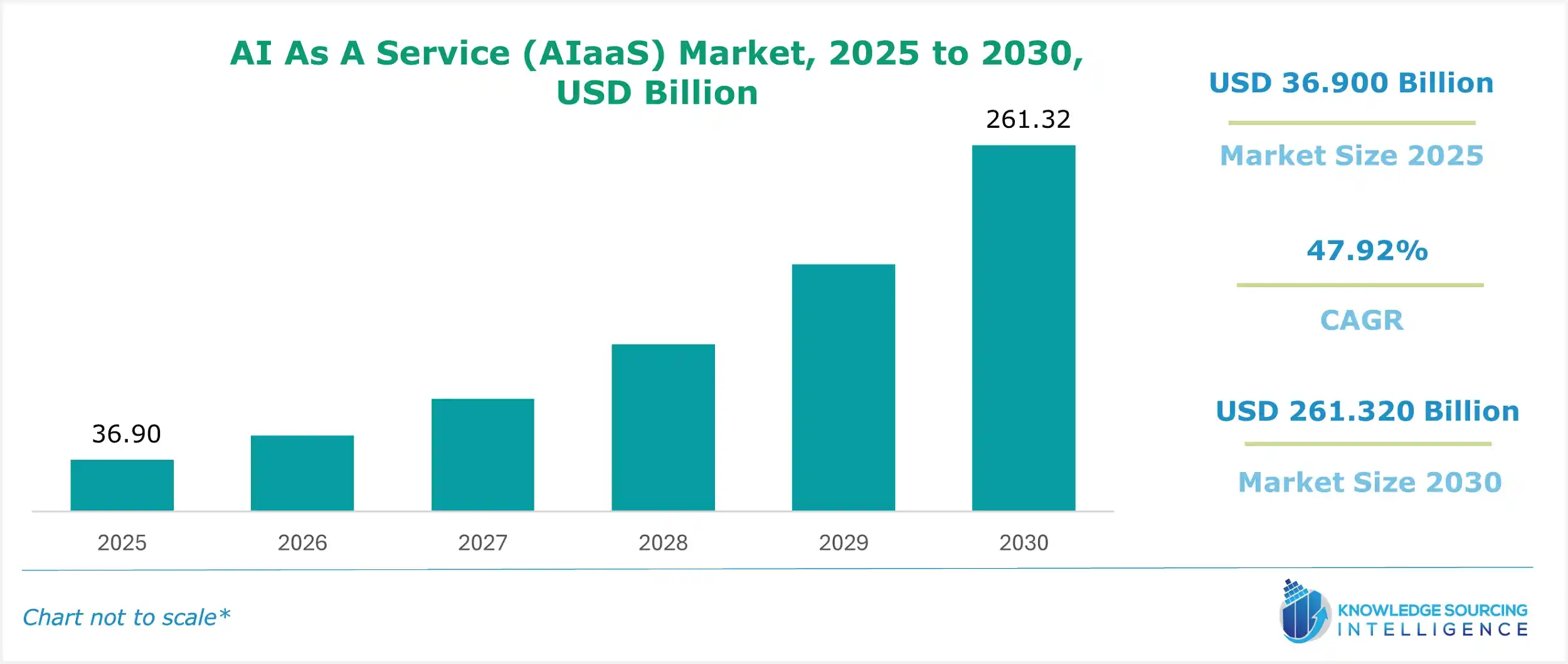

The Artificial Intelligence As A Service (AIaaS) Market is projected to witness a CAGR of 47.92% during the forecast period to reach a total market size of US$261.320 billion by 2030, up from US$36.900 billion in 2025.

AI As A Service Market Introduction:

The AI as a Service (AIaaS) market is witnessing rapid growth, driven by its cloud-based, cost-effective approach to delivering artificial intelligence (AI) solutions. AIaaS enables businesses to leverage AI algorithms, machine learning platforms, and artificial neural networks without significant infrastructure investments or high startup costs. Its pay-as-you-go pricing and scalability allow companies to focus on core operations, boosting adoption across industries.

AIaaS services include natural language processing (NLP), computer vision, AI chatbots, and virtual assistants, enabling machines to process human language, analyze visual data, and provide customer support. These tools enhance business efficiency, customer engagement, and data-driven decision-making in sectors like retail, healthcare, finance, and manufacturing. Technological advancements, fueled by R&D investments from major players, further drive AIaaS popularity.

The high initial costs of traditional AI implementation have historically limited adoption, but AIaaS overcomes this by eliminating the need for in-house AI infrastructure. Cloud computing ensures accessibility and flexibility, making AI solutions viable for small and medium enterprises (SMEs). North America leads the market due to its advanced technology ecosystem, while Asia-Pacific, particularly China and India, grows rapidly due to digital transformation.

