Report Overview

AI in Customer Service Highlights

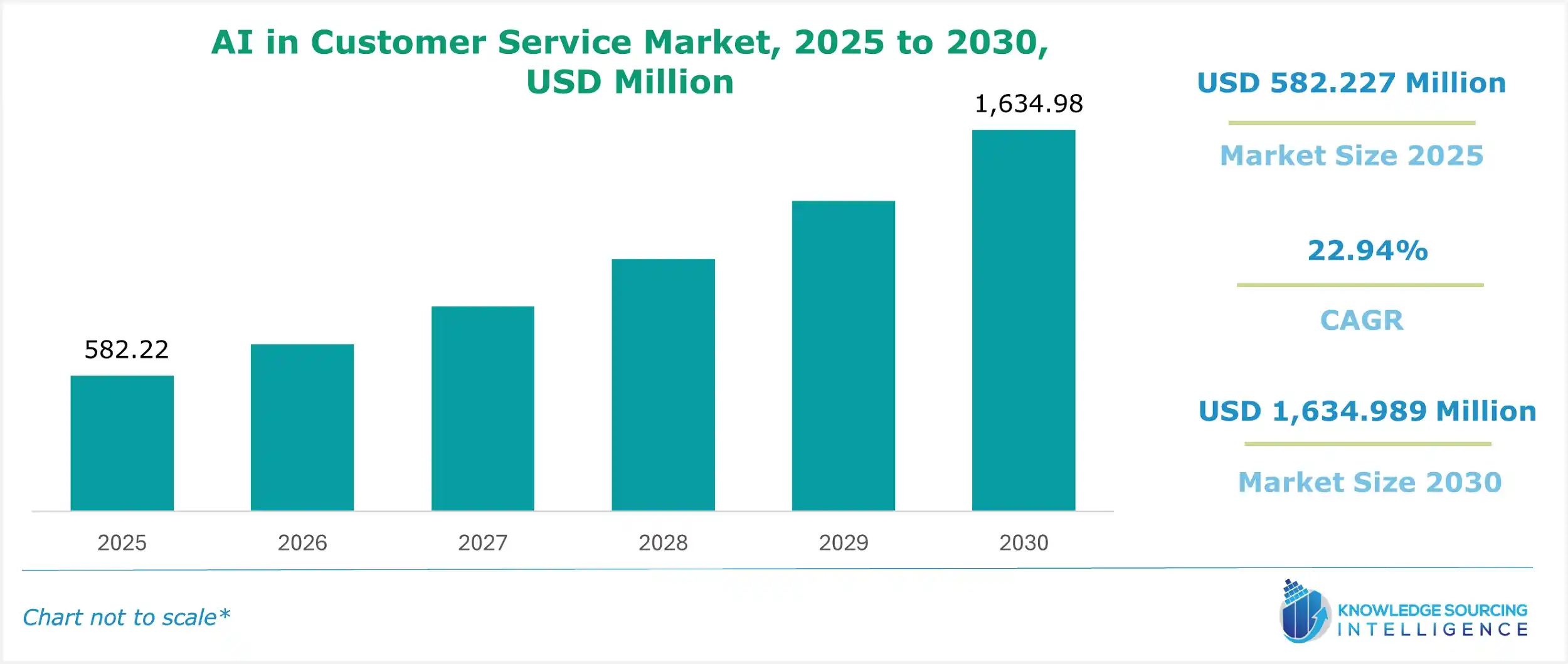

AI in Customer Service Market Size:

The AI in the customer service market is estimated to attain a market size of US$1,634.989 million by 2030, growing at a 22.94% CAGR from a valuation of US$582.227 million in 2025.

AI in Customer Service Market Introduction:

The AI in customer service market is experiencing rapid growth, driven by the increasing adoption of artificial intelligence (AI) technologies like machine learning (ML) and natural language processing (NLP). These solutions analyze customer behavior to deliver personalized assistance, enhancing customer experience and service efficiency. AI-powered tools enable businesses to understand consumer preferences and provide tailored customer support, fueling market expansion.

Virtual assistants and voice-based communication systems are key growth drivers, facilitating real-time customer interactions. Chatbots and AI voice assistants, powered by NLP, handle inquiries, resolve issues, and offer 24/7 support, improving customer satisfaction and reducing operational costs. These technologies are widely adopted in industries like retail, e-commerce, healthcare, and finance, where personalized customer service is critical.

