Report Overview

5G NTN Backhaul Market Highlights

5G NTN Backhaul Market Size:

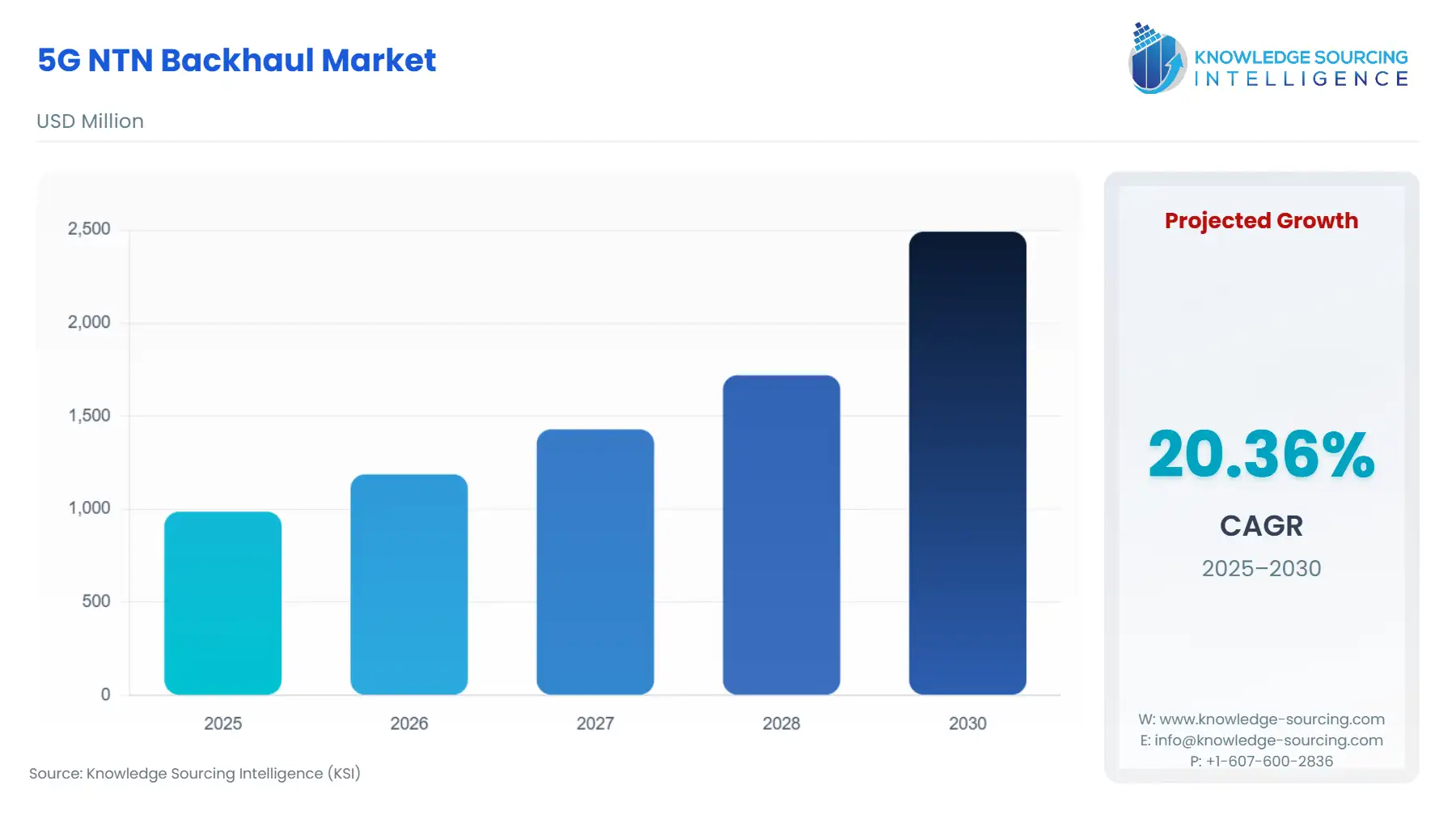

The 5G NTN Backhaul Market is projected to grow at a CAGR of 20.36% over the forecast period, reaching US$2,492.048 million by 2030 from US$986.672 million in 2025.

