Report Overview

Advanced Polymer Composites Market Highlights

Advanced Polymer Composites Market Size

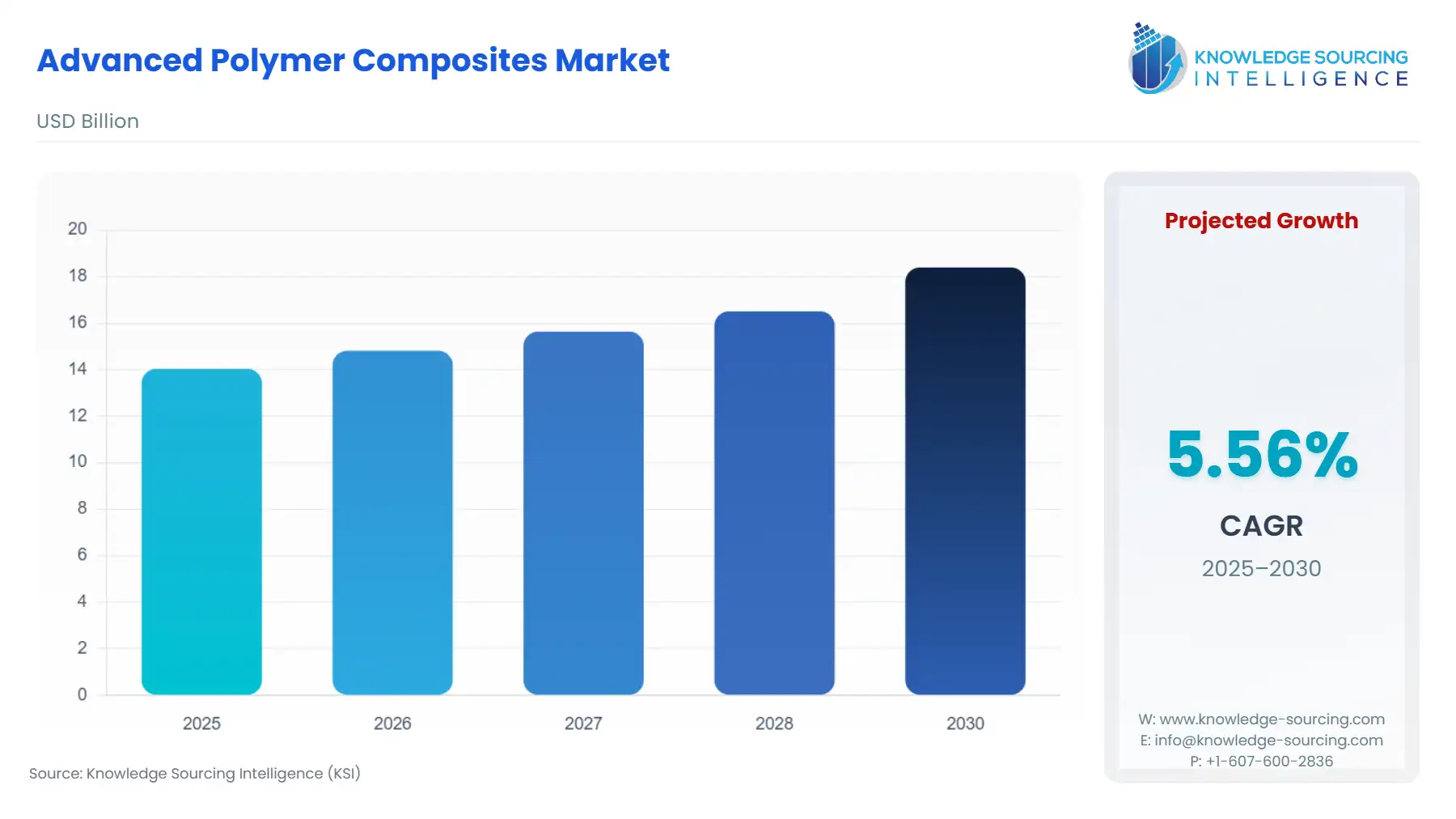

The advanced polymer composites market is estimated to grow from US$14.034 billion in 2025 to US$18.394 billion in 2030 at a 5.56% CAGR.

Advanced polymer composites are high-performance materials formed by blending polymers with strength-adding fibers or particulate reinforcements. The materials are exceptionally strong and lightweight and, therefore, used in industries including aerospace, automotive, and construction. They enhance or optimize performance, reduce weight, and improve efficiency in all applications. Furthermore, advances in sustainability make these composites more friendly to the environment, seeking to meet the rising demand for environmentally responsible solutions.

The advanced polymer composites market is booming due to the growing demand for these materials, as lightweight yet high-strength materials are required in the aerospace, automotive, construction, and electronics industries. Combining polymers with reinforcing materials such as fibers or particles gives these composites better mechanical properties than single polymers. Fuel efficiency is increasing with the apparent decrease in the weight of automotive vehicles. Vehicle manufacturers are more focused on new technology and energy efficiency to produce greener and high-performance composites, propelling the industry’s expansion. Major leaders such as Hexcel Corporation, Toray Industries, and Teijin Limited lead the way in developing advanced solutions that will meet the changing needs of the industries. This market is expected to grow as regulatory compliance becomes mandatory and industrialization increases.

Advanced Polymer Composites Market Growth Drivers:

- Growing demand from the end-user industries is propelling the market growth.

