Report Overview

Global Almond Market - Highlights

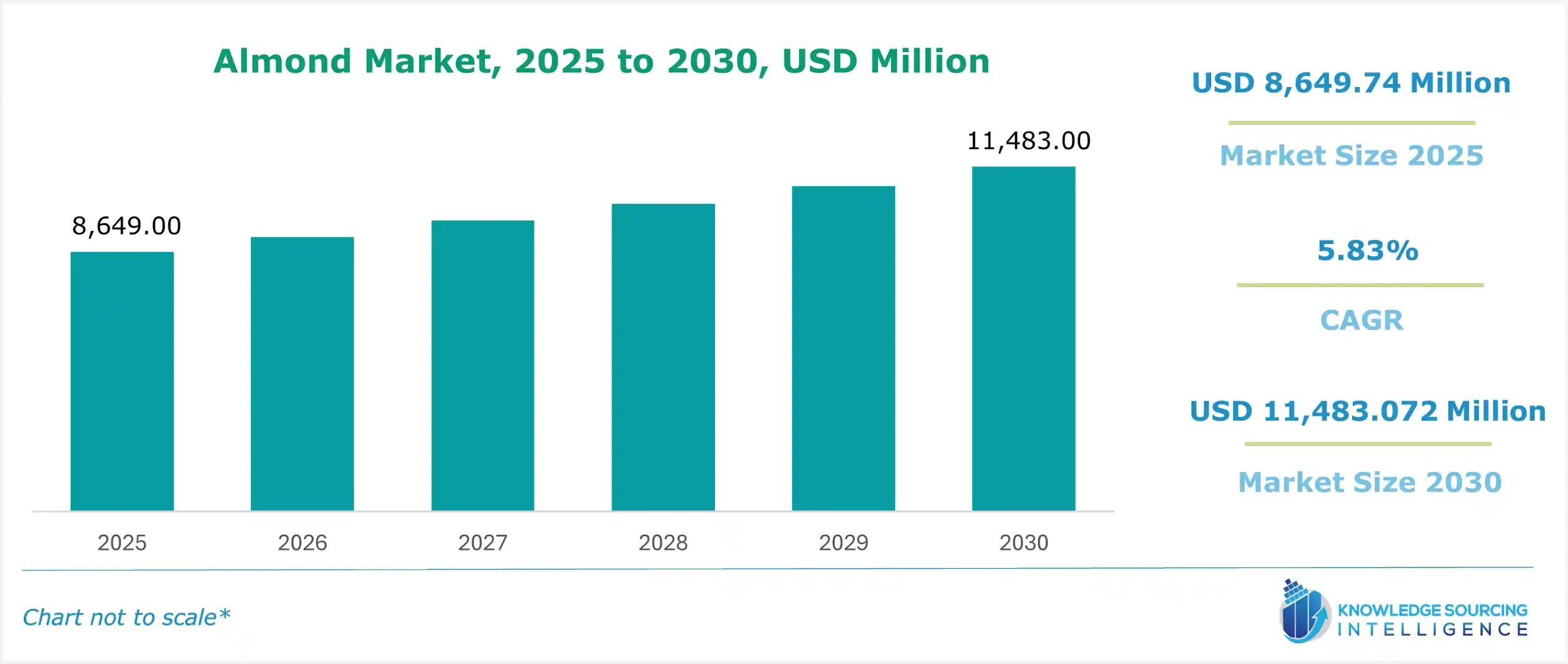

Almond Market Size:

The global almonds market is estimated at US$ 8,649.748 million in 2025 and is expected to grow at a CAGR of 5.83% to attain US$ 11,483.072 million by 2030.

Almonds offer their applications across multiple sectors, especially in the food and beverage and pharmaceutical sectors. In the pharmaceutical sector, the nut is utilized for the treatment of constipation, polyuria, facial paralysis, and leprosy, among others. The increasing global utilization of e-commerce retail is among the major factors pushing the growth of the market during the estimated timeline. With the rise in the utilization of e-commerce platforms, the accessibility of consumers in purchasing high-quality almonds increases.

Almond Market Overview & Scope:

The global almonds market is segmented by:

- Type: The butte almonds category of the type segment is estimated to attain a greater market share, whereas the nonpareil almond category is also expected to grow at a higher rate. Nonpareil almonds remain a favored choice among consumers as well as food manufacturing companies because they possess attractive flavor along with proper form and texture, which consistently drives market demand.

- Nature: Under the nature segment, the organic almonds category is estimated to attain a greater market share, whereas the conventional almonds category is also expected to grow at a higher rate.

