Report Overview

AI Camera Market Size, Highlights

AI Camera Market Size:

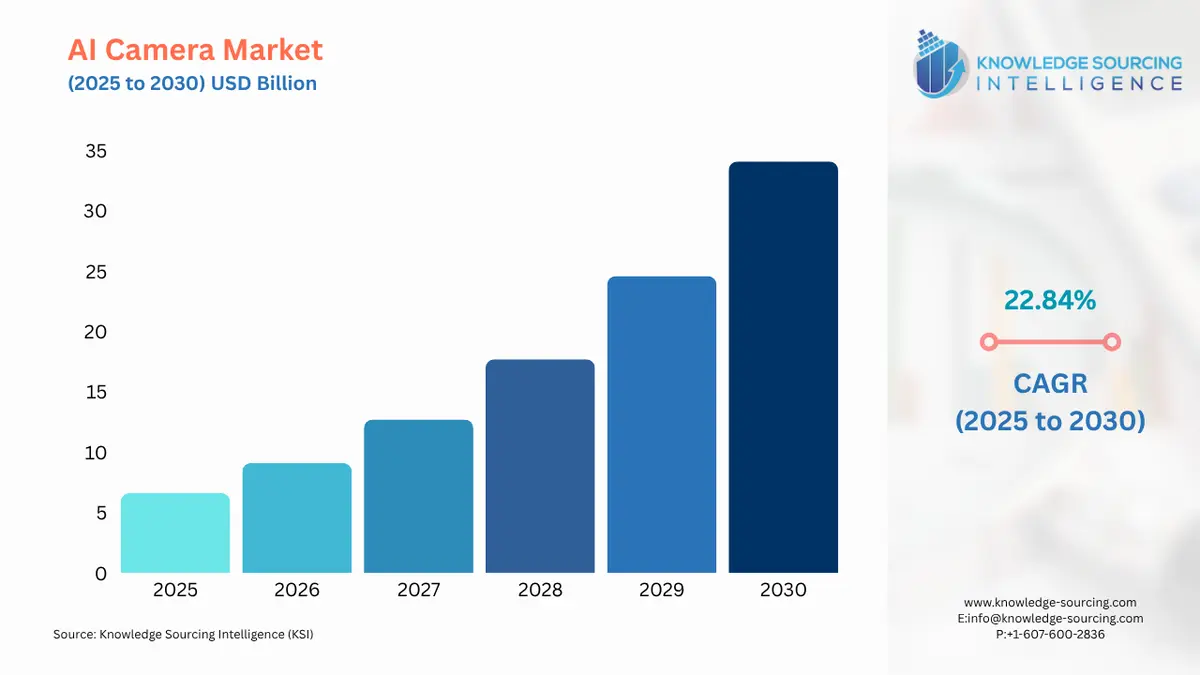

The artificial intelligence (AI) camera market is projected to grow at a CAGR of 22.84% over the forecast period, increasing from US$6.581 billion in 2025 to US$34.128 billion by 2030.

AI camera is a type of device that includes artificial intelligence software integrated into the main camera system. The AI-enabled cameras offer multiple key benefits compared to basic cameras, including better image quality, face & object recognition, and enhanced surveillance.

The rising demand for consumer electronics worldwide is among the major factors propelling the AI camera market expansion during the forecasted timeline.

The production of consumer electronics in Japan witnessed a growth of about 104% in August 2024 compared to August 2023. In August 2024, the total production of consumer electronics in the nation was recorded at YEN 892,282 million, as stated by the Japan Electronics and Information Technology Industries Association.

AI Camera Market Growth Drivers:

- Growing global demand for smartphones are accelerating the integration of AI camera

The increasing demand and ownership of mobile and smartphones in the global demand is among the key factors propelling the utilization of AI cameras. The GSMA, a global non-profit organization in the mobile industry, stated that in 2022, the total smartphone ownership in the global market was 76% and will reach 92% by 2030.

Furthermore, the International Telecommunication Union, in its global report, stated that in 2023, the total mobile phone ownership was recorded at 78%. The agency further stated that in Europe and the Americas, the total mobile phone ownership was recorded at 93% and 88%, respectively. In the Arab States and Asia Pacific region, mobile phone ownership was recorded at 82% and 75%, respectively.

AI Camera Market Segmentation Analysis:

- The CCTV camera segment is anticipated to hold significant market share in the projected period.

Various countries' government projects can expand opportunities for manufacturers and integrators across diverse industries. This expansion is increasingly stretching their surveillance network, leading to greater demand for AI-powered CCTV solutions. In August 2024, the Indian Railway Board announced a plan to install AI-enabled CCTV cameras on locomotives and key yards, where they will survey unusual conditions and common occurrences of rail accidents. They also planned to cover the Kumbh Mela period and ensure greater security and safety against vandalism and accidents.

With this installation plan by the Railway Board, the market for AI-based cameras will be boosted due to the requirement for high-resolution cameras, sophisticated video analytics software, versatile data storage and management systems, and integration with the existing railway infrastructure. The introduction of new AI-powered cameras will increase its demand due to modernizing innovations and the industry's emphasis on developing superior surveillance systems. These developments assist in expanding the overall AI-powered surveillance market as manufacturers bring out newer and more complicated products.

