Report Overview

Artificial Intelligence (AI) In Highlights

AI In Banking Market Size:

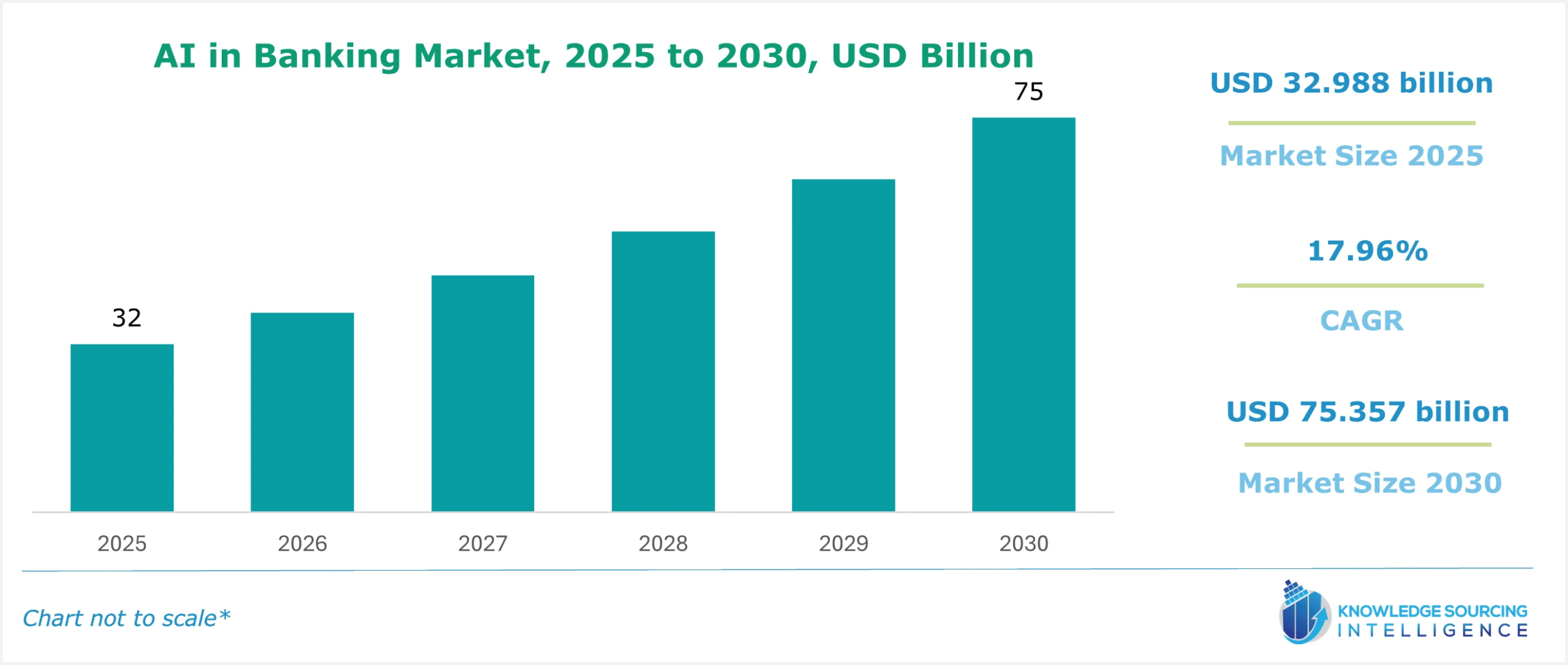

Artificial intelligence (AI) in the banking market is estimated to grow at a CAGR of 17.96%, attaining US$75.357 billion by 2030, from US$32.988 billion in 2025.

AI In Banking Market Introduction:

The integration of artificial intelligence (AI) into the banking sector has ushered in a transformative era, reshaping how financial institutions operate and interact with customers. AI technologies are driving a shift toward customer-centric services, enhancing operational efficiency, and bolstering security measures. From fraud detection to personalized banking experiences, AI is redefining the industry’s landscape. This report explores the key trends, growth drivers, geographical outlook, and recent developments in the AI in banking market, highlighting its profound impact on the global financial ecosystem.

