Report Overview

Application Development Software Market Highlights

Application Development Software Market Size:

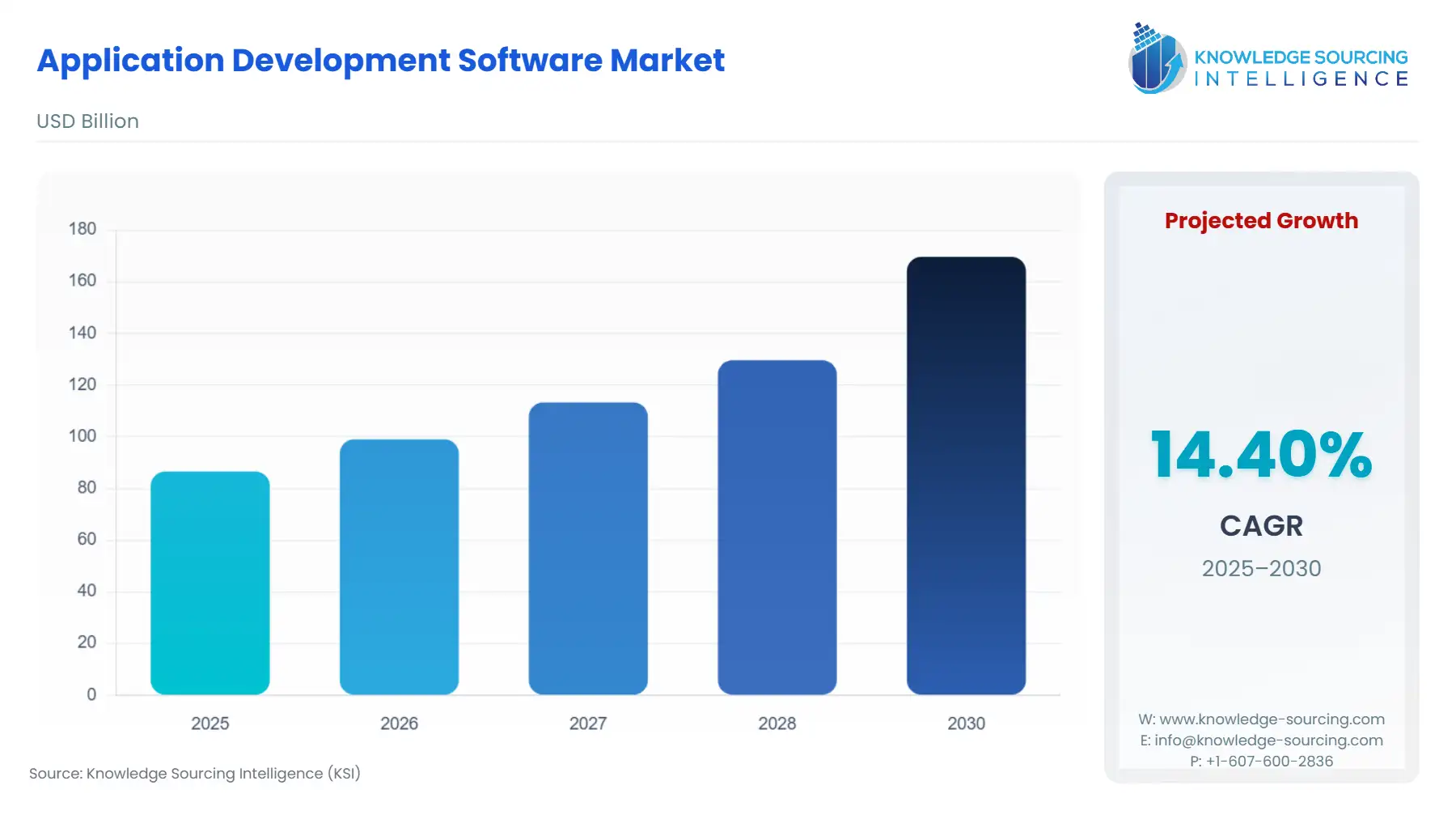

The application development software market is anticipated to grow from USD 86.593 billion in 2025 to USD 169.677 billion in 2030 at a CAGR of 14.38% during this period.

Application development software makes valuable business coding applications, such as word processors, enabling a firm to improve its operations by tracking productivity and employee work progress. This software is integral to project planning, customer interaction, and establishing a reliable link with service providers.

