Report Overview

Artificial Intelligence (AI) In Highlights

AI in Medical Billing Market Size:

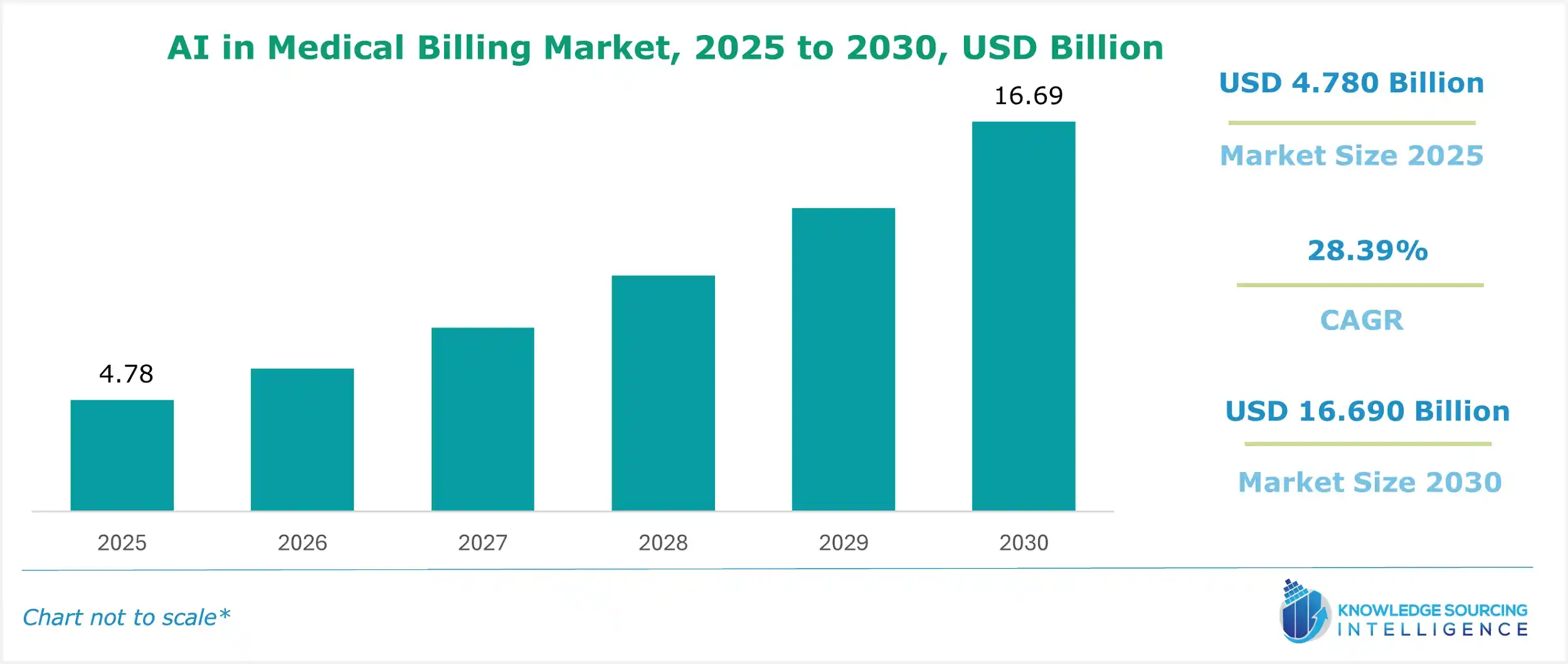

Artificial Intelligence (AI) in Medical Billing Market is expected to grow at a CAGR of 28.39%, reaching a market size of US$16.690 billion in 2030 from US$4.780 billion in 2025.

Medical billing is one of the key components of the revenue cycle of health care because of its complex systems and coding styles, as well as the submission of various bills. Given that tedious manual chores are being abolished, precision enhanced, and costs reduced, the sector is expected to embrace such technologies. Medical billing has undergone changes, including analyzing medical data by AI and, where appropriate, searching for the right medical coding before making the billings and following up on the claims once submitted to ensure effectiveness.

The market for AI in medical billing is propelled by the increasing demand for simplicity in operations, cost containment, and better revenue management. Considering the changes in the entire healthcare sector, healthcare providers are searching for newer solutions to enhance their efficiency and profitability. It can be expected that artificial intelligence will completely transform the medical billing landscape.

AI in Medical Billing Market Growth Drivers:

- Increasing adoption of Electronic Health Records (EHRs) boosts AI in the medical billing market.

