Report Overview

Aerosol Refrigerants Market Size, Highlights

Aerosol Refrigerants Market Size:

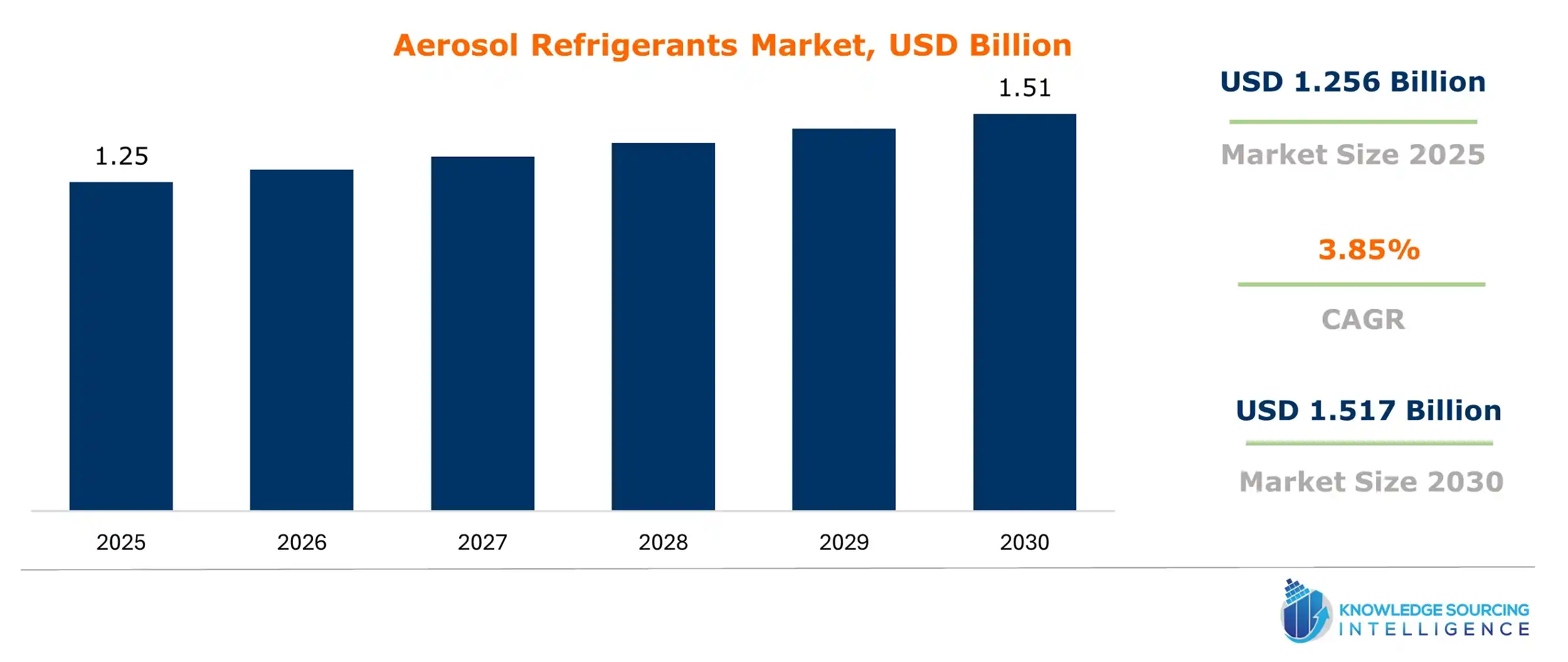

The aerosol refrigerant market is expected to grow at a CAGR of 3.85%, reaching a market size of US$1.517 billion in 2030 from US$1.256 billion in 2025.

Aerosol Refrigerants Market Key Highlights:

- Demand for eco-friendly, non-ozone-depleting aerosol refrigerants drives market growth.

- Asia Pacific dominates, led by China and India’s urbanization and appliance demand.

- Energy-efficient cooling solutions fuel aerosol refrigerant use in residential and industrial sectors.