In December 2024, Panasonic Life Solutions India (PLSIND) i-PRO AI launched new surveillance and advanced security solutions at IFSEC India 2024. The two products include an AI-enabled High Zoom Bullet Camera and an X-series Camera with AI-based On-site Learning analytics. These solutions offer unparalleled strength in security and surveillance to the Indian market.

In June 2024, i-PRO unveiled its new AI-enabled corner camera purposely designed for correctional facilities in Japan. The small size, IK11-rated camera can withstand 70 Joules of impact, exceeding the IK10 (20J) impact ratings of comparable devices. It is probably the smallest form factor with this compact and robust stainless steel form factor.

Security enhancement, including facial recognition, object detection, and motion tracking, is a major factor driving the growth of AI-enabled cameras in the CCTV camera segment. AI algorithms enable real-time processing of huge video data using fast methods of threat recognition and less manual monitoring. Even though there is considerable capital investment at initial cost, AI CCTV cameras incur long-term savings from their operation in emergencies by eliminating the demand for extra security personnel.

- Image and face recognition segment is expected to hold substantial market share in the coming years.

In February 2024, Smart City Lucknow set up 1,000 AI-enabled cameras with face recognition at strategic points across the city. These cameras are intended for crime prevention along with the safety and security of the city. The technology will enable the cameras to identify suspicious moves and send signals to the police control room for the safety of citizens, thus preventing most of the crime in the city. AI and deep learning algorithms have made striking advances in improving the accuracy and speed of image and face recognition. These high-resolution cameras save very detailed images for more exact recognition. Countries are investing more in AI and camera surveillance, positively impacting market expansion in the coming years.

The Indian Railways announced a plan to install IDIS video tech in July 2024 as a security and safety backbone for a multi-year modernization project. The first step will be to reduce and manage peak volumes of passengers safely. Phase 1 will see the introduction of AI-enabled biometric surveillance cameras at around 230 Eastern railway stations across the network that consume high daily footfalls. High-resolution cameras, coupled with AI-powered video analytics and facial recognition, would be installed across hundreds of platforms. Benefits from efficiencies this technology will reap with low total costs of ownership were the reasons for the contract awarded to IDIS.

These government initiatives are boosting public safety and security with an AI-powered surveillance system, promoting the deployment of such technologies in other key verticals such as transportation, retail, and urban planning. The landmark achievement of this project also signifies that government and diverse sectors are seeing increased importance in staging advanced AI-enabled image and face recognition camera technologies applied to large infrastructures toward future innovations and market expansion.

The growth in the image and face recognition segments is majorly due to the rise in security threats, accurate identification, and the need for improved surveillance to thwart breaches and terrorism. Smart city initiatives are underway to safeguard urbanization and population growth with efficient traffic management, public safety, and traffic detection using AI-powered cameras. These cameras with face recognition technology will help optimize traffic flow and eliminate congestion, leading to better public transportation and improving public safety.

AI Camera Market Geographical Outlook:

- North America will continue to hold a remarkable share of the market during the forecast period.

The Artificial Intelligence (AI) Camera market in the United States is rapidly expanding owing to the rapid technological breakthroughs in AI and surging demand for intelligent surveillance systems. The capabilities of cameras have increased significantly by including AI and machine learning. These now include object detection, facial recognition, and behavior analysis.

These developments have allowed data to be processed in real-time, and thus, AI cameras have become important in any industry requiring prompt decisions, such as security and retail. These cameras are applied in many sectors, including public safety, smart homes, automotive systems, and retail settings. For instance, in retail, AI cameras analyze customer behavior to maximize store layouts and marketing techniques. In security applications, they can rapidly identify possible risks and improve surveillance capabilities.

Growing demand for smart home devices and developing smart city projects further fuel the demand for AI cameras. These cameras are embedded with IoT technologies to create connected environments, enhancing automation and energy efficiency. In 2024, some communities in the United States advanced their smart city efforts using technology for better urban living, sustainability, and connectivity.

For instance, Seattle was declared the brightest city in the United States for 2024, having a strong focus on infrastructure and sustainability related to technology. The city has several AI and IoT enterprises, has greatly increased its tree cover, and is developing electric vehicle (EV) charging stations. Seattle's initiatives focus on how to make technology an everyday component of life, with public services and environmental outcomes as well.

As the market matures, innovations such as multimodal sensing, advanced learning algorithms, and enhanced video analytics will probably define the future landscape of AI cameras, making them indispensable tools across various sectors.

The surging demand for advanced surveillance solutions in various sectors mainly dominates the U.S. AI camera market. Increasing security concerns motivate organizations to invest in AI cameras, providing features like facial recognition, object detection, and real-time analytics. This is of particular interest in law enforcement and public safety applications where AI technology provides improved monitoring and response time. Moreover, the interconnection of AI with smart devices and the IoT system enables the emergence of smarter environments, enhancing market growth.

AI Camera Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI Camera Market Size in 2025 | US$6.581 billion |

| AI Camera Market Size in 2030 | US$34.128 billion |

| Growth Rate | CAGR of 22.84% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI Camera Market | |

| Customization Scope | Free report customization with purchase |

AI camera market segmentation:

- By Application:

- Smartphones and Tablets

- CCTV Camera

- Digital Camera

- Others

- By Technology:

- Image and Face Recognition

- Voice and Speech Recognition

- Computer Vision

- Others

- By Geography:

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America