Report Overview

AI-Based Optical Character Recognition Highlights

AI-Based Optical Character Recognition Market Size:

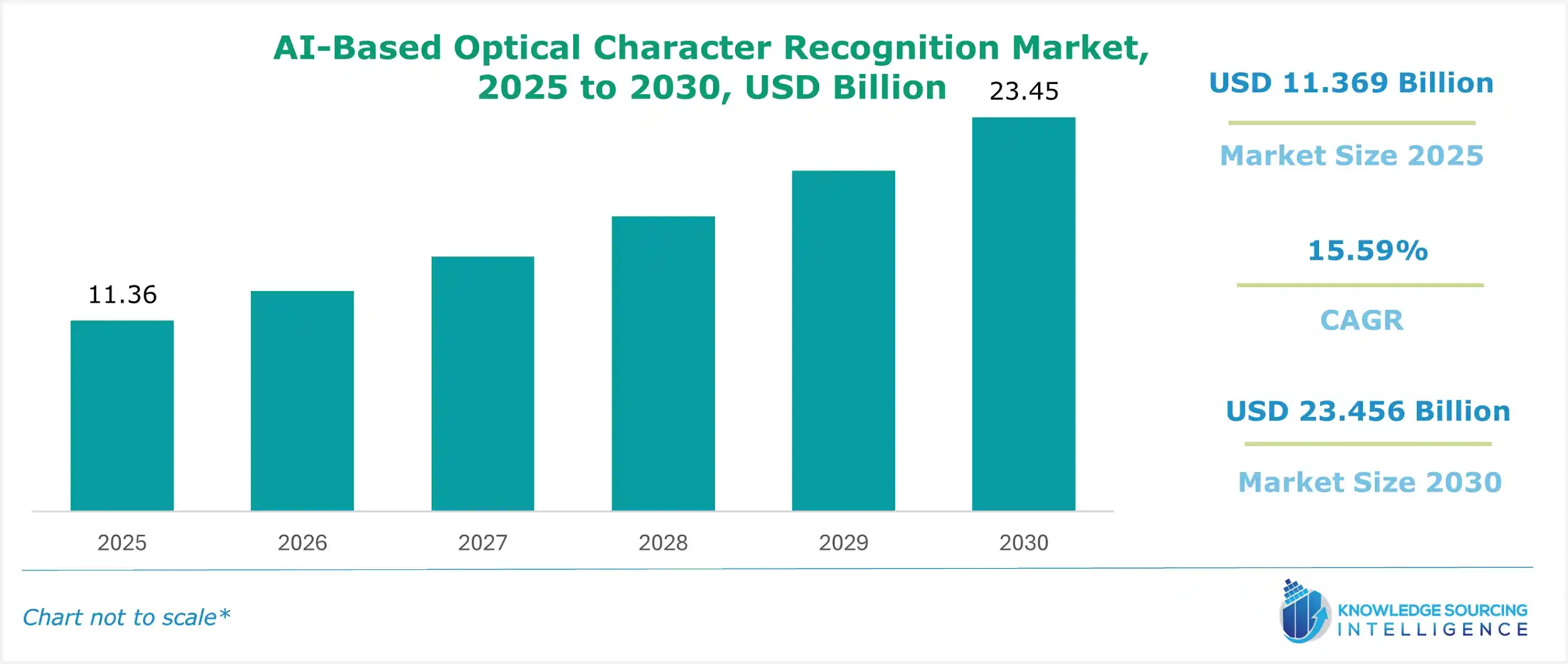

The AI-based optical character recognition market is estimated to reach US$23.456 billion by 2030 from US$11.369 billion in 2025, growing at a CAGR of 15.59%.

An artificial intelligence-based optical character recognition tool is a form of advanced software that helps in automate the extracting and recognition process of multiple types of documents or images. It helps minimize the rate of error and enhances the processing speed. The increasing sector output of the BFSI industry is among the major factors propelling the growth of the global AI-based OCR market, during the forecasted timeline.

In the BFSI sector, the AI-based optical character recognition solution helps in enhancing the KYC or identity verification process of the documents, and can also create digital copies of documents. The AI-based OCR solution also helps in enhancing the efficiency and accuracy of document verification, increasing customer satisfaction. The global BFSI Sector witnessed significant growth, for instance, the Government of the UK, in its report stated that in 2023, the financial and insurance sector contributed about 8.8% or GBP 208.2 billion to the nation's GDP.

The growing adoption of smartphones, especially the developing economies is among the major factors propelling the growth of the AI-based OCR market. The increasing global output of the BFSI sector is also expected to boost the market during the forecasted timeline.

AI-Based Optical Character Recognition Market Growth Drivers:

- Increasing usage of smartphones in the global market

The increasing adoption and utilization of smartphones in the global market are among the key factors propelling the growth of AI-based OCR platforms during the forecasted timeline. Smartphones help in enhancing the consumer experience to the AI-based OCR platforms and it also increases the reach of the technology to a vast population. The global population using smartphones witnessed significant growth during the past few years and is further expected to rise during the forecasted period.