Technological advancements in AI algorithms and cloud computing enhance the scalability and accessibility of AI solutions, enabling businesses to deploy intelligent automation seamlessly. North America leads the market due to its advanced technology infrastructure and high AI adoption rates, while Asia-Pacific, particularly China and India, is growing rapidly due to digital transformation and increasing internet penetration.

Despite challenges like data privacy concerns, innovations in secure AI systems and ethical AI practices are addressing these issues. The AI in customer service market is poised for exponential growth, driven by machine learning, NLP, virtual assistants, and customer-centric innovations, reshaping customer service with efficient, personalized solutions.

AI in Customer Service Market Overview & Scope

The AI in Customer Service Market is segmented by:

- Technology: The AI customer service market by technology is segmented into chatbots, virtual assistance, generative AI-based FAQs, and others. Chatbots are used as a messaging tool for conversation, as they can answer questions and make connections. Virtual assistants offer a wider range of capabilities, such as making face-to-face conversations to make customers more comfortable. Generative AI-based FAQs is a Natural Language Processing technique used to automatically generate answers based on the data. Data insights from customers can provide valuable insights into customer behavior and preferences, and the process to improve them.

- Deployment: AI customer service market segmentation by deployment into cloud, on-premise, and hybrid. Depending on the organizational size and requirements, the deployment is employed. As the size of the organization grows, it could have on-premises for better data security.

- Application: AI customer service market segmentation by application can be divided into finance, IT & telecommunications, companies, government, retail, healthcare, hospitality, and others. AI chatbots and virtual assistants are great tools for knowing and managing customer finances, accounts, transactions, and debts. In Tech companies, AI customer service assists with product-related questions and software usage, and applications. Retailers have expanded the market through e-commerce sites; they are leveraging AI tools for better customer service.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. The North American region is anticipated to grow at a significant rate in the forecast period, owing to increasing e-commerce, the biggest investment in the development of AI, and the US private investment was $ 77.65 billion in 2023.

Top Trends Shaping the AI in Customer Service Market

1. High growth potential in cloud-based solutions

- The demand for AI cloud-based solutions in customer service is expected to rise as businesses increasingly look for intelligent and real-time support systems. With growing customer expectations for instant, personalised assistance, companies are using cloud-based AI tools like chatbots, voice assistants, and predictive analytics to streamline interactions across digital channels.

- Another key driver is the need for efficiency and cost reductions, as cloud infrastructure is helping companies to deploy in a way that provides real-time customer data. As a result, AI cloud-based platforms have gained demand for their flexibility, responsiveness, and ability to deliver consistent customer experiences globally.

- According to Verint’s survey reports “State of Digital Customer Experience”, in 2024, around 72% of people used online, social media, and/or private messaging to contact a company, whereas in 2023, around 50% used these mediums to contact a company; this shows an increase of 22%.

2. Increasing product launches & collaboration, and investment in technology

- High labor costs, lack of efficiency, and availability 24*7 are causing product development and investment in technology. According to the data by Epoch 2025, the annual number of notable AI systems by domain can learn, show tangible results, and contribute advancements, mostly in the vision and language domains, i.e., 19 and 61, respectively, thereby showing the importance of this developing technology in human interaction-related services. Others included were multimodal, which was 23 in 2024.

Additionally, the growing collaboration between market players and government or private enterprises for the setup of quantum computing solutions and innovative product development is also expected to potentially promote the market expansion in the years to come. For instance, in October 2024, Kustomer announced the launch of AI native customer service platform, which enables organizations to offer next-generation CX at a quick speed and scalability. It utilizes industry-leading AI agents and pricing models to remove bad customer service and support businesses to compete with AI-driven technology.

AI in Customer Service Market Growth Drivers vs. Challenges

Opportunities:

- Increase in global online retail sales: The increase in global online retail sales is forecasted to boost the demand for AI customer services. In the retail industry, AI customer services offer convenient and quick customer support, enhancing the customer experience. These services also help businesses reduce operating costs and increase customer acquisitions. The US Census Bureau reported that the nation's e-commerce or online retail sales continually expanded over the past few quarters.

The e-commerce sales in the third quarter of 2023 were recorded at about US$279.739 billion, which increased to US$283.293 billion in the fourth quarter of 2023, finally reaching US$289.204 billion in the first quarter of 2024.

For instance, retail brands in the United States are opting for AI and other emerging solutions to better understand their customers’ preferences and prevent loss. According to the “2023 National Retail Security Survey” conducted by the National Retail Federation and covering 177 US brands, 37% of the respondents are investing in AI-related technologies for fraud detection analytics, while 15% have already started implementing them.

