Report Overview

Artificial Intelligence (AI) In Highlights

Artificial Intelligence (AI) In Geriatric Robotics Market Size:

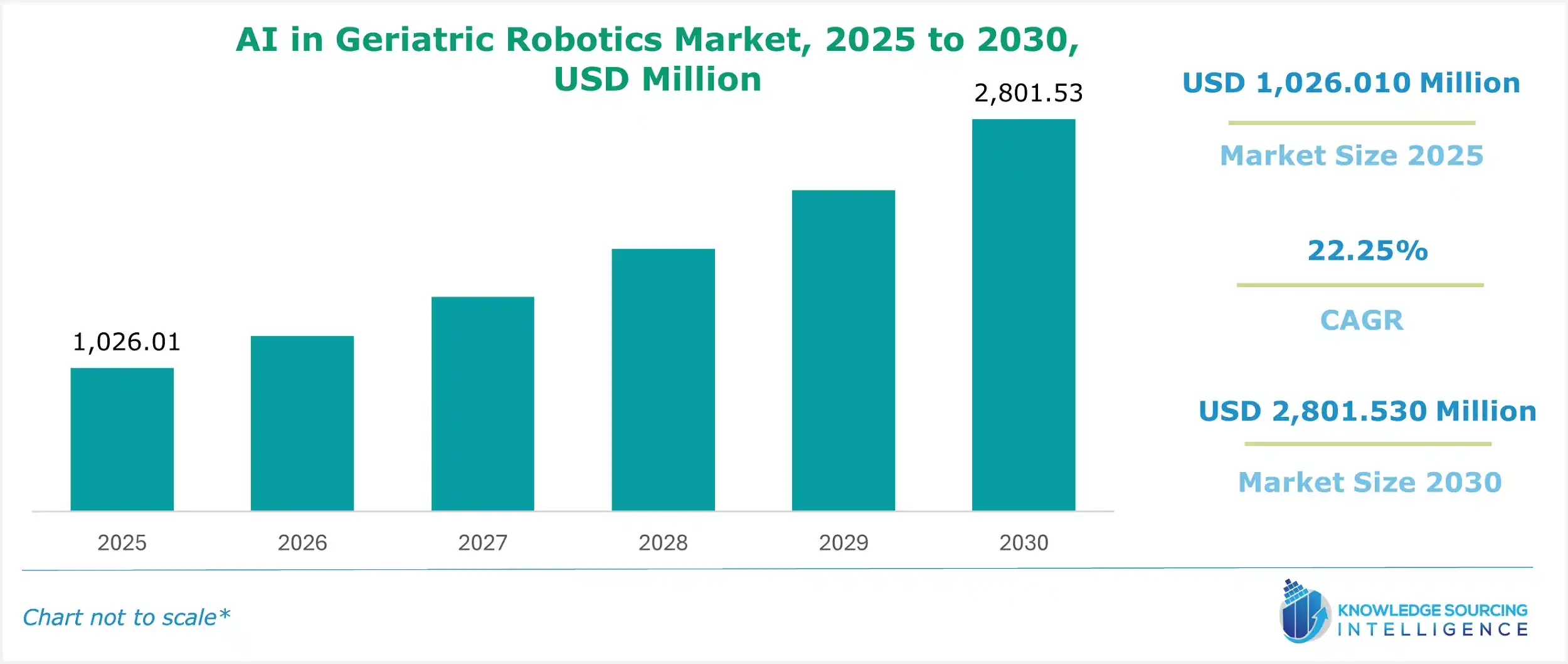

Artificial Intelligence (AI) In The Geriatric Robotics Market is expected to grow at a CAGR of 22.25%, reaching a market size of US$2,801.530 million in 2030 from US$1,026.010 million in 2025.

The progress in Artificial Intelligence (AI) for geriatric robotics marks a milestone in providing comprehensive elderly care because it incorporates cognitive capabilities in machines to solve the problems brought about by the increase in the aging population. The continuous global orientation on older populations compels the need to enhance the mobility, well-being, and independence of elderly patients in new ways. These AI-powered geriatric robots, however, are more advanced than just companionship or social interaction and can help with everything from the performance of the activities of daily living to health care and monitoring activities. Hence, these machines are equipped with enhanced intelligent systems that allow them to provide specific and customized care to individual patients, thus increasing senior citizens' overall quality of life. AI in the geriatric robotics market is very promising since it can transform geriatric care, facilitate aging in place, and ease the burden on caregivers and the healthcare infrastructure.

Artificial Intelligence (AI) in Geriatric Robotics Market Growth Drivers:

- Integration of robotics in healthcare settings enhances AI in the geriatric robotics market.

Robotics integration in healthcare settings has improved both patient care and operational efficiency. The improved capabilities of robotics allow for accurate and repeated activities, decreasing human error and expediting medical processes. Surgical methods using robotic technologies allow a surgeon to perform with higher precision and less invasive techniques, leading to less time for recovery and better patient outcomes. In the context of aging populations, these robots significantly impact performing routine tasks, providing maintenance, and encouraging independence. Furthermore, these robots in health systems alleviate the workload of healthcare workers, allowing them to concentrate on more complicated and crucial patient care components. As advancements in robotics are still being reported, so is the use of the technology in various healthcare settings, enhancing healthcare provision and patient satisfaction.

- The growing adoption of AI-powered assistive devices is boosting AI in the geriatric robotics market.