AI in Banking Market Trends:

The adoption of AI in banking has accelerated, driven by the need for enhanced efficiency, security, and customer satisfaction. AI-powered systems are enabling banks to streamline operations, reduce costs, and deliver tailored services. Below are the key trends shaping the AI in banking market:

Customer-Centric Transformation: AI is enabling banks to shift from traditional, transaction-focused models to highly personalized, customer-centric approaches. By leveraging advanced analytics and machine learning, banks can analyze vast amounts of customer data to offer tailored financial products, such as customized loan offers or investment advice. This personalization enhances customer satisfaction and loyalty, positioning banks to compete in a digital-first world.

Enhanced Security Through AI: Intelligent algorithms are revolutionizing fraud detection and prevention. AI systems can analyze transaction patterns in real time, identifying anomalies that may indicate fraudulent activity within seconds. For instance, in August 2024, Zest AI introduced Zest Protect, a fraud detection solution designed to identify suspicious activities during the loan application process. This capability is critical as cyber threats grow in sophistication, allowing banks to protect customers and maintain trust.

Cost Reduction and Productivity Gains: AI-driven automation is reducing operational costs by streamlining repetitive tasks such as customer inquiries, loan processing, and compliance checks. By automating these processes, banks can allocate resources more efficiently, improving productivity and reducing human error. The Bank for International Settlements (BIS) emphasizes that central banks should embrace AI, recognizing its potential to transform economic systems by optimizing operations and fostering innovation.

Data as the Cornerstone of AI: The proliferation of data in the digital age has made it a critical asset for AI applications in banking. With 5.4 billion internet users globally in 2023, up from 5.1 billion in 2022 according to the International Telecommunication Union (ITU), banks have access to unprecedented volumes of data. This data fuels AI algorithms, enabling predictive analytics, customer segmentation, and risk assessment, which are essential for delivering innovative financial solutions.

Central Bank Cooperation: The BIS Annual Economic Report underscores the need for central banks to collaborate on AI adoption. As AI reshapes the financial sector, central banks must work together to establish regulatory frameworks, ensure data privacy, and promote ethical AI use. This cooperation is vital to maintaining stability and trust in the global financial system as AI adoption scales.

AI in Banking Market Growth Drivers:

Several factors are propelling the growth of AI in the banking sector. These drivers reflect the convergence of technological advancements, changing consumer behaviors, and the increasing complexity of financial operations.

Surge in Digital Payments

The rise of digital payments is a significant driver of AI adoption in banking. As consumers increasingly rely on mobile apps and online platforms for financial transactions, banks face pressure to enhance their digital offerings. In India, for example, digital payment transactions grew at a compound annual growth rate (CAGR) of 44% from FY 2017-18 to FY 2023-24, with transaction volumes rising from 8,839 crore in FY 2021-22 to 13,462 crore in FY 2022-23. This surge has challenged banks to manage high transaction volumes while maintaining security and efficiency.

AI addresses these challenges by enabling banks to process transactions faster and more accurately. Machine learning models analyze transaction data to detect patterns, predict customer needs, and prevent fraud. Additionally, AI-powered chatbots and virtual assistants handle customer inquiries, reducing the burden on human staff and improving response times. By leveraging customer data, banks can move beyond basic demographic segmentation, treating customers as individuals and offering personalized services such as tailored payment plans or savings recommendations.

Growing Internet Penetration

The global increase in internet users, reaching 5.4 billion in 2023, has fueled demand for innovative banking solutions. This growth has prompted banks to invest in AI technologies to meet evolving customer expectations. For instance, Bank of America reported a 94% increase in AI and machine learning patents and pending applications since 2022, with nearly 1,100 in its portfolio, over half of which have been granted. These patents reflect the bank’s commitment to using AI to enhance customer experiences, streamline operations, and develop new financial products.

AI enables banks to capitalize on the digital shift by offering seamless, user-friendly interfaces on mobile apps and websites. Predictive analytics powered by AI can anticipate customer needs, such as recommending savings plans based on spending habits or alerting users to potential overdrafts. This proactive approach strengthens customer relationships and drives engagement, positioning banks as leaders in the digital banking space.