The growing demand for advanced polymer composites is highly dependent on their numerous applications in several industries. Their characteristics, including strength, lightweight properties, and high-temperature performance in aerospace and defense, have been particularly relevant as fuel efficiency and performance improve. These composites have also strengthened applications for the technologically advancing space sector.

In automotive applications, these composites are geared towards the further reduction of vehicle mass and improvement in fuel economy as well as safety features. In wind energy, composites are intended to produce highly performant and durable turbine blades. Structural reinforcement and insulation can be provided for lightweight and durable construction applications. In a much wider application, these polymers also serve in electronics, depending on their thermal and electrical properties for components like connectors and circuit boards. This shows the most applicable industry: demand for advanced polymer composites will steadily increase as industries pursue better performance, sustainability, and efficiency.

- Increasing focus on sustainability has positively impacted the market expansion.

One of the most important factors driving the use of these materials is the increasing emphasis on sustainability. To prevent the high-impact activities that industries have on the environment, materials that are proven to be eco-friendly and energy-efficient should be used. Advanced composites can meet this requirement because they are light enough to assist in reducing fuel consumption for the aerospace and automotive sectors. Furthermore, many of these materials can be recycled, minimizing wastage and promoting the practice of a circular economy.

The US National Science Foundation (NSF) has partnered with BASF, Dow, IBM, PepsiCo, and Procter & Gamble to unveil the $9.5 million SPEED initiative under the Molecular Foundations for Sustainability program. The program aims to accelerate the development of sustainable polymer solutions to address global challenges like plastic waste while enhancing the nation's competitive edge. The NSF's share is $7 million, while industry partners have brought in $2.5 million in pooled resources and in-kind contributions, which underscores a collaborative thrust about developing eco-friendly new materials.

An important aspect of this shift towards sustainability is support from unified environmental goals worldwide that push manufacturers to invest in greener solutions. This would certainly provide polymer composites with an edge as far as durability and strength are concerned. Effective sustainability, conjoined with long-lasting resources, means little waste processing. Its demand is increasing as governments and consumers are becoming more environmentally conscious.

Advanced Polymer Composites Market Restraints:

- High cost of raw materials & complexity in processing

The advanced polymer composites market growth faces many challenges. The high cost of raw materials and manufacturing processes are major barrier to their limited availability in some industries. The complexity of processing and specific requirements for equipment further increase the time and cost of production. In addition, the absence of recycling infrastructure poses some environmental threats, as many of these materials cannot be reused or disposed of properly.

Limited awareness and knowledge further slow the adoption of such materials in various sectors. Apart from that, although composites provide high strength, they sometimes show durability issues when exposed to extreme conditions, like UV exposure or aggressive chemicals, thus limiting their applications in certain environments. All these problems restrict the mass use and proliferation of advanced polymer composites.

Advanced Polymer Composites Market Geographical Outlook:

- The North America region is poised for steady growth.

By geography, the advanced polymer composites market is segmented into North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. North America has a great opportunity to grow in the advanced polymer composites market. The contributions come primarily from key industries like aerospace, automotive, and defense. According to the Aerospace Industries Association (AIA), the aerospace and defense sector in the U.S. brought in more than $955 billion in sales in 2023, showing that the industry was rising with an annual growth rate of 7.1%. This sector should be recognized for its significant role in maintaining and creating jobs. For every $1 million in sales, approximately four jobs are generated in manufacturing and the supply chain. This highlights the sector's importance to a healthy economy, ensuring that sustainability is not compromised.

The United States remains the research and development powerhouse, with innovations in composite materials impacting the markets. Aerospace and defense industries use advanced composites primarily because of their lightweight, durable, and high-performance properties that improve fuel efficiency and safety. The automotive industry is increasingly adopting these materials to develop lightweight vehicles that optimize performance against fuel efficiency standards and thus contribute to market growth.

North America boasts great government support emphasizing sustainability and green technologies. This will promote the growth of more eco-friendly composite solutions and appeal to their environmental benefits in generating demand and adoption. Thus, it can be concluded that North America is a major player in the advanced polymer composites market owing to its growth, size, and technology trends.

Advanced Polymer Composites Market Key Developments:

- December 2025: Toray Advanced Composites successfully qualified its Cetex® TC1225 LMPAEK thermoplastic composite in the NCAMP database, enabling broader aerospace structural applications.

- November 2025: Teijin Carbon and A&P Technology launched BIMAX TPUD, a high-performance braided fabric designed to scale manufacturing of complex thermoplastic composite parts.

- July 2025: Arkema’s affiliate PI Advanced Materials officially unveiled the new Zenimid™ brand for ultra-high-performance polyimide materials used in aerospace, automotive, and electronics sectors.

- March 2025: Toray Group showcased next-generation thermoplastic composite technologies at JEC World 2025, highlighting Cetex® and other advanced composite innovations.

Advanced Polymer Composites Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Advanced Polymer Composites Market Size in 2025 | US$14.034 billion |

| Advanced Polymer Composites Market Size in 2030 | US$18.394 billion |

| Growth Rate | CAGR of 5.56% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Advanced Polymer Composites Market |

|

| Customization Scope | Free report customization with purchase |

Advanced Polymer Composites Market Segmentation:

- By Type

- Thermoset

- Thermoplastic

- By Product Type

- Resin

- Fiber

- By End-User Industry

- Aerospace and Defense

- Automotive

- Energy & Power

- Construction

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Others

- North America