Challenges like data privacy and integration complexities persist, but secure AI frameworks and standardized platforms are addressing these concerns. The AIaaS market is poised for growth, propelled by cloud-based AI, machine learning, NLP, and business innovation.

AI As A Service Market Overview:

Artificial intelligence as a service (AIaaS) refers to providing artificial intelligence (AI) services and tools through cloud computing platforms to users for accessing and utilizing AI capabilities without investing in and maintaining the underlying infrastructure. It is a cost-effective way for organizations to use AI technologies such as machine learning, deep learning, natural language processing, and computer vision through APIs or other cloud-based services in their applications and processes.

The AIaaS market is growing rapidly due to a combination of technological, economic, and strategic factors. It has a lower upfront investment, as increasing pay-as-you-go models allow organizations to scale services up or down based on demand. In addition, the growing proliferation of cloud platforms is making AI tools more accessible and deployable across regions and industries such as healthcare, finance, retail, manufacturing, logistics, and marketing. Furthermore, there is increasing demand for AI-powered features like chatbots, recommendation engines, sentiment analysis, and predictive analytics, giving a boost to the AIaaS market. Many companies lack skilled AI professionals, propelling the growth of AIaaS providers to bridge the gap. Thus, all these factors are collectively driving the market growth.

The biggest driver of the AIaaS market is its cost-effectiveness and scalability. It allows companies to use advanced tools without investing on expensive infrastructure or hiring specialists. With flexible pricing and easy access, even small businesses can start using intelligent solutions and grow as needed. In addition, it offers companies operational efficiency, driving market expansion. A study by Stanford, MIT, and NBER found that access to AI assistance increases worker productivity, as measured by issues resolved per hour, by 15% on average.

According to a recent survey, 66% of industry leaders predict AI will become an integral part of their business within the next 2-3 years. This clearly highlights that businesses are looking forward to adopting AI in automating their business processes, driving market growth.

Enterprise adoption of AI is rapidly accelerating, with AI adoption in enterprise infrastructure projected to grow by over 30% by 2026, driving a 33% annual increase in demand for AI-ready data center capacity through 2030. (Google Cloud AI in Business Trends 2025 Report). For instance, Prudential plc, a leading insurance provider, partnered with Google Cloud in October 2024 to deploy MedLM, Google’s healthcare-focused generative AI model, to streamline the medical insurance claims process. By automatically analyzing and summarizing diagnostic reports, prescriptions, and invoices, Prudential doubled the automation rate of claim reviews while improving accuracy and speeding up approvals.

Thus, the growth in demand for AI from various industries due to its benefits, such as scalability, operational efficiency, automating processes, and cost-effectiveness, is boosting market expansion.

The market is now experiencing a changing landscape. There is an emergence of new trends such as the rise of Agentic AI and Autonomous AI agents, and the growth of No-Code or Low-Code platforms. At the same time, providers are launching tailored AIaaS solutions for specific industries, addressing unique challenges like compliance, fraud detection, or patient diagnostics. Generative AI is being integrated into AIaaS platforms.

The market is evolving from simple AI tools (like chatbots) to sophisticated, autonomous AI agents and multi-agent systems (MAS) capable of managing complex workflows with minimal human intervention. For instance, Waymo One demonstrates practical multi-agent AI applications. AIaaS providers are increasingly offering these advanced AI agent ecosystems as scalable cloud services. According to a Capgemini survey of 1,100 executives at large enterprises, only 10% currently use AI agents, but 82% plan to adopt them within the next three years, highlighting a strong upward trend in enterprise AI integration. Additionally, 71% believe AI agents will significantly improve workflow automation and customer service satisfaction.

AI As A Service Market Drivers:

- The Growing adoption of cloud computing is expected to increase the demand for Artificial Intelligence as a Service (AIaaS) solutions globally.

One of the major factors anticipated to drive the Artificial Intelligence as a Service market’s growth during the forecast period is the shift of a large number of organizations to cloud computing. Cloud computing allows companies to use artificial intelligence without the need to set up an AI infrastructure, saving them cost and time. It allows the companies to focus completely on their core business, as AI as a service is provided by third parties, which is leading to rising demand for AIaaS and propelling its market growth in the coming years.