Demand for Enhanced Security

As digital transactions proliferate, so do cyber threats, making security a top priority for banks. AI’s ability to detect and prevent fraud in real time is a critical growth driver. Intelligent algorithms analyze vast datasets, identifying suspicious patterns and flagging potential threats before they escalate. Zest Protect, launched by Zest AI in August 2024, exemplifies this trend by enabling banks and credit unions to identify fraudulent loan applications with high accuracy. By integrating AI into security protocols, banks can reduce financial losses, protect customer data, and maintain regulatory compliance.

Regulatory and Compliance Support

AI is also transforming how banks manage regulatory compliance. With increasingly complex regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements, banks are turning to AI to automate compliance processes. Machine learning models can analyze transactions for suspicious activity, ensuring adherence to regulations while minimizing manual oversight. This automation reduces compliance costs and allows banks to focus on strategic initiatives, further driving AI adoption.

AI in Banking Market Geographical Outlook:

The adoption of AI in banking varies across regions, with the Asia Pacific market poised for significant growth during the forecast period. This section explores the factors driving AI adoption in key regions, with a focus on the Asia Pacific.

Asia Pacific: A Hub for AI Innovation

The Asia Pacific region, particularly China, is witnessing phenomenal growth in AI adoption within the banking sector. Chinese banks are leveraging AI to enhance operational efficiency, improve customer experiences, and diversify revenue streams. A survey by SAS and Coleman Parkes Research, involving 1,600 decision-makers across industries, revealed that 83% of Chinese respondents use generative AI, compared to a global average of 54% and 65% in the United States. This high adoption rate underscores China’s leadership in AI-driven banking innovation.

One key driver of AI adoption in China is the need to diversify income sources. Experts estimate that AI could increase fee-based income for banks from 30% to 40% of total revenues, reducing reliance on net interest income, which is sensitive to central bank policies. AI enables banks to automate processes such as customer onboarding, loan approvals, and fraud detection, resulting in significant cost savings. For example, major Chinese banks use machine learning models to make approximately 400 million decisions daily, giving them a competitive edge over their counterparts in Singapore and India.

In addition to China, other Asia Pacific countries, such as India and Singapore, are also embracing AI in banking. India’s rapidly growing digital payment ecosystem, coupled with government initiatives to promote financial inclusion, is driving demand for AI-powered solutions. Singapore, a global financial hub, is investing in AI to enhance its fintech ecosystem, with banks adopting AI for risk management and customer engagement.

North America: A Leader in AI Innovation

North America, particularly the United States, remains a leader in AI adoption in banking. The region’s robust technological infrastructure, coupled with significant investments in AI research, has created a fertile ground for innovation. Banks like Bank of America are at the forefront, leveraging AI to enhance customer experiences and streamline operations. The U.S. government’s American AI Initiative is further supporting this growth by establishing guidelines for AI applications across industries, including banking.

Europe: Balancing Innovation and Regulation

Europe is also a key player in the AI in banking market, with banks adopting AI to comply with stringent regulations while enhancing customer services. The European Union’s focus on data privacy, exemplified by the General Data Protection Regulation (GDPR), has prompted banks to develop AI solutions that prioritize data security and ethical use. Countries like the United Kingdom and Germany are leading AI adoption in Europe, with banks investing in AI-powered chatbots, fraud detection systems, and predictive analytics.

AI in Banking Market Product Offerings by Key Companies:

Several technology companies are driving AI innovation in the banking sector by offering cutting-edge solutions tailored to financial institutions’ needs. Below are examples of key players and their AI offerings:

International Business Machines Corp.: IBM is a global leader in AI and analytics, offering a range of solutions for the banking industry. Its IBM WatsonX Assistant is an AI-powered chatbot designed specifically for banking, enabling institutions to automate customer service, process loan applications, and provide personalized financial advice. IBM’s core competencies include analytics, AI, automation, blockchain, and cloud computing, making it a trusted partner for banks seeking to modernize their operations. In addition to AI solutions, IBM provides consulting services, infrastructure, and cybersecurity support, ensuring comprehensive digital transformation for its clients.