- Strict regulations on high-GWP substances challenge manufacturers to innovate low-GW

The aerosol refrigerant market is a niche product in the larger refrigeration industry, focusing on aerosol propellants for various cooling applications. These refrigerants are stored in pressurized containers and may be released as fine particles or droplets, making them suitable for widespread applications, including household appliances, automotive air conditioning, and industrial cooling systems.

Aerosol refrigerants are specifically valued for environmental benefits. Most of the aerosol refrigerants are formulated to be non-ozone-depleting, unlike the popular though well-known ozone-depleting traditional chlorofluorocarbons and hydrochlorofluorocarbons. For example, HFC-134a has gained popularity due to its lower environmental impact as well as flexibility in applications from domestic refrigeration to mobile air conditioning. The increasing focus on energy efficiency and sustainability has heightened the demand for refrigerants, as industries seek solutions aligned with global environmental goals.

Aerosol Refrigerants Market Growth Drivers:

- Multiple uses of Aerosol Refrigerants

Aerosol refrigerants have different uses. In households, they are most useful in refrigerators and air conditioners as they keep the temperatures required for food storage and comfort. In commercial use, aerosol refrigerants play an important role in supermarkets and food storage rooms through the protection of sensitive products from contamination via transport and storage. The automotive sector also needs aerosol refrigerants to maintain comfortable climate control conditions in vehicles.

Additionally, high GWP compels the market towards more natural refrigerants, like hydrocarbons. Regulatory measures linked with phasing out high-GWP substances and environmental friendliness are driving this industry in this way. More attention is given to environmental sustainability by consumers, which also affects the market evolution. This puts the aerosol refrigerant market squarely on a trajectory of continued growth as manufacturers innovate in response to these trends, channeling efforts toward energy-efficient and environment-friendly innovation across all sectors.

- Increasing Demand for Energy-Efficient Cooling Solutions

The key drivers for the aerosol refrigerant market growth are the increasing demand for energy-efficient cooling solutions. Rising global temperatures and rapid urbanization help create the ever-growing need for efficient cooling solutions in residential, commercial, and industrial sectors. This increase in demand is most significant in the economically fast-developing countries, like Asia-Pacific, due to increased household incomes, which equate to increased consumption of air conditioners and refrigerators. Consumers continued to drive this upward trend by increasing their consumption of consumer appliances requiring refrigeration. Households and businesses sought reliable cooling devices to comfort and preserve perishable goods.

The market landscape also changed with the move towards "green" refrigerants. Regulatory demands, such as the Kigali Amendment to the Montreal Protocol, compel manufacturers to upgrade from high-GWP materials to more environmentally friendly ones. This change not only meets broad global sustainability aims but is also aligned with the desires of customers to buy more environmentally responsible products.

The performance of aerosol refrigerants is improved through technological innovation. Developers can create eco-friendly formulation and application technologies. New-generation refrigerants are designed to offer much better performance while still being within strict environmental restrictions. The demand for highly advanced cold chain solutions in the food and pharmaceutical industries is boosting this market. These credible aerosol refrigerants are more important as they can keep temperature-sensitive products safe during storage and transport.

