Report Overview

AI Image Generator Market Highlights

AI Image Generator Market Size:

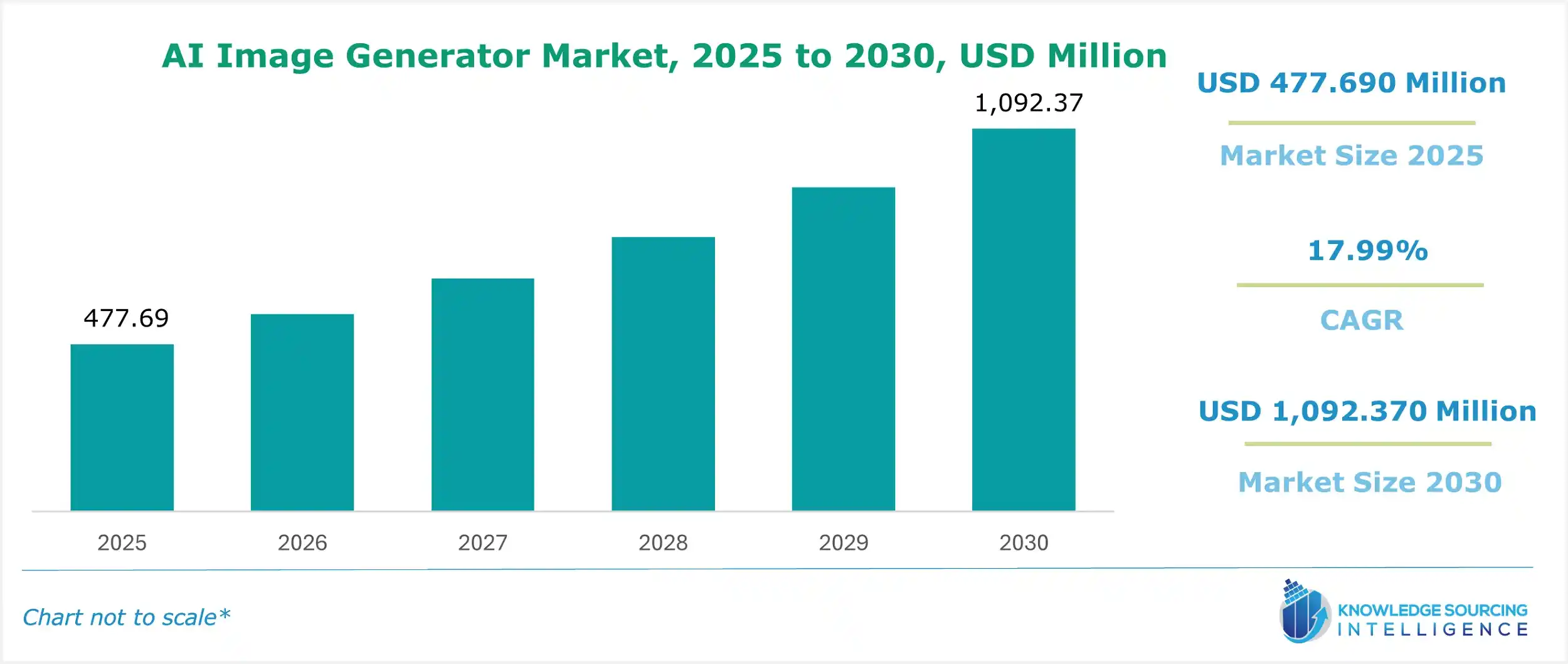

The AI Image Generator Market is expected to grow at a CAGR of 17.99%, reaching a market size of US$1,092.370 million in 2030 from US$477.690 million in 2025.

AI Image Generator Market Key Highlights:

- Deep Learning Advancements: GANs and VAEs enhance high-quality, realistic image generation.

- Visual Content Demand: Digital marketing and e-commerce drive AI image generator adoption.

- Entertainment Applications: AI creates visuals for films, games, and social media campaigns.

- North American Leadership: Tech giants and innovation hubs fuel market growth.

An AI picture creation tool comes under the category of generative models and is also known as an AI image generator. It is an artificial intelligence program designed to create realistic images based on input, either taken completely from scratch or off existing data. This all-over deep learning process includes the use of generative adversarial networks (GANS) and Variational autoencoders (VAES). These images, developed from figures, are an almost perfect representation of real photos or art forms.

AI Image Generator Market Trends:

AI image generators have applications in a variety of sectors, such as art and design, entertainment and gaming, fashion and e-commerce, and energy and healthcare imaging, among others. They produce images of real people of different age groups and places, and even create special effects that render the creative process effortless. In medical imaging, they generate synthetic medical images to complement training data and simulate medical situations. This enables academics and clinicians to develop and test AI algorithms for medical imaging interpretation, diagnosis, and therapy planning.

