Report Overview

Adsorbent Market Size, Share, Highlights

Adsorbent Market Size:

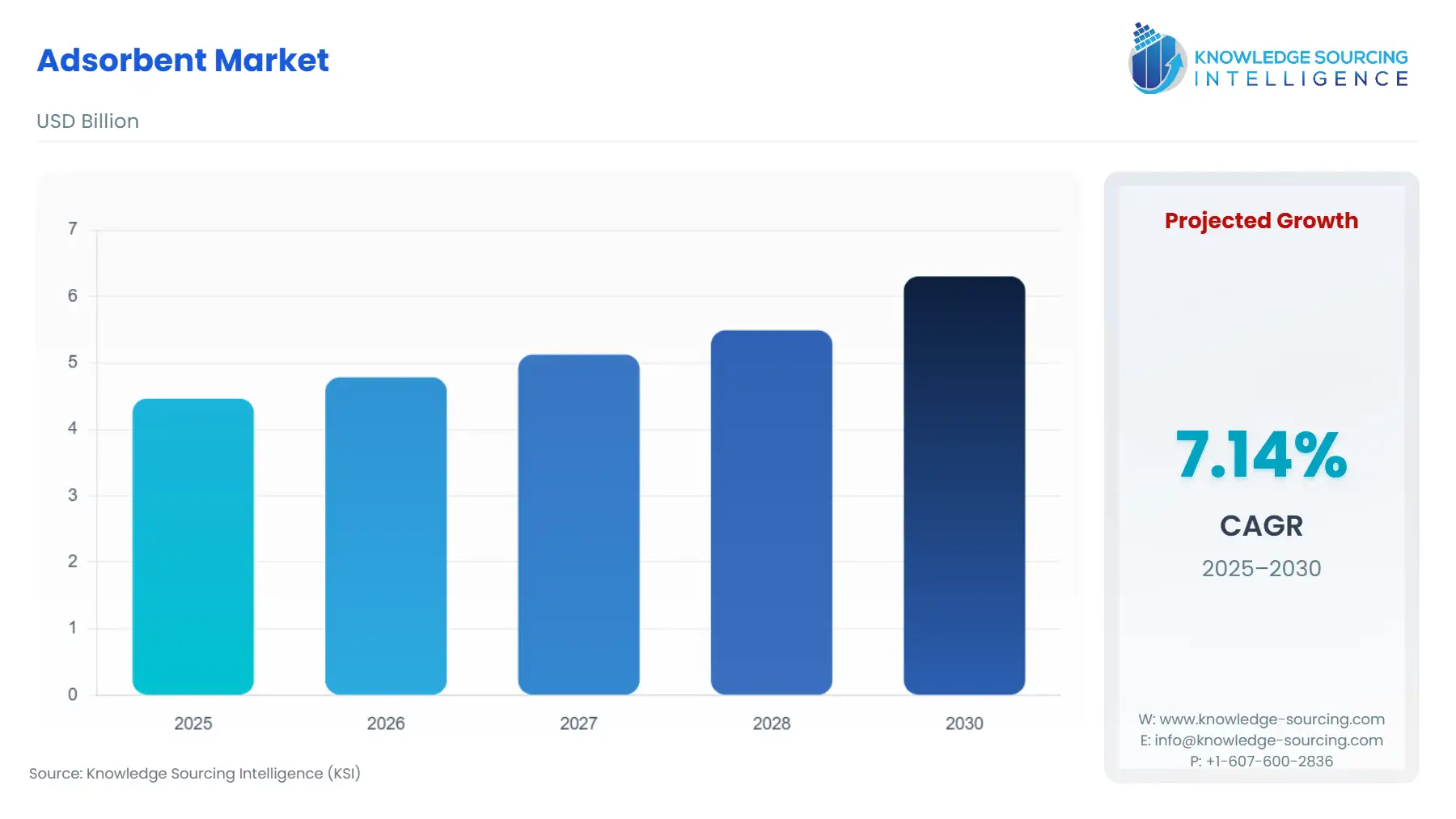

The global adsorbent market is expected to grow at a CAGR of 7.14%, reaching a market size of US$6.304 billion in 2030 from US$4.466 billion in 2025.

Adsorbents are compounds with high absorption properties, owing to which they are used for removing impurities from solid, gaseous, and liquid states. Such compounds are utilized either in the shape of rods, monoliths, or moldings and comprise various types such as silica gel, activated alumina, activated carbon & zeolites. Major applications for adsorbents include oil & gas refining, food processing, chemicals, and wastewater treatment, among others.

Favorable investment in wastewater treatment facilities, booming chemical production, and the implementation of oil & gas exploration projects have provided a major boost to the market demand for adsorbents, thereby propelling the overall market’s growth. Moreover, favorable government policies to minimize carbon emissions to achieve “Net Zero Emission” are also acting as an additional driving factor.

Adsorbents Market Growth Drivers:

- Favorable investment in wastewater treatment facilities is stimulating market growth.