5G NTN, or non-terrestrial network, is a form of advanced 5G connectivity technology that extends the reach of the network coverage beyond the terrestrial constraints. This technology provides high-speed and low-latency internet connectivity worldwide, even in remote locations. The increasing global adoption of smartphones is among the major factors propelling the global 5G NTN backhaul market growth during the estimated timeline. With the increasing global ownership of smartphones, the demand for reliable, high-speed, and low-latency network connectivity will grow. The 5G NTN backhaul technology also ensures the availability of network connectivity across different locations of the globe, even where wired or traditional network connectivity is lacking.

The adoption of smartphones worldwide has witnessed major growth over the years. The GSMA, in its global report, stated that in 2023, smartphones contributed to about 78% of the global internet connection, which is estimated to rise to 91% by 2030. The agency further stated that in 2023, smartphone adoption in the Asia Pacific region was recorded at 78%, whereas smartphone adoption in the European and Latin American regions was recorded at 82% and 80%, respectively. The major factor propelling the global 5G non-terrestrial networking (NTN) backhaul market growth is the increasing global utilization of 5G internet.

Similarly, the growing demand for IoT technology is also pushing the demand for 5G NTN backhaul during the estimated timeline.

5G NTN Backhaul Market Overview & Scope:

The 5G NTN Backhaul Market is segmented by:

- Architecture: The 5G NTN Backhaul Market is segmented into antenna unit and radio unit.

- Use Case: The 5G NTN Backhaul Market is segmented into eMBB and eMTC.

- Platform: The 5G NTN Backhaul Market is segmented into the UAS platform, which is further sub-segmented into LEO satellite, MEO satellite, and GEO satellite.

- Location: The 5G NTN Backhaul Market is segmented into urban, rural, remote, and isolated.

- End-Use: The 5G NTN Backhaul Market is segmented into space, ground, air, and maritime.

- Region: The 5G NTN Backhaul Market is segmented into North America, Europe, the Middle East and Africa, and Asia Pacific.

Top Trends Shaping the 5G NTN Backhaul Market:

1. The growing utilization of 5G internet and the expansion of IoT technology will offer market growth

- There is a growing utilization of 5G internet. This will offer new market growth factors to the 5G NTN backhaul market. Alongside, the rapid expansion of IoT technology in the coming years will substantially boost the market growth.

2. Antenna Unit Architecture will be growing significantly

- The Aus will be growing significantly due to the increasing expansion of 5G base stations. It acts as a vital gap-filler and extends connectivity to regions where traditional base station deployment is challenging or costly.

- NTT DOCOMO, Japan's oldest mobile provider and biggest user base, at present boasts around 78 million users and an Average Revenue Per Unit (ARPU) of approximately $44. On March 25, 2020

5G NTN Backhaul Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing utilization of 5G internet: The global utilization of the Internet has witnessed significant growth over the past few years. The International Telecommunication Union, in its global report, stated that in 2023, about 67% of the global population had access to the Internet. The agency further stated that in 2021, the total number of individuals using the Internet was recorded at 4.9 billion, which surged to 5.1 billion in 2022 and 5.4 billion in 2023. The ITU stated that the total coverage of 5G internet in 2021 was recorded at 18%, which surged to 31% in 2022 and 38% in 2023. The coverage of 5G internet, especially in developed and higher-income countries, witnessed significant growth. The total coverage of the 5G network in the Americas region, as per the ITU, was recorded at 59% in 2023, whereas the coverage of the 5G network in Europe was recorded at 68%. Similarly, in the Asia Pacific and Arab States, the coverage of the 5G network was recorded at 42% and 12%, respectively. With the increasing utilization of 5G internet, the demand for efficient and low-latency connectivity is rising. The NTN backhaul technology helps enhance the efficiency of the 5G network and increases its coverage.

- Government support is driving the market: Government support is one of the major drivers for the 5G NTN backhaul market by facilitating infrastructure development, funding research, and creating regulatory frameworks that encourage innovation. For instance, to increase the availability of broadband, the Japanese government offers incentives to organizations planning to build fiber optic networks in specific locations, such as rural areas. Moreover, the Japanese government offers specific financial assistance, such as tax subsidies, to carriers and suppliers who aim to create the 5G network to promote 5G.

Challenges:

- High cost: The high cost of deployment and operation of the 5G NTN backhaul system poses a significant restraint to the growth of the market. The system requires satellites, high-altitude platforms, and an advanced ground station, along with high equipment and technology costs, and spectrum licensing requires a substantial capital investment and high cost, significantly restraining the market.