AI Image Generator Market Growth Drivers:

- Advancements in deep learning fuel the AI Image Generator Market growth

Deep learning approaches, particularly generative models such as GANs and VAEs, have considerably enhanced the capabilities of AI picture generators, resulting in superior image quality, resolution, and variety in created images. GANs provide realistic, high-resolution images, but CNNs generate lifelike images with detailed features and textures. These models can learn complicated patterns from big datasets and capture several visual features, making them valuable in various fields. Conditional GANs and style transfer let users influence the image production process depending on particular input factors, resulting in more personalized visuals.

Moreover, these innovations have enhanced the capabilities and applications of AI image generators in many industries, facilitating their market growth and driving research and development in computer vision and image synthesis.

- Increasing Demand for Visual Content boosts the AI Image Generator Market growth

The proliferation of digital marketing, social networking, online shopping, and other entertainment and activities has increased the demand for quality images. Through AI image generation, businesses and content providers can readily fabricate pictures, graphics, and artworks that the audience finds fitting and interactive.

Adobe FireFly employs generative AI together with straightforward text prompts to generate quality outputs such as visually appealing graphics, text styles, and unique colour schemes. It can create entirely new material from reference pictures and explore more possibilities much faster. Some of its features include text-to-image, generative fill, 3D to picture, and many others.

- Increasing use in the entertainment industry is propelling market growth

AI image generators are essential in the entertainment business, allowing for the generation of visual effects, character designs, scene backgrounds, and game components for movies, television, and animation. They also help artists create digital artwork, sketches, and creative ideas. Moreover, they find their application in the domains of internet marketing, advertisement in printed or non-printed forms, generation of online content, celebrity endorsement, and promotion of an individual. They help in creating eye-catching visuals for managing photos on social networks and for advertising and marketing activities on services such as Instagram, Facebook, Twitter, etc. This segmentation allows for targeted marketing, product development, and customization to maximize the value and utility of AI image generators in various application domains.

AI Image Generator Market Restraints:

- Quality and Authenticity concerns are hampering the market growth

The authenticity of AI picture production is sometimes missing, particularly in situations where realism is critical. Addressing these challenges necessitates continual research and development efforts to increase produced pictures' realism, fidelity, and variety. Advancements in AI algorithms, data augmentation techniques, picture synthesis methodologies, and user feedback systems may all help to improve the quality and authenticity of AI-generated content.

AI Image Generator Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

North America indeed holds a significant share of the AI image generator market. Giant AI research centers, leading tech firms, and a plethora of start-up companies are all located within the confines of Silicon Valley. This concentration of talent and resources facilitates the technological improvement geared towards artificial intelligence image creation, increasing the industry's growth rate. Companies such as Google, Microsoft, Facebook, and Adobe, major players in the technology sector, have also invested lots of resources and efforts in AI development. They are offering image-capturing applications through dedicated applications, clouds, and other tools.

The use of AI technology is rather common among North American industrial and commercial companies and organizations, incorporating AI in marketing, content development, and customer engagement practices. The strong digital structure in the region and a population that is receptive to technology creates a favorable environment for adopting artificial intelligence in every sector of the economy. With several IT giants around and a vast population that embraces AI technology, North America is one of the active players in using AI image generation technology. The strong share of the market due to the overall media and entertainment industry, investment-ready nature, and the pro-innovation policy helps in ensuring growth and creativity in the future.

AI Image Generator Market Key Launches:

- In October 2024, a new synthetic text generator was introduced by MOSTLY AI, a provider of synthetic data solutions, to help businesses with their biggest AI training problems. While addressing data concerns, this cutting-edge platform enables businesses to gain more insights from their proprietary datasets. Businesses can safely use the synthetic text generator to train and optimize their large language models (LLMs) by accessing their proprietary data from chatbot conversations, emails, and customer service transcripts. The platform can incorporate proprietary data while ensuring diversity gaps and personally identifiable information (PII) are avoided.

- In October 2023, Adobe gave a notice regarding Adobe MAX 2023, the largest global creative conference known globally, which took place in Los Angeles over three days. The congress focused on how it is possible to develop creativity and business content distribution through AI technologies. Adobe also held a meeting for financial professionals and investors.

List of Top AI Image Generator Companies:

- Adobe

- OpenAI

- Crayon LLC

- jasper.ai

- Dream Studio

AI Image Generator Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI Image Generator Market Size in 2025 |

US$477.690 million |

|

AI Image Generator Market Size in 2030 |

US$1,092.370 million |

| Growth Rate | CAGR of 17.99% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in the AI Image Generator Market |

|

| Customization Scope | Free report customization with purchase |

The AI image generator market is analyzed into the following segments:

- By End Users

- Individuals

- Industry/Professional

- By Application

- Entertainment

- Marketing and Advertising

- Arts and Design

- E-commerce

- Others

- By Solution

- Software

- Services

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America