Report Overview

Artificial Intelligence (AI) In Highlights

Artificial Intelligence (AI) in Transportation Market Size:

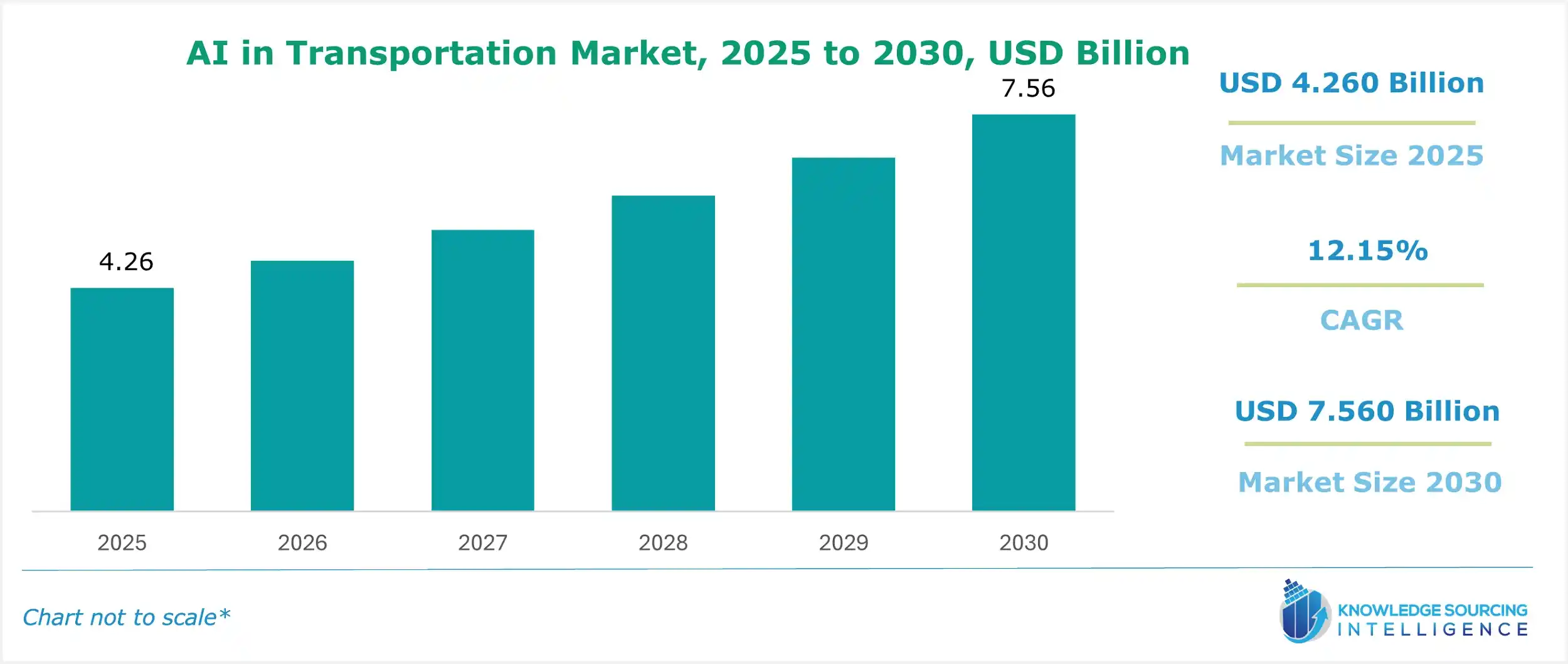

The Artificial Intelligence (AI) in the Transportation Market is expected to grow at a CAGR of 12.15%, reaching a market size of US$7.560 billion in 2030 from US$4.260 billion in 2025.

Artificial Intelligence (AI) in Transportation Market Trends:

The AI in transportation market is rapidly expanding, driven by the integration of artificial intelligence (AI) to enhance efficiency, safety, and sustainability in transportation systems. AI technologies, including computer vision, sensor fusion, machine learning, and deep learning, are pivotal in developing autonomous vehicles. These systems enable real-time analysis of complex traffic environments, ensuring safe navigation and obstacle detection for self-driving cars.

Beyond autonomous driving, AI optimizes traffic management through sensors, cameras, and data monitoring, improving traffic flow in cities and on highways. AI-powered systems analyze data to reduce congestion, lower emissions, and promote alternative fuels, aligning with sustainable transportation goals. For instance, computer vision monitors traffic patterns and airport operations, while machine learning models enhance predictive analytics for efficient traffic control.

AI also bolsters transportation safety by detecting accidents and security risks. Risk management systems leverage AI algorithms to mitigate threats, ensuring safer public transportation and logistics. Optimization algorithms further improve fuel efficiency and support eco-friendly modes, contributing to smart cities and green mobility.

North America leads the market due to technological advancements and government support, while Asia-Pacific, particularly China and Japan, grows rapidly due to urbanization and infrastructure investments. Challenges like data privacy and system integration persist, but AI innovations drive growth. The AI in transportation market thrives on autonomous systems, traffic optimization, and sustainability, reshaping modern mobility.