- Application: The confectionery categories of the segment are estimated to attain a greater market share, whereas the bakery products category is also expected to grow at a higher rate. The market expands actively through confectionery categories because changing consumer tastes and health patterns have taken effect. Key driving factors are that consumer demand for wholesome snacks keeps rising because people appreciate almonds for their health advantages.

- End-user: The bakery products category of the type segment is estimated to attain a greater market share, whereas the dairy products category is also expected to grow at a higher rate.

- Distribution Channel: The online segment is estimated to attain a greater market share, whereas the offline category is also expected to grow significantly. This trend can be driven by several factors, such as the convenience of online shopping, the variety of applications of almonds, and, most importantly, the convenience of buying almond products on the go.

- Region: North America will hold a significant share during the forecast period. The growing shift towards healthier lifestyle adoption in the region has resulted in a change in customers’ food habits, which has positively impacted the demand for almonds, whose consumption assists in reducing cholesterol, blood pressure, and overall heart health. According to the International Nut & Dried Fruit Council’s Statistical Yearbook 2024, the USA leads almond exports with 67% of the global exports I 2023, equating to 956.362 MT.

Top Trends Shaping the Global Almond Market:

1. Rise in demand for nutrition-rich food products

- The growing demand for nutrition-rich food products in the global market is among the key factors driving the demand for the market. Almonds are a species of nuts that offer multiple benefits to consumers. Almonds help in improving heart health and aid in weight management. The nut also improves bone health and boosts cognitive functions.

2. Growth in the vegan diet

- The increasing global demand for a vegan diet is estimated to propel the growth of the market during the forecasted timeline. Vegan almond milk has grown in popularity in recent years as an increasing number of people around the world have adopted veganism.

Global Almond Market Growth Drivers vs. Challenges:

Opportunities:

- Rising adoption of almond milk: The demand for almond milk in the vegan milk sector has witnessed a major growth. The AgFunderNews of the USA, in its report, stated that in July 2024, the sale of almond milk in the nation reached 1.55 billion in a year. Similarly, the Good Food Institute, in its Germany Plant-based Foods Retail report, stated that in 2023, the sale of almond milk in the nation was recorded at 18%, which increased from 17% in 2022.

- Growing utilization of the e-commerce sector: The rise of e-commerce platforms has made almond products more accessible, offering convenience and a wider selection of almond-based products, including organic and specialty options. This ease of access is crucial for the growth of the B2C segment, which will lead to the expansion of the market of almonds in the coming years. The global good and beverage segment's B2C eCommerce forecast for US$415.9 billion in 2024 is projected to reach a value of US$534.2 billion by 2027, as per the International Trade Administration (ITA).

Challenges:

- Increasing demand for sustainable farming: The growing requirement for sustainable farming concerning environmental impact and its awareness among consumers could hamper the market.

Global Almond Market Regional Analysis:

- North America: The United States is the largest almond producer in the world. Owing to its technological edge, government support, fertile soil, and abundant sunshine, almond production has been growing at a lucrative pace in the country. California is the largest almond-producing state in the US, accounting for 80% of the global demand. As per data published by the Almond Board of California, there are over 7,600 almond farms in the state, of which 70% are 40 hectares or more.

Global Almond Market Competitive Landscape:

The market is fragmented, with many notable players including Atlas Almonds, South Valley Farms, Harris Family Enterprises, Western Nut Company, and BAPU Almonds, among others:

- Expansion: In October 2024, Ohala launched FruitionOne as the first nonpareil almond variety, which permits almond producers to do away with their conventional pollenizer tree operations in production areas. The company finished its USDA Regulatory Status Review process for FruitionOne, while early orders are predicted to come in during late 2026, and deliveries will begin commercially in 2027. A trial installation of Nonpareil almond orchards using FruitionOne almond varieties is currently happening in California.

- New Product: In October 2024, Oppy announced the launch of a new range of almond products, which includes Toasted Almonds & Cherries and Sea Salt Almonds, among others, in partnership with Blue Diamond Growers.

Almond Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Almond Market Size in 2025 | US$660.386 million |

| Almond Market Size in 2030 | US$851.898 million |

| Growth Rate | CAGR of 5.22% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Almond Market |

|

| Customization Scope | Free report customization with purchase |

Almond Market Segmentation:

By Type

- Butte Almonds

- Nonpareil Almond

- Sweet Almond

- Peerless Almond

- Green Almond

- Others

By Nature

- Organic Almonds

- Conventional Almonds

By Application

- Confectioneries

- Bakery Products

- Dairy Products

- Desserts & Sweets

- Breakfast & Cereals

- Others

By End-User

- Bakery Products

- Pharmaceutical Companies

- Dairy Products

- Home Kitchens

- Hotels and Restaurants

By Distribution Channel

- Online

- Offline

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Taiwan

- Thailand

- Others