Report Overview

Artificial Intelligence (AI) in Highlights

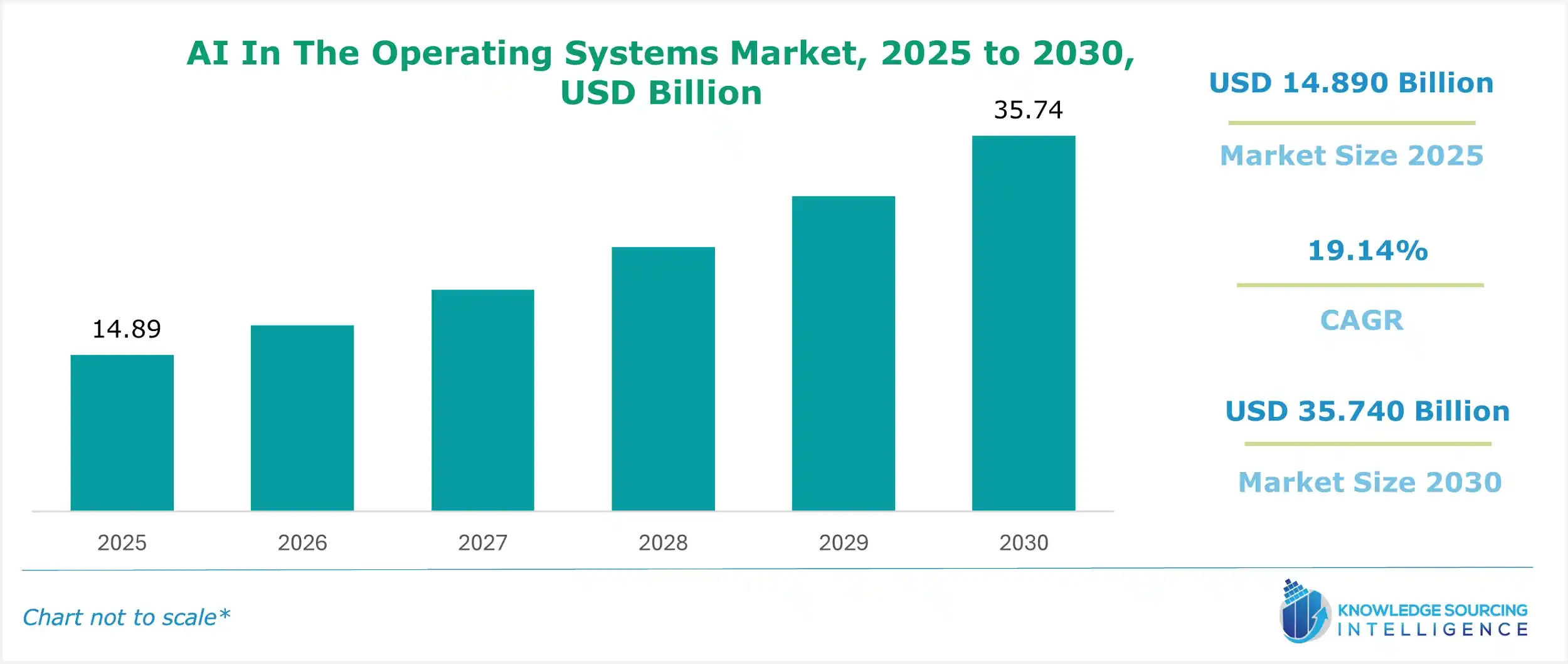

Artificial Intelligence (AI) in Operating Systems Market Size:

Artificial Intelligence (AI) in Operating Systems Market is estimated to attain US$35.740 billion by 2030, from US$14.890 billion in 2025, growing at a CAGR of 19.14%.

An operating system (OS) is a set of computer programs that manage and run other programs necessary for the computer after being installed or loaded into the computer. It offers multiple features to users, as it helps in the manipulation of file systems, the allocation of resources, and file management.

Integrating AI technologies in the OS ecosystems helps create a deeper algorithm and machine learning of the computer. It also allows the operating systems to analyze and understand the users' patterns and behavior, improving the program's experience.

The AI technologies embedded in the operating systems offer multiple key benefits to the users, as they help in self-correcting any programming errors that can occur in the background. It can also self-optimize and auto-scale a series of tasks, which generally take longer manually. The integration of AI in OS programs also helps to provide a localized or personalized user experience and improves the safety of computing devices.

The artificial intelligence in the operating system market is expected to witness growth during the forecast period. The introduction of AI in this industry aims to provide a more personalized and efficient user experience. AI algorithms and programs constantly evaluate the users' patterns, behaviors, and preferences, which can be further used to tailor multiple functions such as news feeds, app suggestions, and alert settings.

A key factor that is expected to drive AI in the OS market is the increasing investments in AI technologies and their capability. Various companies and public organizations introduced multiple investment plans for the development of AI-based technologies. Countries like India, Japan, the USA, and the UK have also introduced key policies and schemes to boost the development of AI technologies in their respective nation.

