Report Overview

Acousto-Optic Devices Market - Highlights

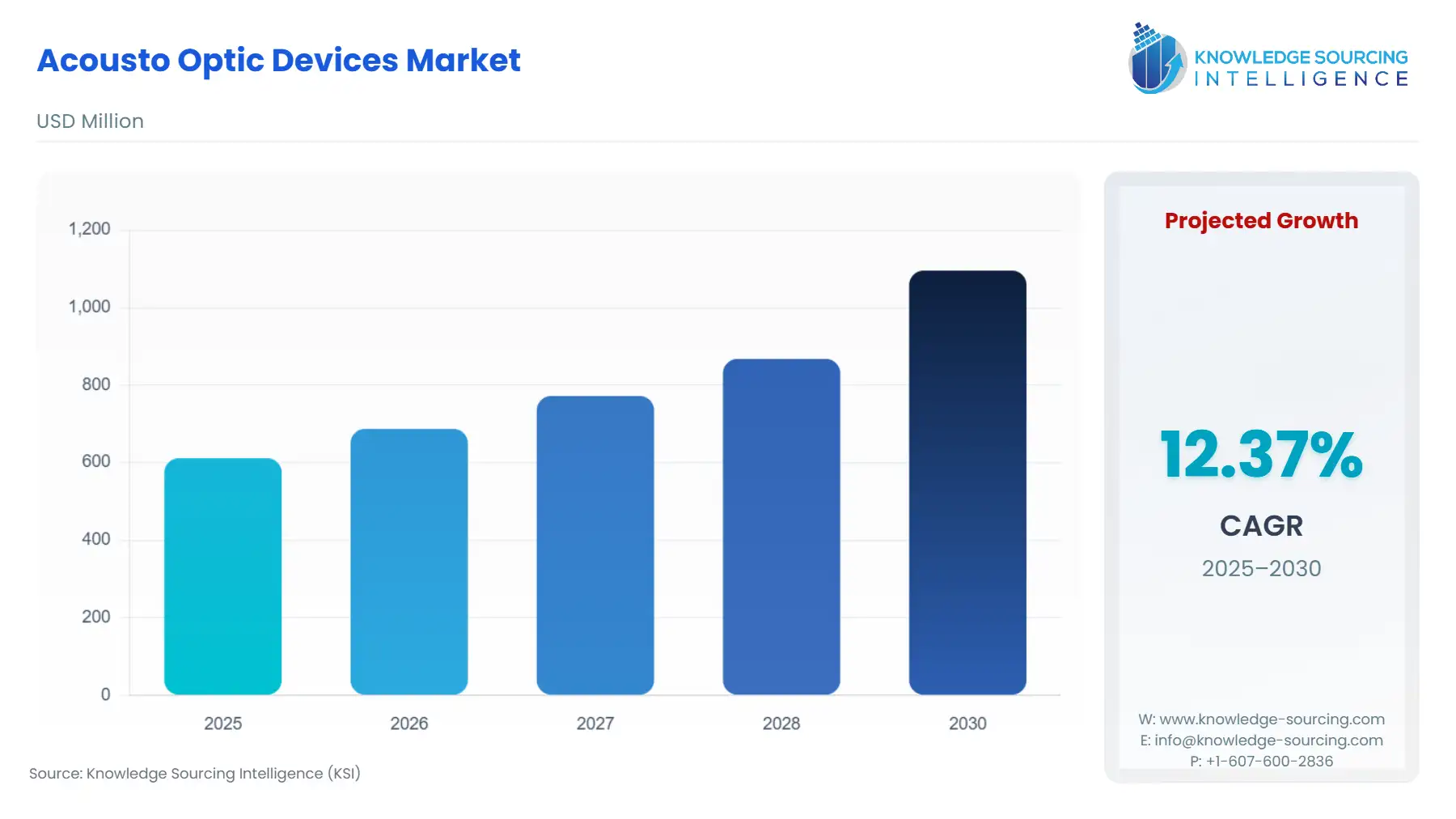

The acousto-optic device market will grow from US$0.61 billion in 2025 to US$1.10 billion in 2030 at a CAGR of 12.36%.

When using acoustic optic devices as modulators, the drive power is changed to alter the amount of light in the deflected beam while maintaining a constant acoustic wavelength (frequency). Acoustic optical devices frequently regulate the laser light's power using an electric drive signal. These devices are used in many applications, such as endoscopy, medical microscopy, aerial observation, and art conservation.

The demand for acoustic-optical devices has increased in biomedical imaging and scanning due to research in imaging cytometry, photoacoustic imaging, optical coherence tomography, and multiphoton microscopy. Because they employ ultrasonic grating technology, acoustic optical devices can be applied in various clinical and medical settings. AO modulators find significant applications in laser communication systems as external modulators.

Acousto-Optic Device Market Drivers:

Surge in laser-based fiber optic sensing in Aerospace applications

The market is expanding due to ongoing advancements in aerospace, as manufacturers increasingly use fiber lasers to address manufacturing challenges like significant weight reduction and other issues.