The increasing adoption of electronic health records (EHR) accelerates the prevalence of artificial intelligence in the medical billing sector. EHR stores patients' health records in a computer to enable easy management, storage, access, and even sharing of health records among health providers. As EHRs have comprehensive and up-to-date patient information, algorithms can also use patient data to retrieve the correct billing codes and submit processed claims. Joining AI with EHR systems eases the processes of filing claims as it reduces errors and cuts down on management burdens. Since most healthcare providers worldwide are increasingly embracing an electronic form of maintaining patient records, the scope of AI-enhanced medical billing systems increases, propelling market growth.

- Demand for streamlined healthcare operations enhances AI in the medical billing market growth

The need for optimized healthcare processes is a key driver of AI in the medical billing industry’s expansion. Increasing volumes of patients and complicated billing systems necessitate the need for effective measures in the management of healthcare institutions. Medical billing solutions based on AI can eliminate labor-intensive processes such as claim processing and billing submission and improve revenue cycle management. By adopting AI, health care slashes down the costs associated with billing, improving billing processes and the system's general efficiency. This desire for faster procedures encourages the use of AI solutions in medical billing, moving the industry forward.

- Automation of manual billing processes is boosting AI in the medical billing market expansion.

In the AI in the medical billing industry, automation of manual billing procedures is a critical growth element. Traditional billing operations, including claim production, billing, and submission, can be time-consuming and error-prone. AI-powered automation automates these operations by utilizing powerful algorithms to extract key information from medical data, assign appropriate billing codes, and manage claim submissions. AI billing aims to shorten the billing process, improve quality, and reduce the manpower needed to engage them in more crucial activities by lowering manual work. This level of automation is productive and cuts costs, and thus, reimbursements are done faster, explaining the need for AI in medical billing.

AI in Medical Billing Market Restraints:

- Rising security concerns are anticipated to impede market growth

Healthcare systems have incorporated the use of AI in medical billing, which is an improvement. However, issues in the market, such as privacy and confidentiality, still hinder the large-scale adoption of these solutions.. Therefore, AI-based systems that use that data must have very stringent policies, such as HIPAA, to prevent data misuse and establish high levels of security. The dangers posed by breaches of systems and loss of data are quite real. As such, any security system for a healthcare facility must be water-tight, as any slight deviation will likely have dire economic and legal consequences for the healthcare service provider. There is also the issue of a patient’s data being exposed, which is damaging and entirely unfavorable to the organization.

AI in Medical Billing Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

North America makes large R&D investments, especially in the fields of AI and healthcare. This investment supports the growth of AI applications and innovation in several medical domains, including medical billing. Significant funding is available in the area for new businesses and technology startups. The expansion of AI startups that focus on healthcare, including medical billing solutions, is aided by this financial support. On AI projects, startups, technology companies, and healthcare facilities in North America frequently work together. These partnerships encourage the creation of innovative approaches to medical billing.

AI in Medical Billing Market Key Developments:

- November 2025: Jorie AI Showcases Advanced Automation Platform at HLTH 2025. Jorie AI revealed a trademarked “SmartCore Engine” at the HLTH 2025 conference in Las Vegas, positioning its automation solution for healthcare revenue-cycle management; the company’s site confirms the launch and conference timing.

- June 2025: Commure Introduces “Commure Agents” AI Assistants with Full EHR Integration for Revenue Cycle & Workflow Automation. Commure formally launched its suite of AI-agents designed to integrate directly with EHR systems and automate complex tasks, including billing workflows, prior authorizations, claims processing, and denial management.

- April 2025: Cedar Launches “Kora” AI Voice Agent for Patient Billing Calls. Cedar announced the launch of Kora, an AI-voice agent developed in collaboration with Twilio and trained on Cedar’s proprietary healthcare billing data, to automate patient billing inquiries, improve first-contact resolution, and reduce call-center volume.

- June 2024: Claimocity presented its game-changing AI-powered Charge Capture product, solidifying its position as the leading platform for billing software and revenue cycle management services for inpatient providers. This cutting-edge platform uses AI to dramatically reduce administrative burden (by 85%) and increase revenue (by 6% or more) by streamlining the billing process for acute, facility-based providers.

List of Top AI in Medical Billing Companies:

- Waystar

- Nextgen Healthcare, Inc.

- Cerner Corporation

- Mckesson Corporation

- Epic Systems Corporation

AI in Medical Billing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Medical Billing Market Size in 2025 | US$4.780 billion |

| AI in Medical Billing Market Size in 2030 | US$16.690 billion |

| Growth Rate | CAGR of 28.39% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in Medical Billing Market |

|

| Customization Scope | Free report customization with purchase |

AI in Medical Billing Market Segmentation:

- By Deployment Mode

- Cloud-Based

- On-Premise

- By Application

- Automated Billing and Documentation

- Revenue Cycle Management

- Claims Processing

- Denial Management

- Fraud Detection

- Others

- By End-User

- Hospitals And Clinics

- Healthcare Payers

- Ambulatory Surgical Centers

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America