Report Overview

Artificial Intelligence (AI) In Highlights

AI in Life Sciences Market Size:

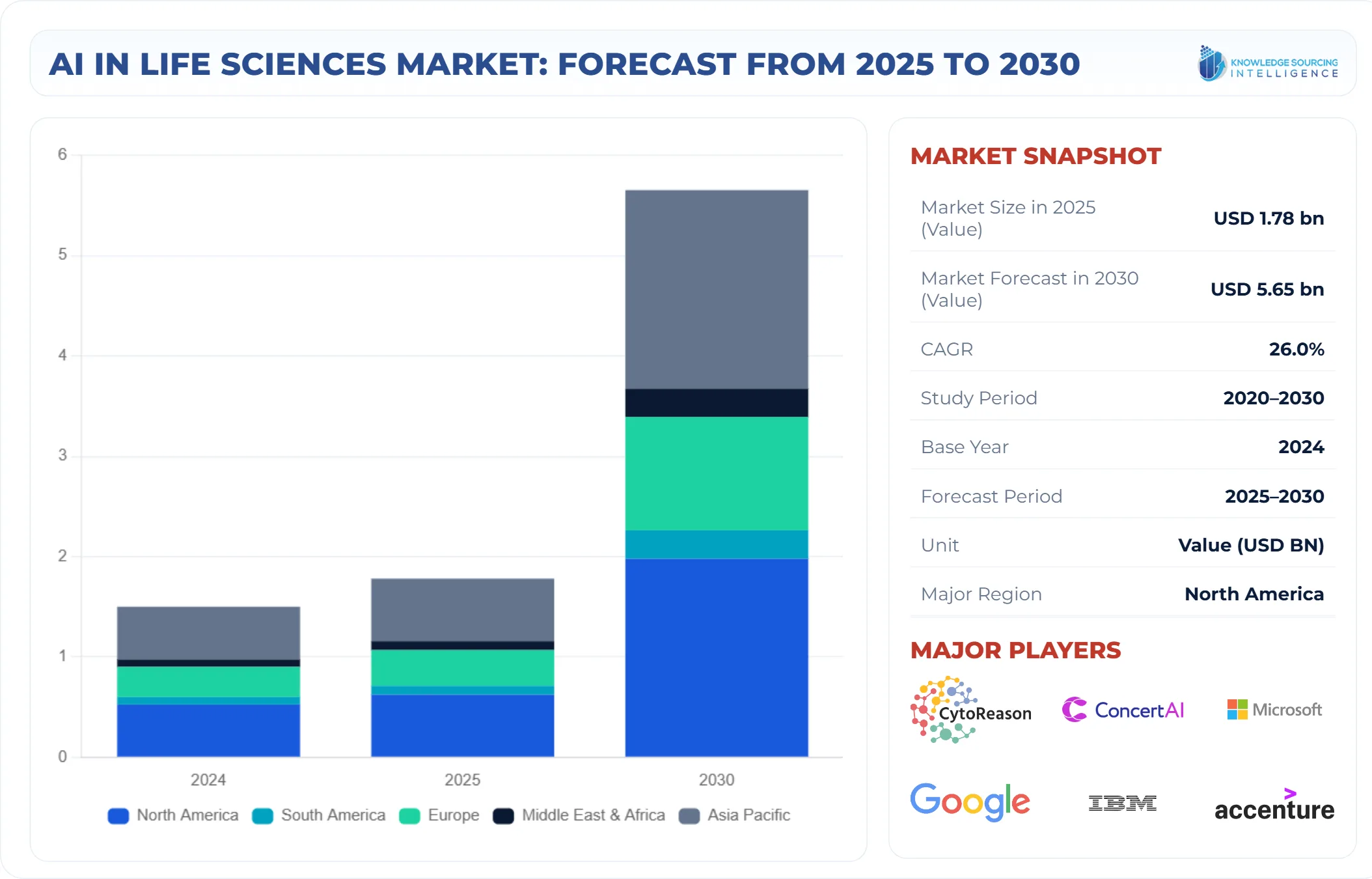

The AI in Life Sciences Market is projected to witness a CAGR of 26.00% during the forecast period to reach US$5.650 billion by 2030, up from US$1.780 billion in 2025.

Life sciences is one of the industries witnessing a push toward more productive methods in response to escalating costs. In the life sciences industry, Artificial Intelligence (AI) typically helps to identify relationships from read-across data or generate mechanistic insight about how a tool is working. The substantial growth of AI in the life sciences market is due to the increasing volume of data generated in this sector. This data assists in producing predictable and accurate insights across various applications within the life sciences field.

In addition, growing investments in medical research are driving the creation of new treatments that rely upon faster and more efficient means for researchers to reach essential data sets by making them easily accessible. This, in turn, is fueling an increasing adoption of AI services to analyze unstructured data and draw insights related to the specific requirements of the projects, propelling the market expansion.

AI in Life Sciences Market Growth Drivers:

- Growing expenditure on drug discovery is predicted to accelerate the demand for AI in life science globally.