For instance, in June 2022, e& Enterprise, a division of e& Group Limited, collaborated with DataRobot to introduce an industry-first Enterprise AlaaS solution for public and private companies looking to accelerate their digital transformation. It provides an end-to-end cloud solution that allows building, training, deploying, and managing AI & ML solutions at a fraction of the cost of in-house. Further, it allows governments and private companies to deploy AI fixes at scale and realize business value with minimal upfront AI expertise. Similarly, there are more companies are adopting cloud computing to upgrade their businesses, which is anticipated to boost the market growth during the assessment period.

- The increasing investments in artificial intelligence are anticipated to drive market growth.

The field of artificial intelligence has been attracting huge investments in recent times by various end-user industries. For instance, the World Economic Forum reported that the investment by companies in AI for manufacturing is predicted to rise by 57% by 2026, accounting for a growth from $1.1 billion in 2020 to a value of $16.7 billion in 2026. This represents a major upsurge in which machines will act intelligently and carry out complex functions that are similar to the human mind's workings. Besides ramping up revenue and trimming expenses, it could also decrease the risk of exposure and revolutionize the manufacturing industry. This will promote the utilization of AIaaS in advancing AI technology, fuelling market expansion.

Countries like China, the United Kingdom, and the United States are spending huge amounts on AI. The technological companies are also investing in AI-related solutions. For instance, a Microsoft report anticipated that the employment of the GenAI tool could save the UK public sector £17bn by 2035, though even just a five-year delay in adoption would lead to a loss in its economy by up to £150bn.

Furthermore, the governments of various countries are passing policies for the development of AI in their respective countries. For instance, the Chinese government has passed policies like the "National New Generation AI Plan," which focuses on becoming the primary hub for new AI innovations by 2030, and many other supporting objectives for the country and industry improvement, leading to increased investments in AI. The increased investment in AI is driving the adoption of Artificial Intelligence as a Service, which is expected to fuel market expansion in the forecast period.

- Rising Demand for AI-Driven Solutions & Automation:

The growing need for AI-based solutions and automation is a key factor driving the global AI as a Service (AIaaS) market’s expansion. Organizations in various industries want to improve operational efficiency, reduce costs, and make better decisions. AIaaS provides a flexible, on-demand solution to access powerful AI tools without requiring extensive technical skills or major infrastructure investments. This demand is especially strong in fields like BFSI, healthcare, retail, and manufacturing, where automating customer service, fraud detection, diagnostics, and supply chain optimization has clear benefits. The AIaaS model enables businesses to quickly implement AI tools, such as natural language processing and machine learning, accelerating their time to value and boosting their responsiveness.

In line with this, about ten countries are already providing AI-enabled services to their citizens, and 75 nations plan to share their AI strategies by 2024. The United States has requested an impressive $3 billion for AI in the FY25 budget. Meanwhile, Singapore aims to invest $1 billion in AI over the next five years. South Korea is prepared to invest $6.94 billion in AI by 2027. This reflects a global consensus that AI is central to economic competitiveness, national security, and citizen service delivery. These investments often lead to public-private partnerships, which further drive demand for AIaaS solutions, especially among smaller agencies or startups that benefit from ready-to-deploy AI capabilities through cloud-based platforms.

Furthermore, many governments are already deploying AI for automating citizen services, managing infrastructure, or improving policy analysis, and they increasingly rely on AIaaS providers to support these initiatives. This global push toward AI adoption, backed by policy, funding, and strategic intent, is accelerating AIaaS demand and shaping it into a foundational technology layer that underpins digital transformation across both public and private sectors.

AI As A Service Market Segment Analysis:

- The energy sector is expected to lead the market growth

By application, the Artificial Intelligence as a Service (AIaaS) market is segmented into BFSI, Retail, IT and Telecom, Healthcare, Manufacturing, Government, Energy, and Others. The AIaaS market in the energy sector is gaining significant momentum due to the growing need for efficient grid management and predictive maintenance. AIaaS allows energy providers to use advanced analytics for real-time monitoring, fault detection, and performance improvement of power plants, transmission lines, and distribution systems without the burden of heavy upfront investment. By offering scalable and cloud-based AI tools, service providers help utilities improve asset reliability, lower operational costs, and reduce downtime, making grid operations smarter and more responsive.

Another major factor is the increasing integration of renewable energy sources, such as wind and solar, into power systems. For instance, according to the estimates of the Office of Energy Efficiency and Renewable Energy, five states of the United States, namely California, Hawaii, Nevada, Vermont, and Massachusetts, generated more than 15% of their total electricity using solar energy, with California leading at 27.5%. This represents that the growing penetration of solar energy will aid market expansion.