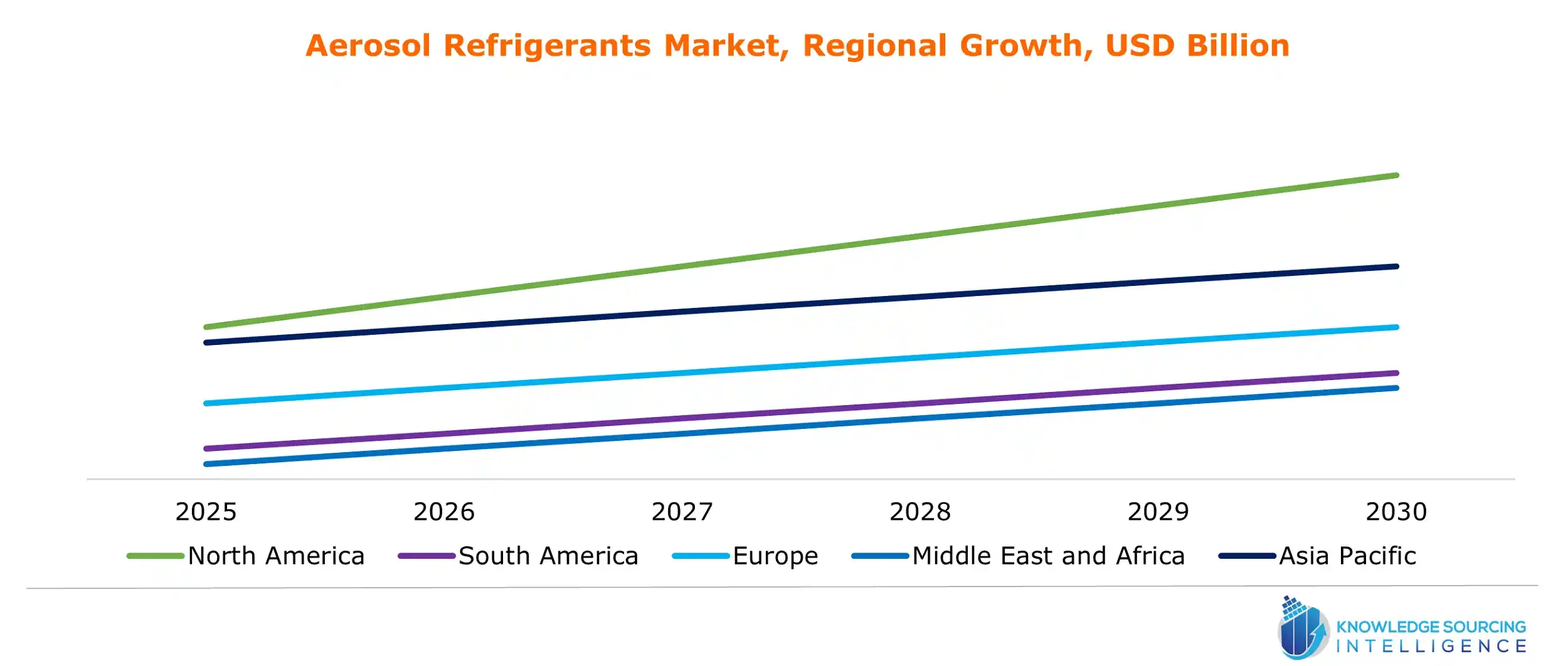

Aerosol Refrigerants Market Geographical Outlook:

- The Asia Pacific region will dominate the aerosol refrigerant market during the forecast period.

The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

Rapid urbanization and economic development in countries like China and India act as a driving factor for this trend. China, which happens to be the world's largest refrigerant market, is driven by a broad industrial base and increasing consumer expenditure on air conditioning units and refrigeration equipment. Low regional production costs also drive market expansion since manufacturing becomes an attractive proposition.

In addition, tightening regulations in the Asia Pacific region increase demand for eco-friendly alternatives. Phasing out HCFCs by 2040 and reducing HFCs by 85% by 2047 encourages manufacturers to innovate towards low-GWP solutions. This migration aspect is in tune with the global agenda for sustainability and matches the needs of the increasingly environmentally conscious consumers.

Large consumer markets, in addition to a rapidly growing disposable income, are also boosting demand for domestic appliances that require refrigerants. Infrastructural development within Southeast Asian countries, especially Thailand and Indonesia, is further likely to fuel the market. The pharmaceutical sector’s growth, mainly in temperature-sensitive cold chain logistics, also adds to the ever-increasing demand for reliable refrigerants.

Aerosol Refrigerants Market Restraints:

- A strict regulatory environment for the usage and production of refrigerants is one major restraint in the aerosol refrigerant market. Most governments are now adopting more stringent regulations to phase out the high GWP substances, such as certain hydrofluorocarbons (HFCs), especially those having a destructive impact on climate change. This regulatory pressure compels the manufacturer to expend valuable resources in research and development to come up with acceptable alternatives, which can be costly and time-consuming.

The switch to low-GWP and natural refrigerants will also require changes in the operating processes, therefore adding to further strains on resources. The illicit trade in banned refrigerants dilutes the effect of efforts made by legitimate businesses to promote sustainable practices. As such, it can be said that the evolution of such rules does curb companies' market entry and growth-innovative capacity in a complex landscape and thus restrains the aerosol refrigerant overall market growth.

