Report Overview

Advanced Malware Protection Market Highlights

Advanced Malware Protection Market Size:

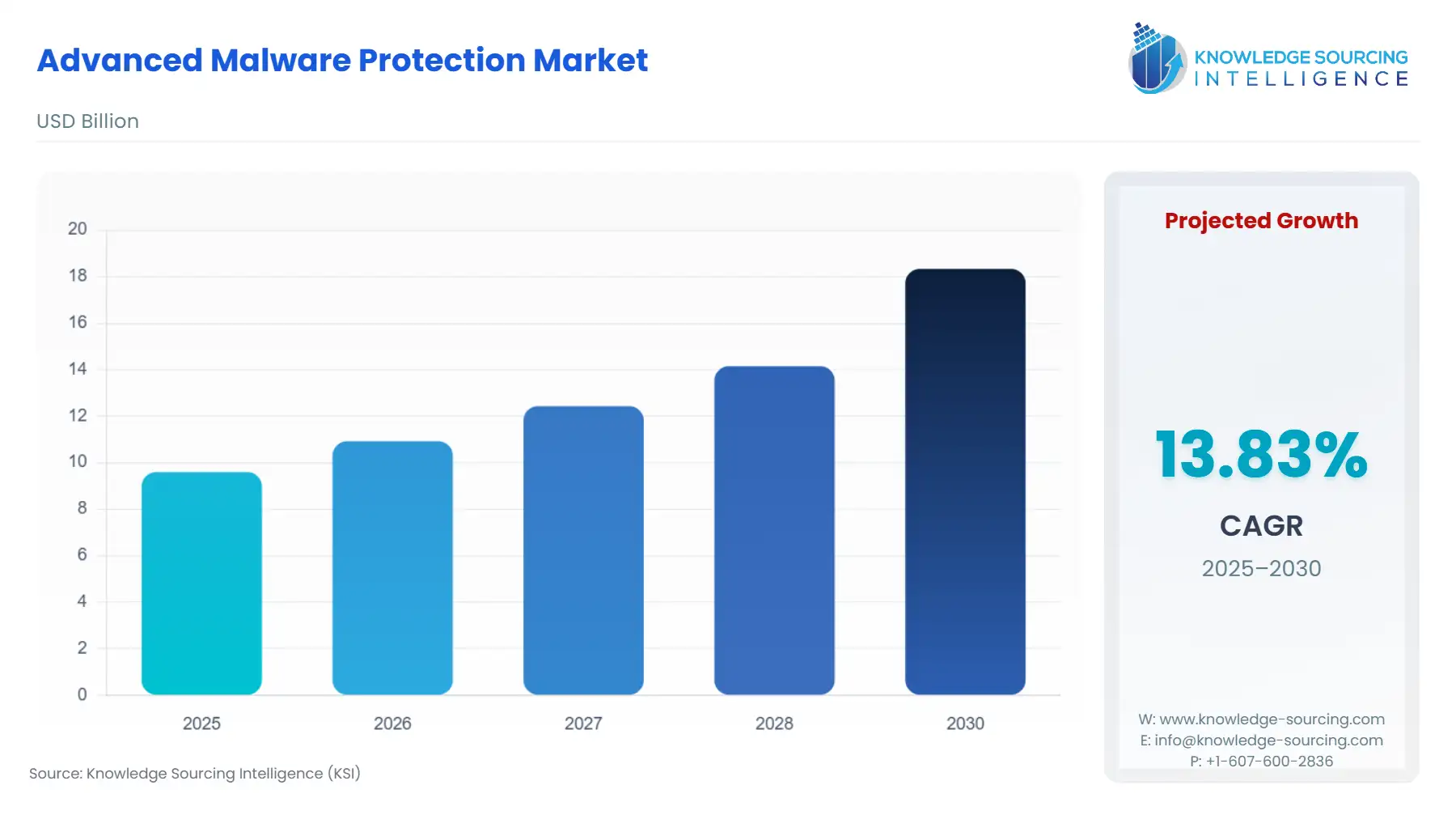

Advanced Malware Protection Market, growing at a 13.42% CAGR, is projected to achieve USD 20.423 billion in 2031 from USD 9.596 billion in 2025.

Advanced Malware Protection Market Trends:

Malware protection serves as a robust cybersecurity shield, offering extra defense against online threats. Once installed, it continuously scans devices, identifies, isolates, and eliminates any existing malware, ensuring the safety of the systems. End users of advanced malware protection include banking, financial services and insurance (BFSI), government, retail, manufacturing, and various other industries. The escalating occurrences of cyber-attacks, coupled with the growing trend of remote work, are key factors driving the growth of the advanced malware protection market.

Advanced Malware Protection Market Growth Drivers:

Increasing cyber threats bolster the advanced malware protection market growth

Advanced malware protection is used to safeguard computer systems, networks, and digital assets from sophisticated and evolving cyber threats. As cyber criminals continuously develop more complex attack techniques, the risk of data breaches, financial losses, and reputational damage escalates. Consequently, the increasing frequency and severity of cyber threats have fueled the demand for advanced malware protection solutions, prompting the growth of the market. According to the IBM report, in 2022, there was a notable surge in thread hijacking incidents, where cyber attackers exploited compromised email accounts to interject into ongoing conversations, pretending to be the original participant. X-Force reported a 100% increase in the monthly rate of such attempts when compared to the data from 2021.