The International Trade Administration, of the US Government, in its report stated that in India, the total population using the smartphone was recorded at 650 million, as of mid-2024, with about 950 million internet subscribers. Similarly, the GSMA, in its global report stated that the smartphone adoption in the Asia Pacific region was recorded at 78%, whereas in the Eurasia and Europe region, the smartphone adoption was recorded at 83% and 82% respectively, in 2023. In Greater China, Latin America, and North America region, smartphone adoption in 2023 was recorded at 84%, 80%, and 86% respectively.

- Rising demand for AI-based OCR for image input

There's a rising demand for Optical Character Recognition based on AI for image input. The demand is growing by leaps and bounds, driven primarily by the requirement for effectively extracting data from images in various industries such as e-commerce, government, business operations, and many more. The predominant reason for this surge is the growing digitization and automation of processes, particularly in data entry applications, because such AI OCR systems yield higher productivity and accuracy.

Moreover, Governments are increasingly turning to AI-OCR system solutions in recognition of better data management processes and service delivery. They are scalable AI systems that fit into any number of organizations, including large government agencies, to manage massive numbers of documents and different sources of data with accuracy. Further, automation of inspection with the aid of AI OCR in manufacturing, thereby reducing cost while also increasing the traceability of the product.

A recent report by the National Institute of Standards and Technology states that advances in technology concerning artificial intelligence have caused up to a 15% drop in error rates over the last few years in the field of accurate and reliable data extraction from images. In April 2024, Ricoh Company, Limited acquired natif.ai, a German startup whose innovative software is focused primarily on AI-enabled intelligent capture, appreciating more advanced image recognition and OCR technology. This acquisition strengthens Ricoh's AI expertise in OCR systems.

Furthermore, WallTech launched a multimodal intelligent OCR recognition solution based on the AI model of Amazon Claude 3.5 in June 2024. The new integration is reportedly up to 99% accurate, coupled with a 30% time-saving efficiency while processing complicated documents, showing a great stride in AI-founded OCR technology. Additionally, Google provides Vision AI which is a strong image recognition technology that lends itself to the creation of computer vision applications, which, from photos and videos, extract insights. The solution hence allows numerous applications to improve their data extraction processes through the integration of AI-based OCR functionalities.

AI-Based Optical Character Recognition Market Geographical Outlook:

- The North America region is expected to witness significant growth in the AI-based optical character recognition market

In the US, the increased intake of artificial intelligence in OCR technology is showing rapid growth at this time. This is due to rapid advancement in artificial intelligence and digitizing business operations and the inclination toward greater automation in work efficiency. AI-based OCR captures both machine learning and artificial intelligence so that even more effective detection, extraction, and processing have been done through almost all forms of written document-from handwritten occurrences to scanned images and printed texts. Transformation to businesses in terms of speeding up workflows, improving accuracy, and allocation of time and resources to reduce cost could be done through data entry without manual work.

The demand for AI-based OCR is rising in the United States, marking its entry into a broader trend of digitization and automation. Recent product launches of leading businesses have expanded advantages in AI technologies, and government support has primed the AI-based OCR growth space. Further, several noteworthy developments have occurred during 2023 and 2024 in the AI-based OCR sector in the United States. For instance, the introduction of Transcribe AI by Revvity; advanced data entry that will change the operations of a clinical laboratory in 2024 when it will apply AI-supported optical character recognition technologies that transcribe handwritten information on test-request forms.

Moreover, the breakthrough signifies the technology's ability to enhance accuracy in vital areas, as noted by the health sector. Similarly, there are further advanced features of this product from Symmetry Systems, referred to as the OCR Image Analyzer, which provides intelligent functionalities that identify and secure those business-critical images maintained in hybrid cloud environments. Further, the joining of AI features into Acrobat by Adobe to allow users to create and amend images in PDF using easy text prompts illustrates the adaptability of AI-based OCR in document management and accessibility. These advances show how organizations are always innovating to meet the growing demand for intelligent data-processing solutions.

AI-Based Optical Character Recognition Market Key Developments:

- In September 2024, iPro Co. Ltd., a global leader in advanced sensing technology, announced the launch of the Active Guard Intelligent Search Application, which integrates high-performance OCR solutions developed by Vaxtor.

- In June 2024, Gcore, a global leader in edge AI and cloud network solutions, announced the launch of an Advanced AI solution for Real-Time Online Content Moderation and Moderation, that combines OCR and speech recognition technology among others.

List of Top AI-Based Optical Character Recognition Companies:

- NAVER Cloud Corp

- IDCentral

- Cognex Corporation

- Klippa App BV

- Qualitas Technologies

AI-Based Optical Character Recognition Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI-Based Optical Character Recognition Market Size in 2025 | US$11.369 billion |

| AI-Based Optical Character Recognition Market Size in 2030 | US$23.456 billion |

| Growth Rate | CAGR of 15.59% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI-Based Optical Character Recognition Market |

|

| Customization Scope | Free report customization with purchase |

AI-Based Optical Character Recognition Market Segmentation:

- By Input Type

- Image

- Documents

- Scanners

- By End-Users

- BFSI

- Government

- Airports

- Healthcare

- Retail

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific Region

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Indonesia

- Others

- North America