Moreover, AI-based forecasting models can predict changes in renewable output, optimize energy storage, and balance supply with demand. This supports a more stable grid and hastens the global shift to clean energy, helping countries meet their decarbonization goals more efficiently.

In addition, the rapid growth of smart cities and digital infrastructure is driving the adoption of AIaaS in the energy sector. The Smart Cities Mission (SCM) aims to improve the quality of life in India's cities through smart, sustainable solutions. Its goal is to create cities that are economically vibrant, inclusive, and environmentally friendly. By focusing on key areas like infrastructure, governance, and social development, SCM aims to change urban living across the country. With 100 cities leading the initiative, the mission has made significant progress, having completed 7,380 out of 8,075 projects, with an investment of Rs 1,47,704 crore. These completed projects show SCM’s commitment to creating smarter, more livable urban spaces for everyone.

Governments and energy providers are investing in smart meters, IoT-enabled grids, and decentralized energy systems that need intelligent, real-time decision-making. AIaaS provides the flexibility, speed, and affordability to implement these solutions at scale, making it a key driver of energy innovation. As regulatory support increases and digital transformation deepens across the energy landscape, AIaaS will play an important role in creating resilient, efficient, and sustainable energy ecosystems.

Major service providers are further involved in various strategies, fueling the market expansion. For instance, in June 2025, Hitachi Vantara, the data storage, infrastructure, and hybrid cloud management subsidiary of Hitachi, Ltd., introduced Hitachi EverFlex AI Data Hub as a Service. This new offering is a fully managed, all-in-one service that focuses on AI data preparation challenges. It provides a modern data lakehouse with built-in workbench features for AI, business intelligence (BI), and data needs.

AI As A Service Market Geographical Outlook:

- The North American region is expected to hold a substantial Artificial Intelligence as a Service (AIaaS) market share.

The North American region is anticipated to hold a significant market share owing to the presence of market leaders such as Microsoft Corporation, Amazon Web Services, Google LLC, and IBM Corporation, among others. Further, the region has a strong industry player presence, leading to increasing technological advancements. Hence, there will be a higher tendency to adopt technologies like AIaaS for diverse industries in the coming years.

In addition, North American countries like the United States and Canada are anticipated to witness substantial growth during the forecast period due to rising investments in cloud-based solutions and an emerging sector realizing the utilization of AlaaS for multiple applications. Furthermore, the rising number of start-ups in the region providing AIaaS solutions is anticipated to propel the market growth during the forecast period.

AI As A Service Market Key Developments:

- In May 2025, Brillio launched ADAM, an Agentic Data Management platform that uses intelligent, self-governing AI agents to automate the full data lifecycle—covering engineering, governance, analytics, and operations. The platform is already being used for MLR automation in life sciences, marketing ROI in telecom, and churn prediction in consumer sectors, offering a low-code, industry-specific, and explainable AI-driven data architecture.

- In May 2025, Manhattan Associates introduced Agentic AI support within its Manhattan Active® solutions, unveiling intelligent autonomous digital agents to enhance supply chain commerce execution, optimization, and user experience. Key agents include the Intelligent Store Manager, Labor Optimizer Agent, Wave Inventory Research Agent, Contextual Data Assistant, and Virtual Configuration Consultant.

- In 2025, Barclays agreed to purchase 100,000 licenses for Microsoft’s Copilot AI assistants, integrating them into Microsoft 365 to enhance productivity and drive enterprise SaaS adoption.

- In March 2024, Salesforce launched Einstein 1 Studio, a suite of low-code AI tools including Copilot Builder, Prompt Builder, and Model Builder. This development enables enterprises to create, deploy, and manage AI-powered assistants and models on the Salesforce Platform.

- In 2024, Microsoft partnered with Sanctuary AI to advance humanoid robotics, potentially integrating AI and cloud solutions into Azure-based SaaS applications for automation and enterprise robotics.

List of Top AI As A Service Companies:

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Oracle Corporation

Artificial Intelligence As A Service Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI as a Service (AIaaS) Market Size in 2025 |

US$36.900 billion |

|

AI as a Service (AIaaS) Market Size in 2030 |

US$261.320 billion |

| Growth Rate | CAGR of 47.92% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI as a Service (AIaaS) Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence as a Service (AIaaS) Market Segmentation:

- By Technology

- Machine Learning

- Computer Vision

- Natural Language Processing (NLP)

- Others

- By Software Type

- Software

- Services

- By Deployment

- Public

- Private

- Hybrid

- By Organization Size

- Large Enterprise

- SMEs

- By End-User Industry

- BFSI

- Retail

- IT and Telecom

- Healthcare

- Manufacturing

- Government

- Energy

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America