Amazon Web Services: AWS, a subsidiary of Amazon, offers generative AI solutions tailored for the financial services industry. These solutions focus on scalability, enhanced security, and cost efficiency, enabling banks to deploy AI applications seamlessly. AWS’s offerings include AI-powered contact centers, analytics tools, and IoT solutions, which help banks optimize customer interactions and operational processes. By leveraging AWS’s cloud infrastructure, banks can scale their AI applications to meet growing demand while maintaining robust security protocols.

Other Key Players: Other notable companies in the AI in banking market include Temenos AG, which launched a responsible generative AI solution in May 2024. This solution enhances operational efficiency and enables banks to develop products in real time. Additionally, companies like SAS and Zest AI are contributing to the market by offering advanced analytics and fraud detection solutions, respectively.

AI in Banking Market Key Developments:

October 2025: Financial Stability Board (FSB) Issues a Report on AI Adoption & Related Vulnerabilities in the Financial Sector. While this is a regulatory body rather than a bank, the development is highly relevant to banking-AI: the FSB laid out the next steps for jurisdictions to monitor AI deployment in banking/finance, covering third-party dependencies, concentration risk, and AI-driven fraud.

June 2025: Goldman Sachs Launches Generative-AI “GS AI Assistant” Firmwide for Employee Productivity & Operational Efficiency. According to Reuters, Goldman Sachs rolled out its generative-AI assistant across hundreds of teams (approx. 10,000 users initially) to support document summarization, drafting, data analysis, and reduce operational friction.

March 2025: NatWest Group Forms Collaboration with OpenAI to Enhance Customer Support and Fraud Mitigation. NatWest and OpenAI joined forces to deploy generative-AI tools in NatWest’s customer-chatbot (“Cora”) and staff-assistant (“Ask Archie”), aiming to cut fraud losses and improve digital customer service.

May 2024: IBM partnered with Mizuho Financial Group to develop a proof of concept (PoC) using Watsonx. The three-month trial demonstrated 98% accuracy in monitoring and responding to error messages, showcasing the potential of AI to enhance operational reliability. This collaboration underscores the growing trend of banks partnering with technology providers to integrate AI into core processes.

May 2024: Temenos AG launched a generative AI solution aimed at core banking, offering enhanced operational efficiency and real-time product development capabilities. The solution enables banks to deploy AI safely and quickly, addressing concerns about data privacy and ethical use. This development reflects the industry’s focus on responsible AI adoption to balance innovation with regulatory compliance.

AI In Banking Market Challenges and Opportunities:

While AI offers immense potential for the banking sector, it also presents challenges. Data privacy concerns, ethical considerations, and the need for robust regulatory frameworks are critical hurdles. Banks must ensure that AI systems comply with regulations like GDPR and maintain transparency in their algorithms to build customer trust. Additionally, the high cost of AI implementation may pose a barrier for smaller institutions, requiring strategic partnerships with technology providers.

However, these challenges are outweighed by the opportunities AI presents. By automating routine tasks, enhancing security, and delivering personalized experiences, AI enables banks to stay competitive in a rapidly evolving market. The integration of AI with emerging technologies like blockchain and quantum computing could further revolutionize the industry, creating new revenue streams and enhancing operational resilience.

List of Top AI in Banking Companies:

Zest AI

IBM

Data Robot Inc.

Accenture

Personetics Technologies

Artificial Intelligence (AI) In Banking Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 32.988 billion |

| Total Market Size in 2030 | USD 75.357 billion |

| Forecast Unit | Billion |

| Growth Rate | 17.96% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Solution, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Artificial Intelligence (AI) In Banking Market Segmentation:

By Solution

Hardware

Software

Services

By Application

Customer Service

Robot Advice

General Purpose/Predictive Analysis

Cyber Security

Direct Learning

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Italy

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific Region

China

Japan

India

Australia

South Korea

Others