Artificial Intelligence (AI) in Operating Systems Market Growth Drivers:

- Increasing investment in the AI sector.

Huge investments from venture capitalists and technological giants are driving innovation and development in the field of Artificial Intelligence, owing to which AI operating systems are becoming more widely used in fields other than traditional computing. For instance, Google invested in its AI company, DeepMind, in 2021, emphasizing the creation of AI capabilities across several platforms, including potentially its operating systems (such as Android). In 2021, the company acquired Nuance Communications, which enabled it to access AI-powered speech recognition and language processing capabilities that could be used in its Windows OS. Alexa AI chatbot by Amazon that conducts conversations is linked to a number of Amazon services and products.

- Increased demand for the user dashboard interface

Users want a customized experience from the technologies they use in today's digital world. Operating systems with AI capabilities can recognize each user's unique preferences and routines, customize the interface, recommend suitable apps, and initiate activities automatically in response to user activity. This level of customization has the potential to greatly improve user experience.

For instance, Spotify uses AI to tailor the music experience by analyzing the listening patterns to personalize the interface, recommend relevant music, and even automate playlists for workouts or commutes. Features like "Discover Weekly" provide discoveries based on user preferences, making music exploration easy and entertaining.

Artificial Intelligence (AI) in Operating Systems Market Restraints:

- Technical complications hinder the AI-powered operating system market

Operating systems can be challenging, but developing reliable, efficient, and secure AI models requires significant resources and expertise. Additionally, it can be difficult to balance the power-hungry nature of AI with the battery-saving mode on various devices, such as laptops and phones. In other words, achieving both energy efficiency and powerful AI capabilities is a difficult task.

Artificial Intelligence (AI) in Operating Systems Market Geographical Outlook:

- North America is forecasted to hold a major market share

The North American region is forecasted to witness greater growth in the global AI in the operating systems market, as the region is among the biggest developers and adopters of new technologies like AI across multiple industries.

Countries like the USA and Canada are also home to some of the biggest technological companies, like Apple, Microsoft, BEA Systems, and Google, which have invested huge resources in developing new technologies.

Furthermore, North America is also among the biggest developers of operating systems programs, with Microsoft, Apple, and Android (Google) based in the USA. The governments of the regional countries also introduced multiple policies and investment schemes to encourage the development of AI-based technology. According to the Artificial Intelligence and the Future of Teaching and Learning report, the national AI initiative by the US Government is focused on advancing learning and education outcomes, and long-term investments in ethical and basic AI research. This initiative further helps in encouraging the ethical advancement of AI technology.

Major Players and Products in Artificial Intelligence (AI) in Operating Systems Market:

- Microsoft Corporation is among the biggest operating system developers based in America. The company offers a wide range of products and services, which are aimed at multiple industries. The company offers software solutions, PCs & devices, entertainment products, and other IT and education solutions. The company provides the Windows Operating System, one of the most common PC-based operating systems available globally. This OS features multiple features, like enhanced security, AI, and improved connectivity.

- Apple Inc. is among the leading technological corporations that offer a wide range of products and services globally. The company offers smartphones, wearable products, tablets, PCs, and other home-based technological devices. In September 2024, the company launched its new solution, Apple Intelligence, which is the version of its own AI program. The company offers iOS 18 and iPadOS 18, the operating system for its smartphones and tablet devices, which include AI features. The company also offers macOS Sequoia, the PC/laptop-based operating system, which integrates AI into its key functions.

Artificial Intelligence (AI) in Operating Systems Market Key launches:

- November 2025: Microsoft Releases Windows 11 November 2025 Update with AI Enhancements. Microsoft rolled out the Windows 11 November 2025 update, introducing AI-powered file actions for smarter organization, a redesigned Start menu with predictive suggestions, and enhanced widgets using machine learning for personalized content curation.

- October 2025: Apple Unveils M5 Chip for Advanced AI in macOS and iOS. Apple launched the M5 chip, featuring a 40% performance boost for on-device AI tasks, enabling more seamless integration of Apple Intelligence features like real-time voice assistance and predictive app behaviors across macOS and iOS ecosystems.

- October 2025: Google Announces AI Updates for Android, Including Gemini Enhancements. Google revealed October AI advancements for Android, including Gemini for Home with contextual device management and AI Studio's vibe coding for easier OS-level AI app development, improving personalization and automation in the Android operating system.

List of Top Artificial Intelligence (AI) in Operating Systems Companies:

- Microsoft

- Apple

- Blackswan Technologies

- Android Inc. (Google)

- Humane

Artificial Intelligence (AI) in Operating Systems Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI in The Operating Systems Market Size in 2025 |

US$14.890 billion |

|

AI in The Operating Systems Market Size in 2030 |

US$35.740 billion |

| Growth Rate | CAGR of 19.14% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI in The Operating Systems Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in Operating Systems Market Segmentation:

- By Devices

- Handheld devices

- Laptops and PCs

- Smart Appliances

- Others

- By Application

- Voice Assistance

- Personalization tools

- Software

- Applications

- Others

- By Geography

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America