5G NTN Backhaul Market Segmentation Analysis:

- The antenna unit segment is experiencing considerable growth

The 5G Non-Terrestrial Networking (NTN) Backhaul market is segmented by architecture into antenna unit (AU) and radio unit (RU). The expansion of 5G base stations, while crucial for terrestrial coverage, fuels the growth of the 5G NTN backhaul market, particularly for AUs. As terrestrial networks grow, they inevitably leave gaps, especially in remote or sparsely populated areas. This is where 5G NTN backhaul, powered by advanced AUs, becomes essential, acting as a vital gap-filler and extending connectivity to regions where traditional base station deployment is challenging or costly.

NTT DOCOMO is Japan's oldest mobile provider and biggest user base. At present, the platform boasts around 78 million users and an Average Revenue Per Unit (ARPU) of approximately $44. On March 25, 2020, DOCOMO began offering limited 5G commercial service in Japan's main cities. The business intends to spend more than $7 billion to extend its network across 97% of the nation's inhabited areas by 2025. 8,001 base stations in the 3.5GHz and 4.5GHz frequency bands and 5,001 base stations in the 28GHz range are planned for installation.

Additionally, according to the Ministry of Industry and Information Technology (MIIT) published report, by the end of March 2023, China had more than 2.64 million 5G base stations, 620 million 5G mobile subscribers nationwide, and 5G signals were available in every county. By the end of 2023, China had 2.9 million 5G base stations, up from around 600,000, according to Jin Zhuanglong, minister of industry and information technology.

The increase in base stations also leads to increased network capacity, which supports higher data throughput and a greater number of users and devices. This increased capacity drives demand for robust, high-speed backhaul solutions to efficiently transport data between base stations and the core network. 5G NTN backhaul, with advanced AUs, offers a scalable and cost-effective solution, especially where traditional terrestrial backhaul is limited.

Technological advancements are another significant driver. Innovations in antenna technology, including phased arrays and beamforming, improve signal quality and efficiency. The Low Earth Orbit (LEO) satellite constellations are transforming the market by providing lower latency and higher data rates. Additionally, the integration of terrestrial and non-terrestrial networks requires advanced AUs to allow hybrid network architectures to achieve optimal performance. For instance, in October 2024, Quectel Wireless Solutions, a global IoT solutions provider, unveiled a new series of antennas, further expanding the global antenna offering for customers. The new antennas comprise the ultra-wideband YECT005W1A and YECT004W1A 5G antennas, the combo antenna series YEMN302Q1A, the YECT028W1A 5G and the YECT003W1A 4G antennas, and the LoRa antennas YFNF915F3AM as well as YFNF868F3AM, while also including the Wi-Fi antenna YFBC001WWA and the GNSS antenna YFGC007E3A.

In conclusion, the 5G NTN backhaul market is expanding rapidly due to the need for wider coverage, technological progress, the rise of data-intensive applications, cost-effectiveness, and strategic collaborations. The Antenna Unit segment is essential in enabling these advancements and facilitating the deployment of high-performance 5G NTN backhaul networks.

- The market is expected to witness rapid growth in urban locations

The 5G Non-Terrestrial Networking (NTN) Backhaul market is segmented by location into urban, rural, remote, and isolated. Although it is often perceived as a connectivity solution for distant locations, 5G NTN backhaul provides significant advantages and growth drivers within urban environments. Despite the dense terrestrial infrastructure, urban locations have some unique challenges that NTN can help address. One of the key drivers is capacity augmentation. 5G networks are very bandwidth-hungry, especially in cities, where even fiber backhaul can become congested. NTN backhaul can supplement it, which means it is a capacity booster for urban areas of high-traffic types like stadiums and business districts.

Moreover, the 5G rollout impacts the 5G NTN backhaul market in urban areas with a high demand for high-capacity, low-latency connectivity. As 5G networks densify with many small cells, the need for cost-effective and flexible backhaul solutions increases, making 5G NTN a compelling option. In addition, the focus on latency-sensitive applications in urban environments drives demand for low-latency backhaul, where 5G NTN can be applied.

The U.S. 5G network infrastructure market is driven by growing demand for high-speed connectivity, IoT expansion, and industry-wide digital transformation. For instance, as per GSMA, the penetration of 5G networks in the United States is estimated to reach 94% by 2030. Additionally, significant government initiatives and private investments further accelerate its deployment. Together, these factors position 5G to revolutionize connectivity and enable transformative technological advancements.