The ongoing shift towards digital automation, increased demand for application-specific platforms, and booming cloud computing for processing large company data have greatly boosted the demand for application development software platforms. Moreover, the bolstering growth in work culture in major economies has further laid new norms for workforce skill enhancement and has provided a major scope for overall market growth.

However, technical challenges and issues with scalability, along with high installation costs, can hinder market expansion. This is especially true for local or small-scale firms with limited revenue and technical capabilities, as they lack the necessary infrastructure to operate on such platforms.

Application Development Software Market Drivers:

- Growing demand for application-specific platforms has propelled the market expansion.

In the current period of technological innovation, the demand for a central digital framework featuring a unique architecture that enables enterprises to establish close ties with their employees and customers is growing. Hence, various industrial sectors, such as media and entertainment, BFSI, telecommunication, and government, emphasize using software platforms to analyze business requirements.

According to the “App Attention Index 2023” report issued by Cisco, in which more than 15,000 con summers in 13 countries were interviewed, it was stated that the most heavily used applications in 2023 were entertainment, banking, insurance, retail, and new & information. The same source also specified that consumers used nearly 41 applications and digital services each month. Such a high consumption rate has established a new framework for companies to manage customer relations and track overall productivity. This is expected to drive the demand for application development software in the coming years.

- Growing cloud software spending has provided new growth prospects for the market.

Application development software can be deployed via cloud or on-premise depending on the company’s infrastructure, and due to their ability to provide instant business insights and accessibility, such software is their presence and plays a key role in ensuring business continuity. The growing competitive culture in the business environment has enabled companies to invest in cloud application software to exercise cost-savings & optimize their operations.

According to the March 2023 “Cloud Software Spending Survey” issued by Battery Ventures, nearly 58% of the 100 CXOs who participated in the survey have invested more than US$100 million in application software and cloud infrastructure. Compared to 2022, 46% of the technology budget grew in 2023.

Application Development Software Market Segment Analysis:

- Large enterprises will account for a considerable market share.

Based on enterprise size, the application development software market is analyzed into small & medium enterprises (SMEs) and large enterprises. The latter is expected to account for a considerable market share. Multinational organizations have regional offices and branches spread across various countries and employ a dynamic workforce.

These firms maintain a central framework where they interact with their employees, train them, and work on their skill enhancement. Application software, owing to its ability to grant employees access anywhere, fulfills such requirements, which is why it is used mainly in large companies. Small and medium enterprises are projected to show constant growth during the given time frame.

- North America is poised for significant growth.

Region-wise, the global market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The NA region is expected to account for a considerable market share and is poised for a significant expansion owing to the growing technological adoption and investment in industrial software in major regional economies, namely the United States.

According to the “Industrial Software Market Update” provided by Houlihan Lokey, in September 2023, the LTM (Last Twelve Months) financing activity in industrial software reached US$4.2 billion in the United States. Moreover, the growing business strength, followed by the well-established presence of major market players, provides customized offerings to meet customer requirements. These companies are namely Microsoft Corporation, IBM, Google, and Oracle, and are also acting as an additional driving factor for the regional market growth.

Likewise, Europe and Asia Pacific are projected to grow steadily, fueled by the booming digitization and investment in cloud infrastructure. The South American and MEA regions are poised for positive growth.

Application Development Software Market Restraints:

- High installation costs and technical complexities pose a challenge to market growth.

Application development software, though, enhances the company's overall performance. However, such platforms are based on unique customized architecture, making them more expensive than prepackaged software. Moreover, they might lack compatibility with company operations, making it difficult for data scaling. Hence, such drawbacks can increase the technical complexities while using such platforms and hamper their demand, thereby slowing down their overall market expansion.

Application Development Software Market Key Development:

Application Development Software Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Application Development Software Market Size in 2025 | US$86.593 billion |

| Application Development Software Market Size in 2030 | US$169.677 billion |

| Growth Rate | CAGR of 14.38% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Application Development Software Market |

|

| Customization Scope | Free report customization with purchase |

The Application Development Software Market is segmented and analyzed as follows:

- By Platform

- No Code Development Platform

- Low Code Development Platform

- By Deployment

- Cloud

- On-Premise

- By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprise

- By Application Type

- Mobile Application Development

- Desktop Application Development

- Web and Cloud Application Development

- By End-User

- IT & Telecommunication

- BFSI

- Media and Entertainment

- Government

- Education

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America