Additionally, the high costs of drug discovery further support the use of AI in life sciences. Life sciences market players, therefore, deploy artificial intelligence technology to lower costs and increase the likelihood of success for drug discovery. Discovery consumes a significantly high proportion of the costs associated with it. Hence, decreasing cost and time in drug discovery & increasing clinical trial success rates are necessary and broadly influencing the usage of AI technology in this industry.

For instance, in October 2023, Insmed, a worldwide biopharmaceutical corporation, collaborated with Google Cloud to revolutionize the life sciences sector by employing generative AI. The association focuses on decreasing time and increasing effectiveness in creating and delivering new medications to patients. Insmed's expertise in serious and rare illnesses will be utilized to progress the method. The collaboration will aim at four key life sciences industry angles: drug discovery, development, commercialization, and empowering capacities. Projects are anticipated to be completed within the following 18 months.

- Increasing patient outcomes through AI tools is anticipated to drive AI in the life science market.

The increasing burden of life-threatening diseases, including cancer, is the key factor driving the global AI in the life sciences market. These diseases are complex and need multiple active drugs for therapeutic effect. Since no single therapy proves effective in all patients, selecting an appropriate combination therapy is crucial. The increase in rare & orphan diseases across various countries also requires a focus on precision medication. Hence, the market of AI in life sciences is growing due to the rising manufacturing by pharmaceutical companies for precision medicine and personalized drugs.

Many pharmaceutical companies partner with AI solution providers to use AI in different life sciences sectors. For instance, in April 2024, PathAI collaborated with Google Cloud to accelerate the adoption of AI and advanced pathology in biopharma companies and anatomic pathology labs. The organization will utilize PathAI's AISight1 Intelligent Image Management System (IMS) to coordinate PathAI and third-party algorithms into a single workflow and image analysis stage. This will give analysts and pathologists access to effective biomarker evaluation devices, expanding lab operational proficiency, and supporting disease organization and scoring. The association focuses on bringing AISight to more biopharma companies and labs worldwide.

AI in Life Sciences Market Restraint:

- The shortage of skilled professionals could hinder AI in the life sciences market expansion.

Life science applications of AI require deep domain knowledge, such as biology, chemistry, and medicine, and it can be difficult to find people with all these skills. AI model development and implementation require specialized technical skills like data science, machine learning, or bioinformatics. The market growth of AI in life sciences is being largely limited by the shortage of healthcare professionals capable of using new technologies and tools to understand their patients' conditions and provide customized medication or treatment for them.

AI in Life Sciences Market Geographical Outlook:

- The North American region is anticipated to hold a substantial AI in life sciences market share.

North America shows significant growth in the global AI in life sciences market due to the early adoption of advanced technologies and the presence of key players in the U.S. The country is experiencing a growing surge in demand for AI solutions within life sciences end-user verticals. The existence of global pharmaceutical companies such as Pfizer and Johnson & Johnson in the country is expected to be a key driver for the proliferation of AI solutions for R&D in drug development and discovery. These companies are creating their own AI departments or partnering with multiple AI start-ups, which could assist them in drug discovery and patient monitoring.

Additionally, the market in the regions will experience an uplift due to increased funding of AI technology and supportive government policies for better adoption of this technology in the life sciences industry, such as the USA and Canada. The US government is promoting data sharing, which gives its healthcare AI companies an edge and can be utilized for the manufacturing of personalized medication and treatment.

AI in Life Sciences Market Key Developments:

- October 2025: Anthropic Launches “Claude for Life Sciences”. Anthropic unveiled Claude for Life Sciences, an AI-assistant offering that supports researchers across the full pipeline—from literature review and hypothesis generation through data analysis and regulatory-submission drafting—integrating with lab-platform tools like Benchling, 10x Genomics, PubMed and BioRender.

- June 2025: IQVIA Launches AI Agents for Life Sciences & Healthcare. IQVIA introduced new custom-built AI agents running on NVIDIA technology (using NeMo Customizer, Guardrails, and NIM Agent Blueprints) designed to accelerate workflows in life sciences—such as target identification, clinical-data review, literature review, and HCP engagement.

- June 2025: NVIDIA Partners with Novo Nordisk to Advance Drug Discovery via AI. NVIDIA Corporation announced a collaboration with Novo Nordisk A/S and DCAI’s Gefion supercomputer to apply generative and agentic AI (via NVIDIA’s BioNeMo™, NIM™, NeMo™, and Omniverse™) in early-stage drug discovery, including molecule design, single-cell modelling, and biomedical large-language-model development.

List of Top AI in Life Sciences Companies:

- IBM Corporation

- Microsoft Corporation

- Concerto HealthAI

- Atomwise, Inc.

AI in Life Sciences Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI in Life Sciences Market Size in 2025 |

US$1.780 billion |

|

AI in Life Sciences Market Size in 2030 |

US$5.650 billion |

| Growth Rate | CAGR of 26.00% |

| Study Period | 2020 to 2023 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI in Life Sciences Market |

|

| Customization Scope | Free report customization with purchase |

AI in Life Sciences Market Segmentation:

- By Offering

- Hardware

- Software

- Services

- By Application

- Drug Discovery

- Clinical Trials

- Medical Diagnosis

- Personalized Medicine

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Others

- North America