Artificial Intelligence (AI) in Transportation Market Growth Drivers:

- Rising Mobility-as-a-Service (MaaS) is contributing to AI in the transportation market

MaaS was developed to provide transport services on one platform and a unified solution that can create leverage for AI adoption. In MaaS systems, AI algorithms are applied to optimize routes, predict demand, and thus provide individual travel experiences. Of the various products in the market, the Hitachi Predictive Maintenance for Fleet Operations, powered by Google Cloud, brings together IoT data, RCM methodologies, and AI technology that optimize fleet maintenance efficiency and asset dependability. This is done through augmented reality, machine learning algorithms, and external data, allowing for real-time inspections and repairs of mission-critical fleet assets.

Overall, the advent of Mobility-as-a-Service is what boosts AI technologies in the transportation market, opening doors for commuting and travel to more efficient, convenient, and sustainable mobility solutions.

- Growing consumer demand for convenience is contributing to AI in the transportation market.

The progress of artificial intelligence technologies, coupled with machine learning tools, particularly deep learning. Riding around towns and other places on demand through ride-sharing, or ride-hailing, continues to attract thousands of consumers because this kind of service is very convenient and efficient. In each of these, AI is integrated and used to improve the ride-matching algorithm, optimizing routes, and enhancing user experience. SWIFT is a technology representing one of the most significant differences between traditional and smart organizations. It provides full control of all logistical operations on one platform, as well as flexibility, integration, and comprehensive reporting and analytics.

Convenient driving among consumers in the adoption of AI technologies for transportation usage has therefore increased. Generally, it can thus be observed that the growth in customer demand for convenience is mainly driving this adoption of the use of AI technologies for transportation, thereby making travel experiences more efficient, personal, and convenient for commuters and travelers.

- Rising use of cloud and on-premise services

Transportation stakeholders can access AI capabilities remotely through cloud-based deployment. It provides scalability, flexibility, and cost-effectiveness without the need for upfront infrastructure expenditures, enabling data analysis and novel solutions.

Transportation organizations use on-premises deployment to get better control over data and system configurations. Still, it requires a significant upfront investment in hardware, software, and knowledge.

Transportation organizations may tailor AI deployment models to suit individual requirements, resource restrictions, and strategic goals. Working with the right model, the stakeholders will then be able to maximize fully the benefits of AI across road, rail, air, and marine modes of transportation by enhancing safety, efficiency, and sustainability.

Artificial Intelligence (AI) in Transportation Market Restraints:

- Data privacy and security concerns hamper the market growth

The high volumes of transported data collected, stored, and analyzed raise privacy and security concerns. Breaking or breaching sensitive personal information can damage the trust of customers and hinder the adoption of AI-powered mobility technology.

Artificial Intelligence (AI) in Transportation Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

North American transportation firms, government organizations, and communities were among the first to employ AI technology to improve transportation networks' efficiency, safety, and sustainability. This early adoption has driven the area to the top of AI in the transportation industry.

Overall, North America's leadership in AI technology, together with its supporting ecosystem, strong industrial presence, and early adoption of AI in transportation, establishes it as a prominent participant in the worldwide market.

Artificial Intelligence (AI) in Transportation Market Recent Developments:

- November 2025: Tesla Plans Mega AI Chip Fab with Potential Intel Partnership. Elon Musk announced plans for Tesla's fifth-generation AI chip fabrication facility to power autonomous driving ambitions, exploring a potential partnership with Intel to accelerate production and integration in electric vehicles.

- October 31, 2025: Nissan Expands AI Collaboration with Monolith to Reduce Car Development Time. Nissan and Monolith AI extended their partnership to leverage AI for shortening vehicle development cycles, focusing on predictive modeling for autonomous features and enhanced safety systems in transportation.

- October 30, 2025: C.H. Robinson Achieves Record High Shares with AI-Driven Freight Gains. C.H. Robinson's stock hit a record high despite a freight market slump, attributed to AI automation in shipping quote generation and route optimization, improving logistics efficiency amid industry challenges.

- January 2024, the U.S. Department of Transportation created a $15 million Complete Streets Artificial Intelligence Initiative for Small Businesses. It held the promise of AI breakthroughs in the services of American small businesses to improve transportation systems. They will help decide, design, and implement complete streets.

List of Top Artificial Intelligence (AI) in Transportation Companies:

- Hitachi

- Wialon (Gurtam)

- AltexSoft

- Planung Transport Verkehr GmbH

- Integrated Roadways

Artificial Intelligence (AI) in Transportation Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Transportation Market Size in 2025 | US$4.260 billion |

| AI in Transportation Market Size in 2030 | US$7.560 billion |

| Growth Rate | CAGR of 12.15% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in Transportation Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in Transportation Market Segmentation:

- By Technology

- Deep Learning

- Natural learning process

- Machine Learning

- Others

- By Deployment

- Cloud

- On-Premise

- By Application

- Route optimization

- Shipping volume prediction

- Predictive Fleet Maintenance

- Real-time Vehicle tracking

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America