- Increase in the global accessibility of the internet: One of the primary drivers for the development of the global AI customer services market can be connected to the expanding accessibility of the Internet among individuals. With the increase in internet accessibility, businesses like finance, retail, and others have marked their presence on online platforms. These increases in online businesses create the growth of various fast-paced customer services, like chatbots and virtual assistants.

The International Telecommunication Union (ITU) stated in its report that internet availability among the globe's population has increased constantly. According to the information, approximately 4.9 billion of the population had the availability to the Internet in 2021, which expanded to around 5.1 billion in 2022 and advanced to 5.4 billion in 2023. In 2024, the data reached 5.5 billion, which is 68% of the population.

Challenges:

- Data Privacy and Security Concern: Data privacy and security concerns are affecting AI customer service due to high-profile breaches and abuse of personal data, which is decreasing consumer trust. Stricter information privacy regulations restrain information collection and utilization, preventing AI customer service improvement and deployment. Moreover, executing vigorous data security measures and complying with regulations increases the operational costs of AI customer service solutions.

AI in Customer Service Market Regional Analysis

- North America: North America, led by the United States, is a mature and technologically advanced region in the customer service industry. It has a higher adoption of AI-based customer support and has the presence of key outsourcing companies.

The United States region is expected to have a considerable market share. The United States is one of the major AI-adopting countries. With the continuous trend of mechanical progressions and advancements over different industry verticals, the necessity for AI service solutions such as chatbots, generative AI, and virtual assistance is also anticipated to provide positive expansion. Major divisions such as banking, retail, and healthcare are expected to witness noteworthy growth in AI adoption, further bolstered by continuous ventures to drive the digitization of various industrial businesses.

Besides, digital client engagement is on the rise in the United States, accelerated by the increasing tech-savvy population. According to Verint’s “2023 State of Digital Customer Experience” report, in which more than 2,000 surveys across the US were conducted to determine customers' preferences for brand engagement, 53% of the respondents aged 18 to 44 preferred digital channels, and 47% preferred phones. Such high engagement has motivated companies to adopt a much wider customer-centric approach to providing a seamless customer experience.

Also, the USA is the hub for technological innovations, and favorable investment in artificial intelligence has provided new growth prospects for such technology. Various US-based AI providers are investing in launches and innovations. For instance, in August 2023, Freshworks Inc. launched its AI-powered “Customer Service Suite” that integrates agent-led conversational messaging, automated ticketing management, and self-service bots.

AI in Customer Service Market Competitive Landscape

The AI in Customer Service Market is moderately fragmented, with some key players including Aisera, Ericsson, and Microsoft, among others. Some key developments in the market are:

November 2025: Eleos Life launches AI Voice Agent for 24/7 support. Eleos Life announced the launch of a new AI voice agent designed to offer instant, around-the-clock customer assistance.

November 2025: Kyndryl introduces Agentic AI Framework and services. Kyndryl, a leading enterprise technology services provider, launched new AI-powered services that integrate agentic AI capabilities with its mainframe expertise.

August 2025: EU AI Act rules for General-Purpose AI (GPAI) became applicable. A major regulatory development affecting all companies deploying AI in customer service, the governance rules and the obligations for GPAI models under the European Union's AI Act became applicable, setting a legal framework to ensure AI systems are safe and trustworthy.

March 2025: Deloitte Digital formed a collaboration with NICE to transform their customer service by offering end-to-end AI solutions designed to provide more proactive customer interactions.

February 2025: IBM introduced new AI Integration Services to assist enterprises in creating and scaling AI agents.

List of Top AI in Customer Service Companies:

- Aisera

- Ericsson

- Microsoft

- Tiledesk

- Nokia

AI in Customer Service Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Customer Service Market Size in 2025 | US$582.227 million |

| AI in Customer Service Market Size in 2030 | US$1,634.989 million |

| Growth Rate | CAGR of 22.94% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the AI in Customer Service Market |

|

| Customization Scope | Free report customization with purchase |

AI in Customer Service Market Segmentation:

By Technology

- Chatbots

- Virtual Assistance

- Generative AI-based FAQs

- Others

By Deployment

- Cloud

- On-Premise

- Hybrid

By Application

- BFSI

- IT & Telecommunication

- Government

- Retail

- Healthcare

- Hospitality

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others