Increasing remote work drives the advanced malware protection market expansion

The trend of remote work arrangements has led to an increased dependency on personal devices and home network systems to perform professional tasks. Unlike traditional office environments, where IT departments maintain a high level of network security, these personal devices and home networks are vulnerable to cyber threats, making them easy targets for hackers. The growing vulnerability associated with remote work has, therefore, led to an amplified demand for advanced malware protection. According to the 2021 American Community Survey, the population primarily working from home witnessed a threefold increase between 2019 and 2021. The percentage rose from 5.7%, approximately 9 million individuals, to 17.9%, which represents around 27.6 million people.

Investments and initiatives in the market drive advanced malware protection growth.

Investments and initiatives in the cybersecurity industry can significantly boost the advanced malware protection industry. Initiatives such as the establishment of robust cybersecurity policies, codes of practice, and awareness campaigns can heighten the understanding and recognition of cyber threats among businesses and individuals. This increased awareness has increased the demand for advanced malware protection solutions. For instance, in May 2022, the UK government initiated measures to strengthen app security and privacy following a report by the National Cyber Security Centre (NCSC) that highlighted substantial risks to users from apps that either contain malicious malware or suffer from poor development practices. In response to these findings, the UK government plans to implement a new code of practice.

Advanced Malware Protection Market Geographical Outlook:

Asia-Pacific is expected to dominate the advanced malware protection market.

Asia Pacific will hold a significant share of the advanced malware protection market due to the region’s booming cybercriminal activities, which have driven the governments in the region to enforce strict data protection regulations, encouraging organizations to invest in advanced malware protection. In the February 2023 press release. The Minister of State for Electronics and Information Technology reported that India experienced 13.91 lakh cybersecurity incidents in 2022. Also, rising incidences of spyware, malware, and ransomware attacks are intensifying the focus on advanced malware detection. For instance, in October 2021, Japanese security researchers identified a new variant of the Android information-stealing malware, FakeCop

Advanced Malware Protection Market Restraints:

Data privacy may restrain the advanced malware protection market growth.

Certain organizations may exhibit hesitation when considering the adoption of advanced malware protection solutions, often due to concerns surrounding data privacy. The concern is particularly pronounced when it comes to cloud-based platforms, which are widely used in the field of advanced malware protection. Such platforms often involve data being transferred to and stored in third-party servers, adding a layer of complexity to the control and transparency over how the data is processed and protected. Consequently, these perceived risks and uncertainties about data privacy can deter organizations from integrating advanced malware protection solutions into their security infrastructure.

Advanced Malware Protection Market Key Developments:

June 2023: Monarx and Libyan Spider entered into a partnership to bring advanced malware protection into the Libyan Spider ecosystem, a platform specializing in cloud hosting. This collaboration equips the platform with highly scalable, signatureless scanning technology provided by Monarx. The protection offered extends to a variety of malware types, including Ransomware, Botnets, Trojans, Worms, Key Loggers, Crypto Jackers, Spyware, and Web Shells. This move enhances the security of websites hosted within the Libyan Spider platform, providing comprehensive protection against an extensive range of cyber threats.

July 2022: Amazon introduced its GuardDuty Malware Protection, a new feature designed to detect harmful files located on an instance or container workload operating on Amazon Elastic Compute Cloud (Amazon EC2). This service offers added security without requiring the deployment of any security software or agents. The expansion of Amazon GuardDuty now includes file scanning for workloads using Amazon Elastic Block Store (EBS) volumes. This function aims to identify any malware that could potentially compromise resources, alter access permissions, or illicitly export data.

June 2022: Akamai Technologies, Inc, announced the launch of its Malware Protection solution designed to secure web applications and APIs from harmful uploads. This latest offering enhances Akamai's existing Web Application and API Protection (WAAP) services by identifying and blocking malware at the network edge. This pre-emptive approach ensures that malicious software is intercepted before it can reach and potentially harm the target systems, thereby preventing it from being activated and propagated within the network.

Advanced Malware Protection Market Company Products:

Cisco Secure Endpoint: Cisco Secure Endpoint, a product of Cisco, is an endpoint security solution designed with a strong focus on resilience and speed. This cloud-native platform enables quick detection, response, and recovery from attacks. With its capabilities, it greatly minimizes remediation times, with reductions reported to be as much as 85%. This strategic approach to cybersecurity not only enhances the protection of network endpoints but also significantly streamlines the process of dealing with potential security incidents.

Advanced Malware Protection Companies:

Cisco

Acronis International GmbH

Mimecast Services Limited

Fortinet, Inc.

Forcepoint

Advanced Malware Protection Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Advanced Malware Protection Market Size in 2025 | USD 9.596 billion |

Advanced Malware Protection Market Size in 2030 | USD 18.335 billion |

Growth Rate | CAGR of 13.83% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Advanced Malware Protection Market |

|

Customization Scope | Free report customization with purchase |

Advanced Malware Protection Market Segmentation

By Components

Solutions

Services

By Deployment

Cloud

On-Premise

By Malware Type

Ransomware

Spyware

Fileless Malware

Others

By Enterprise Size

Small & Medium Enterprise

Large Enterprise

By End-User

BFSI

IT & Telecommunication

Military & Defense

Retail

Manufacturing

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others