Over the years, the global population has grown significantly, simultaneously increasing water consumption. To cater to the growing demand for clean water access, major economies are investing in water treatment projects. For instance, in February 2024, the Environmental Protection Agency announced funding of US$2.6 billion to cover a range of projects inclusive of stormwater infrastructure improvement and wastewater sanitation.

Likewise, in May 2023, the Government of Kosovo opened an urban wastewater treatment facility in Gjakova municipality to provide clean drinking water to nearly 30,000 Kosovar citizens. The total project investment amounted to EUR 17 million. Such investment will bolster the requirement for adsorbent material during the purification process, accelerating market growth.

- Ongoing oil & gas exploration projects implementation will propel the market growth.

Adsorbents have a higher tendency to remove impurities from liquid and gaseous states, owing to which they are highly applicable in oil & gas refining operations. With the bolstering growth in petroleum and oil-related product demand globally, major crude oil-producing nations are investing in various onshore and offshore exploration projects and refineries to enhance their production capacity.

For instance, in March 2023, ExxonMobil announced the startup of its “Beaumont” refinery expansion project near the U.S. Gulf Coast. The refinery would add 2,50,000 barrels per day, thereby bringing the total production capacity to 6,30,000 barrels per day and bolstering the company’s growing crude oil production in the Permian Basin.

Likewise, according to the US Energy Information Administration, the county has 132 operable petroleum refineries as of January 2024. Its latest refinery, which holds a capacity of 45,000 barrels/per day, was established in Texas in February 2022. With such upliftment in the oil & gas refineries and exploration projects, the usage of adsorbents in such refineries is anticipated to witness an upward trajectory, thereby stimulating overall industry growth.

- Ongoing establishment of food processing facilities has accelerated the market growth.

Adsorbents play an integral part in separating concentrated particles from extracts, owing to which they are highly demanded in the food & beverage sector for their use during processing. The booming processed food consumption, followed by bolstering growth in consumer scale, is driving the need to enhance processing capacity, which has led to the establishment and investments in food processing facilities.

For instance, in September 2023, the Illinois Department of Commerce and Economic Opportunity announced that cultivated meat and seafood company UPSIDE Foods will open its first processing facility in Glenview to bolster commercial production. Likewise, in July 2024, MANA Nutrition laid the foundation stone for its new food processing facility in Pooler, Ga., which will double the company’s RUSF (Ready-To-Use-Supplemental Food) and RUTF (Ready-To-Use-Therapeutic Food) production. Such a new establishment is expected to bolster the demand for adsorbents, augmenting market growth.

Adsorbents Market Geographical Outlook:

- Asia Pacific is estimated to hold a considerable share of the market.

The global adsorbent market is divided by region into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. APAC is expected to account for a significant market share, fuelled by ongoing investment in major adsorbent applications such as wastewater treatment facilities, oil & gas refineries, and food processing plants in major economies, namely China, India, and South Korea.

For instance, as per the July 2024 PIB release, as of 30th June 2024, the Ministry of Food Processing Industries (MoFPI) has approved nearly 588 food processing units and 76 agro-processing clusters under the PMKSY (Pradhan Mantri Kisan SAMPADA Yojna). Furthermore, under the PMFME (PM Formalization of Micro Food Processing Enterprise), the Ministry has approved nearly 92,549 micro food processing enterprises.

Likewise, in September 2023, SUEZ and Chongqing Water Group formed an agreement for the development of a new water treatment facility in the municipality that will be equipped with resilient infrastructure, purification & pumping stations, and a distribution network will supply 1.68 million m3/day to nearly 2.7 million people living in Chongqing.

North America and Europe are poised for positive growth, which is attributable to the booming investment in new oil and gas refineries. This is followed by favorable efforts undertaken by the major regional economies to increase clean water access to urban and semi-urban areas. Moreover, the South America, Middle East, and Africa regions are estimated to account for a minimal market share.

Adsorbents Market Key Developments:

- Sep 2025: Decarbontek launched a modular structured-adsorbent platform that converts powdered adsorbents into durable fiber adsorbents, enabling scalable CO2 removal with improved flow dynamics and high efficiency.

- May 2025: BASF signed a license agreement to provide its OASE® blue adsorbent technology in a pilot CCS project with Taiwan Power Company (Taipower), reporting > 90% CO2 capture performance.

- Jan 2025: Researchers developed MOFA, a generative-AI + simulation workflow to discover novel MOFs for carbon capture, accelerating high-throughput adsorbent design for CO2 adsorption.

Adsorbent Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Adsorbent Market Size in 2025 | US$4.466 billion |

| Adsorbent Market Size in 2030 | US$6.304 billion |

| Growth Rate | CAGR of 7.14% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Adsorbent Market |

|

| Customization Scope | Free report customization with purchase |

Adsorbent Market Segmentation:

- By Type

- Silica Gel

- Activated Alumina

- Activated Carbon

- Molecular Sieve Carbons

- Molecular Sieve Zeolites

- Polymeric

- By Application

- Oil & Gas Refining

- Packaging

- Chemical

- Food Processing

- Water Treatment

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

-

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Middle East and Africa

- South Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Others

-