The Federal Aviation Administration (FAA) has forced an increase in airplane reliability requirements in recent years, bolstering global confidence in the safety of American-made aircraft and aircraft parts. This resulted in the adoption of fiber lasers since they reduce aircraft weight and offer better energy efficiency, a smaller machine footprint, fewer maintenance needs, longer machine lifetimes, and faster cycle times for high-volume production. Furthermore, the notable expansion of the commercial aviation sector, particularly in the Asia-Pacific area, has led to a rise in aircraft manufacturing.

Increase in demand for semiconductor wafers and discrete semiconductor components leading to the increased usage of acoustic optical devices

The wafer silicon substrate is made using flexible surface acoustic wave technology, which offers the possibility of high-performance flexible wafer-scale devices through direct integration with established microelectromechanical systems (MEMS) and complementary metal oxide semiconductor (CMOS) technologies. The India Electronics and Semiconductor Association projects that the nation's market for semiconductor components will be valued at $32.35,5 billion by 2025. The board of Taiwan Semiconductor Manufacturing Co. (TSMC) has approved a budget of $2.89 billion for 2021 to expand its production capacity. Meanwhile, Tower Semiconductor plans to invest 2021 a total of $150 million to grow production levels at wafer production facilities designed for 200mm wafers in Israel, the US, and Japan.

Increased demand for laser processing

The semiconductor and automotive industries are increasingly using laser-based manufacturing techniques. Many semiconductor companies expanded their manufacturing capacities in response to the rise in demand for semiconductor wafers and discrete semiconductor components.

Additionally, the growing trend toward laser-based fiber optic sensing systems for robotics applications is anticipated to increase the market demand because they provide the highest precision and repeatability required to control and measure extremely fine movement. The increasing demand for laser devices in the healthcare vertical for procedures like LASIK surgery, hair removal, tattoo removal, skin resurfacing, wrinkle reduction, optical coherence tomography, body contouring, etc., is anticipated to boost the market for acousto-optic devices.

High demand from the aerospace and defence industry

The industry is poised to see a significant leap during the forecast period because the gadgets will simplify satellite systems that enhance the employment of surveillance. At the same time, it lowers the military's expenses for installing defense mechanisms. As per the European Union, the aerospace sector in the EU has a total turnover of $151 billion, with the highest spending in research and development. R&D accounts for about 12% of turnover in the aerospace sector. As per the Boeing Services Market Outlook report, there is a significant anticipated growth in the commercial aviation sector in APAC. Additionally, this will increase the number of commercial aircraft deliveries, which will increase demand for aviation services. These factors are examined to propel the market for acoustic optical devices.

Acousto-Optic Device Market Geographical Outlook

Asia Pacific is witnessing exponential growth during the forecast period

In the forecast years, the Asia-Pacific region is anticipated to experience notable expansion. Due to the region's increasing industrialization and developing nations' adoption of optical technologies for precise solutions, the market for acousto-optic devices is expanding quickly. The market is expanding due to various factors, such as the growing number of electronics being built, the expansion of manufacturing facilities, the rapid growth of the semiconductor industry, and the growing applications of acousto-optic devices.

Furthermore, due to US restrictions on Chinese suppliers, Chinese semiconductor companies are increasing their investment for expansion as their clients seek to secure supply. Besides, many consumer electronics are produced in this area, so the use of laptops and smartphones has increased significantly. The Chinese government financed the next stage of the National IC Investment Fund in 2020, raising about $23 to $30 billion. Telangana’s Sultanpur Medical Device Park Project, Palghar Medical Factory Upgrading Project of $27.09 million, Medical Device Cluster Project worth $68 million, and Medical Device Cluster Project costing $136 million are implemented. The Indian government provided the required funds for the entire $68 million Medical Device Cluster Project and the $136 million Medical Equipment Manufacturing Project. The total investment in these two initiatives amounted to $33.87 million. The increasing need for acousto-optic modulators, deflectors, and tunable filters is partly contributable to the rising demand for laser systems that operate on laser light.

These devices use different measures, including non-destructive testing and ultrasonic grating. Moreover, they utilize ultrasonic diffraction, thereby finding applications in multi-layer dielectric diffraction for acousto-optic devices. Consequently, the India Electronics and Semiconductor Association, a semiconductor trade organization, forecasts that by 2025, India’s semiconductor components market will be worth approximately $32.35 Bn. This creates more prospects for acousto-optic markets.

Acousto-Optic Device Market Key Launches:

In May 2020, Taiwan Semiconductor Manufacturing Co. declared it would invest USD 12 billion to construct a chip plant in Arizona. This move alleviated US national security concerns about safeguarding global supply chains in the face of the coronavirus pandemic and bringing more high-tech manufacturing back to the US.

Acousto-Optic Devices Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Acousto-Optic Devices Market Size in 2025 | US$611.632 million |

Acousto-Optic Devices Market Size in 2030 | US$1,095.720 million |

Growth Rate | CAGR of 12.36% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation | Type |

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Acousto-Optic Devices Market | Isomet Corporation, |

Customization Scope | Free report customization with purchase |

Segmentation:

By Type

Modulator

Optic Filter

Deflector

Frequency Shifter

Others

By Application

By Industry Vertical

Telecom

Industrial

Medical

Aerospace & Defense

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

UK

France

Spain

Others

Middle East and Africa

Saudi Arabia

Israel

Others

Asia Pacific

Japan

China

India

Indonesia

Others