Additionally, according to the Ericsson Mobility Report, November 2024, 5G subscriptions in Asia, including India, Nepal, and Bhutan, are predicted to reach above 27 crore by the end of 2024, reaching 23 percent of total mobile subscriptions. In 2030, this will rise to 97 crore and constitute 74 percent of all mobile connections in the region. This will revolutionize many sectors, such as health, education, and agriculture, while closing the digital divide between rural communities and low-income areas.

Redundancy and resilience are the other crucial factors. Urban infrastructure is susceptible to disruption of services. NTN backhaul provides a redundant connection for critical urban infrastructure to continue services in the event of a terrestrial outage. This redundancy increases network reliability, making the urban centers more resilient to unexpected events and protecting vital operations.

Even in cities, coverage "dead zones" exist due to building shadowing or underground locations. NTN backhaul can fill these gaps, ensuring consistent connectivity throughout the urban environment, which is especially important for public safety and emergency services. Furthermore, NTN backhaul supports the growing number of IoT devices and smart city initiatives in urban areas. It offers a cost-effective, scalable way to transport data from these devices, enabling the development and expansion of smart city technologies. Therefore, while often considered a solution for remote areas, 5G NTN backhaul offers valuable benefits within urban locations, making it a key component of the evolving 5G landscape in cities.

5G NTN Backhaul Market Regional Analysis:

- North America: North America is projected to hold a significant market share in the 5G NTN Backhaul Market. The United States 5G non-terrestrial networking (NTN) backhaul market will grow at a significant rate in the forecasted duration, owing to the rapid developments in the satellite deployments associated with 5G technology by major companies in the country. In addition, market developments such as launches and partnerships in the country are further boosting market growth in the foreseeable future. As per 5G Americas, satellite operating companies in the United States are planning to deploy more LEO satellites to increase non-terrestrial networking in the country. For example, ONEWEB plans to have a constellation of over 648 LEO satellites, out of which 542 are already operational as of January 2023. The operator plans on providing its services to businesses and the government, thereby increasing the scope of the market in domains other than the residential segment.

In addition, in March 2023, Globalstar, Inc. announced for delivery of 5G private networks and services, which will be powered by Qualcomm Technologies’ 5G technology portfolio, including Qualcomm® FSM™ 5G RAN platform for small cells. Qualcomm’s FSM platform will be made commercially available to work with Globalstar’s Band n53 terrestrial spectrum for private networks.

List of Top 5G NTN Backhaul Companies:

The 5G NTN Backhaul Market is moderately fragmented; however, there is a growing consolidating trend. It has a mix of global giants, regional satellite operators, and telecom providers. Some of the key players are Qualcomm, Gatehouse Satcom A/S, MediaTek Inc., Samsung, and OQ Technology. Recent developments in the market are:

- Collaboration: In March 2023, Globalstar, Inc. announced for delivery of 5G private networks and services, which would be powered by Qualcomm Technologies’ 5G technology portfolio, including Qualcomm® FSM™ 5G RAN platform for small cells. Qualcomm’s FSM platform will be made commercially available to work with Globalstar’s Band n53 terrestrial spectrum for private networks.

- Product Innovation: In February 2023, Samsung demonstrated its 5G NTN technology on its Exynos Modem 5300 chipset.

5G NTN Backhaul Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| 5G NTN Backhaul Market Size in 2025 | US$986.672 million |

| 5G NTN Backhaul Market Size in 2030 | US$2,492.048 million |

| Growth Rate | CAGR of 20.36% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the 5G NTN Backhaul Market |

|

| Customization Scope | Free report customization with purchase |

5G NTN Backhaul Market Segmentation:

By Architecture

- Antenna Unit (AU)

- Radio Unit (RU)

By Use Case

- eMBB

- mMTC

- URLLC

By Platform

- UAS Platform

- LEO Satellite

- MEO Satellite

- GEO Satellite

By Location

- Urban

- Rural

- Remote

- Isolated

By End-Use

- Space

- Ground

- Air

- Maritime

By Region

- North America

- USA

- Others

- Europe, Middle East and Africa

- Germany

- UK

- Others

- Asia Pacific

- Japan

- China

- South Korea

- Others