In the modern world, the wave of assistive devices powered by AI has solved the problem of how impaired and old people seek help and regain their independence. The deployed assistive technologies built on AI offer unique and flexible options that meet specific needs and settings. AI creates more network possibilities with any system, from home devices that assist in performing regular chores to health and safety wearables. These technologies increase individuals' independence, reducing the level of care needed by professionals. As the improvement of AI algorithms enhances the precision and speed of these devices, they become essential for people with mobility impairments, sensory, or cognitive challenges. The expanding use of assistive technologies and devices driven by AI technology promotes inclusiveness and enhances individuals' living standards worldwide.

- Collaborations between geriatric robotics companies and healthcare institutions boost AI in the geriatric robotics market.

Strategic partnerships between geriatric robotics companies and healthcare facilities have become a key factor in propelling AI in the geriatric robotics market. These collaborations make integrating cutting-edge robotic technology into healthcare settings easier, allowing for real-world testing, feedback, and validation. Access to cutting-edge robotics benefits healthcare organizations by improving patient care and operational efficiency. On the other hand, geriatric robotics companies gain important insights into the unique needs and problems faced by elderly patients, which enables them to create more successful and customized solutions. Partnerships facilitate faster, more efficient creation and market entry of assistive technologies powered by AI that are available to meet the shifting requirements of the elderly consumer and alter old-age care.

- Supportive government policies and initiatives are increasing the AI in the geriatric market size

The motivation and regulation imposed by the state aimed at fast-tracking the geriatric robots industry’s expansion have been useful. It is a known fact that all governments are keen on improving technological advancements in aged care and enhancing independent living for the elderly. Governments contribute to R&D in geriatric robotics by funding, providing grants, and facilitating regulation, leading to product innovation and market growth. In addition, policy structures provide for implementing AI-based assistive devices in the healthcare sector, making it even more accessible for the older population. Additionally, government initiatives support the application of AI in geriatric care to address challenges brought on by an aging population, such as the shortage of caregivers and rising healthcare costs.

Artificial Intelligence (AI) in Geriatric Robotics Market Restraints:

- High costs and human resistance are anticipated to impede market growth

Cost may be a major obstacle. Even with a decline in cost over the past ten years, these assistive robots still require a sizable investment, often thousands of dollars. Even if middle-class or lower-class families want to include eldercare assistive robots in their care routines, they may be unable to afford them due to the pricing structure.

Moreover, human resistance may also be a cause for concern. The concept of a robot working as a caregiver can create feelings of worry for an older adult, their family, or both. As a result, this risk factor may hinder the acceptance and marketability of eldercare robots during the predicted years.

Artificial Intelligence (AI) in Geriatric Robotics Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

North America leads the world in terms of AI in the geriatric robotics market. The region's leadership can be attributed to several factors, including a developed healthcare system, an aging population, and significant investments in cutting-edge technologies like artificial intelligence and robots. Numerous notable companies and research institutions in North America are developing AI-powered geriatric robotics solutions, propelling product innovation and market expansion. The region's prominence in the AI in geriatric robotics market has also been aided by rising awareness of the potential advantages of AI-driven robots in aged care and a growing demand for efficient and customized senior care.

Artificial Intelligence (AI) in Geriatric Robotics Market Key Launches:

- September 2025: Kanematsu Corporation Invests in Intuition Robotics for Japanese Expansion of ElliQ. Kanematsu Corporation and Intuition Robotics announced a strategic partnership and investment directing the Japanese market rollout of the ElliQ senior-care robot.

- August 2025: “Hyodol” AI Companion Robot Deployment Expands Among Elderly in South Korea. A report from Rest of World (27 Aug 2025) described how South Korea has distributed over 12,000 Hyodol AI-companion robots to older adults living alone, providing emotional support and acting as a digital “eyes & ears” for caregivers.

- May 2025: MIT Researchers Unveil Eldercare Robot That Helps Individuals Sit, Stand, and Catches Falls. A team at Massachusetts Institute of Technology (MIT) presented a new elder-care robot prototype capable of assisting seniors with sit-to-stand transitions and detecting falls, supporting independent living.

List of Top AI In Geriatric Robotics Companies:

- Softbank Robotics Group Corp. (Pepper Robot)

- Pal Robotics S.L. (Tiago Robot)

- Robot Care Systems B.V. (Lea Robot)

- Intuition Robotics Ltd. (Elliq Robot)

- Paro Robots Us, Inc. (Paro Robot)

Artificial Intelligence (AI) In Geriatric Robotics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Geriatric Robotics Market Size in 2025 | US$1,026.010 million |

| AI in Geriatric Robotics Market Size in 2030 | US$2,801.530 million |

| Growth Rate | CAGR of 22.25% |

| Study Period | 2020 to 2030 |

| Historical Data | 2019 to 2022 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in Geriatric Robotics Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) In Geriatric Robotics Market Segmentation:

- By Technology

- Machine Learning

- Deep Learning

- Natural Language Processing (NLP)

- Computer Vision

- Others

- By Robot Type

- Assistive Robots

- Companion Robots

- Socially Assistive Robots

- Telepresence Robots

- Others

- By Application

- Healthcare And Medical Assistance

- Social And Emotional Support

- Monitoring And Safety

- Rehabilitation And Physical Therapy

- Others

- By End-User

- Nursing Homes And Assisted Living Facilities

- Hospitals And Clinics

- Home Care Settings

- Research Institutes

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America