List of Top Aerosol Refrigerants Companies:

Aerosol Refrigerants Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Aerosol Refrigerants Market Size in 2025 | US$1.256 billion |

| Aerosol Refrigerants Market Size in 2030 | US$1.517 billion |

| Growth Rate | CAGR of 3.85% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Aerosol Refrigerants Market |

|

| Customization Scope | Free report customization with purchase |

The aerosol refrigerants market is segmented and analyzed as follows:

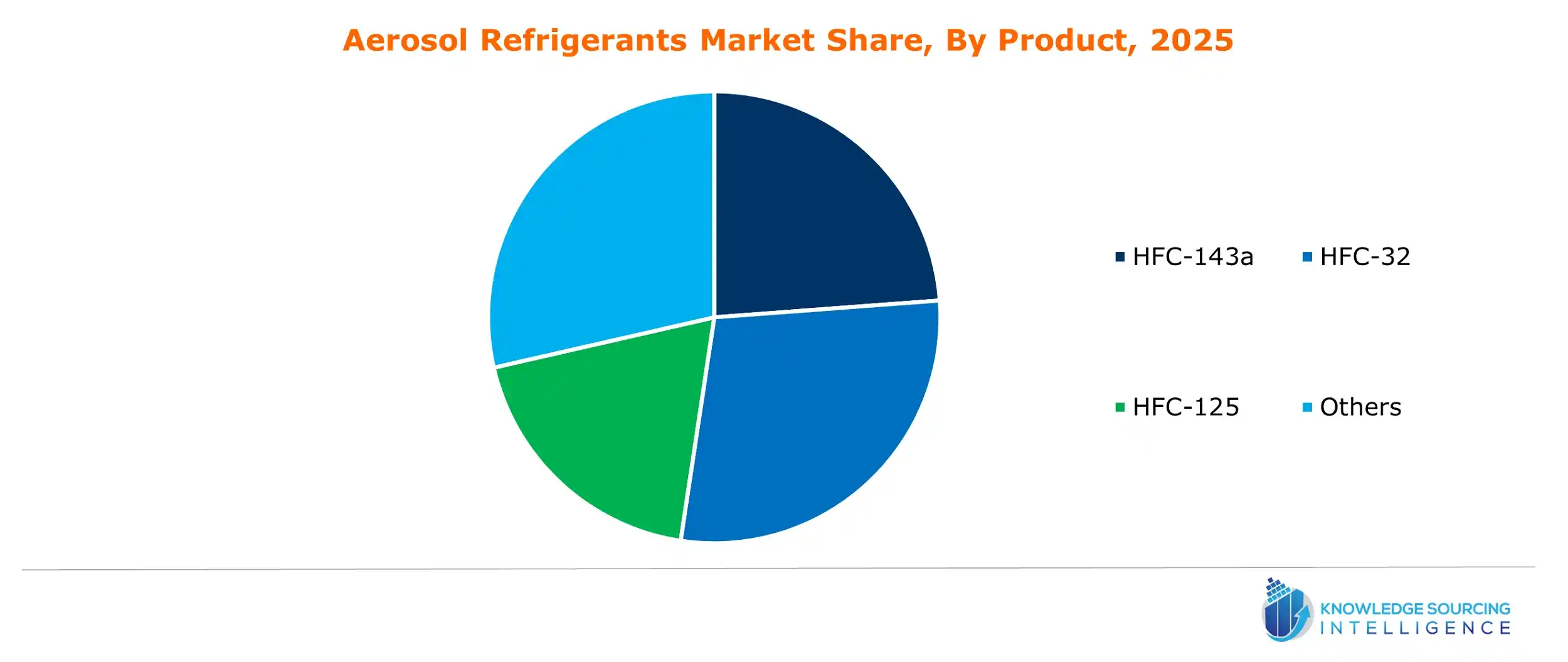

- By Product

- HFC-143a

- HFC-32

- HFC-125

- SF6

- Others

- By End-user Industry

- Residential

- Commercial

- Industrial

- Transportation

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America